6 Internet finance tools in China

0 Comment(s)

0 Comment(s) Print

Print E-mail China Daily, December 4, 2014

E-mail China Daily, December 4, 2014

Internet finance, led by different online money market fund products created separately by Alibaba and Tencent, has been the buzz of China's finance industry since 2013. The transition from traditional financial services to Internet-based alternatives became "a new norm" of the Chinese economy. Different types of online financial businesses have rapidly expanded over the past year.

Experts say Internet finance companies can meet the demand from low-end clients for investment and financial management services by making innovations in financial services, marketing channels and business models. This may help to alleviate the difficulties faced by small businesses as they try to obtain loans and reduce their financing costs.

According to China Internet finance report (2014) released by Financial World and the Internet Society of China in Aug 2014, there are mainly six types of financial businesses related to Internet finance in China: peer-to-peer (also known as P2P) lending, crowdfunding, Internet payment, Internet funds, Internet insurance and e-commerce micro credit.

|

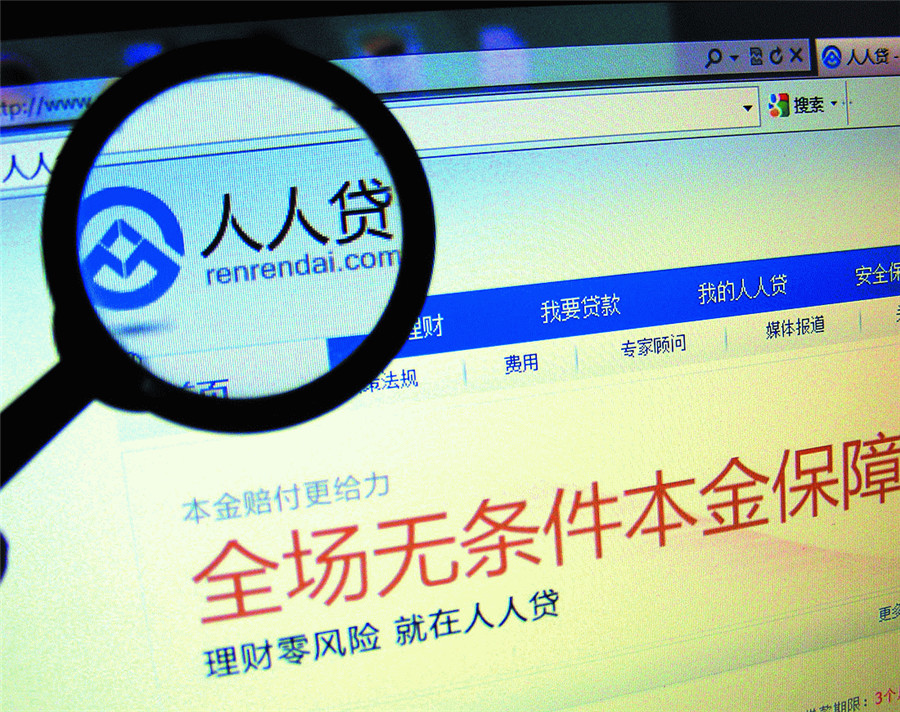

Screenshot of Renrendai.com. [File photo] |

No 1 Peer-to-peer lending

China's peer-to-peer (also known as P2P) lending platforms have emerged quickly. In 2012, there were only 110 P2P lending firms in China. In September, the number of peer-to-peer lending companies increased to 1,438, with outstanding loans hitting 64.6 billion yuan ($10.6 billion), up 11 percent month-on-month.

When Renrendai launched in 2010, it adopted an operating model similar to that of Lending Club, mainly focused on the online micro-credit business. The company shifted to an online-to-offline model after integrating with offline lending service Ucredit in 2012. Renrendai received a $130-million capital injection from a group of investors in 2013, making it the largest raiser of capital in the Internet sector.

Go to Forum >>0 Comment(s)