A close look at China's film market by cities

0 Comment(s)

0 Comment(s) Print

Print E-mail China.org.cn, August 18, 2022

E-mail China.org.cn, August 18, 2022

Editor's note:

Which country has the world's largest film market? Which Chinese city spends most on movie tickets? Which Chinese city has the most theater visits? Who reshaped the business model of the film industry amid COVID-19? Which Chinese movies are top box office earners worldwide? In the following article, Cloud River Urban Research Institute will use the "Index of Chinese Cities' Theater Spending" based on its annual China Integrated City Index to answer these questions.

Posters of the Chinese movies that led the box office worldwide in 2020

China emerges as world's biggest film market

The film industry was one of the hardest hit sectors in the COVID-19 pandemic. China's box office earnings plunged 68.2% in 2020, as its film market was battered by the coronavirus. Fortunately, after the epidemic was swiftly brought under control in China, its film market staged a strong rally.

Failing to effectively contain the virus, North America - the U.S. and Canada - the long-term biggest movie market in the world, saw its box office plummet by a whopping 80.7% in 2020, and for the first time was dethroned by China, where theater attendance returned the fattest in that year.

Unlike the previous year's gloom, China's total box office during the Spring Festival in 2021 hit a record 7.82 billion yuan (US$1.15 billion), setting a few new records, such as the world's single day box office in a single market and the world's weekend box office in a single market.

Which Chinese city tops box office?

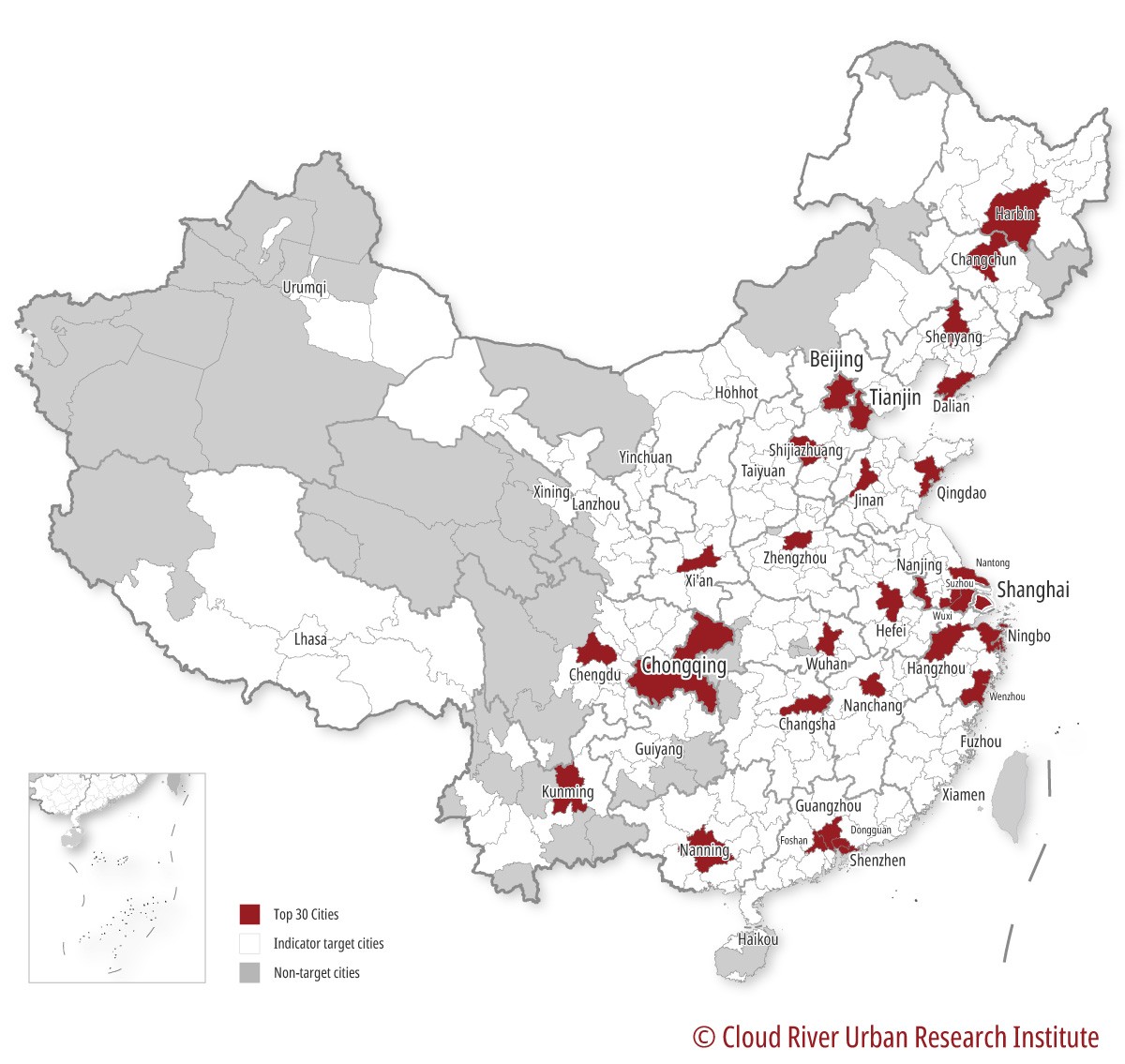

Cloud River Urban Research Institute released the "Index of Chinese Cities' Theater Spending" for 297 Chinese cities at prefecture level and above, drawing on its annual China Integrated City Index.

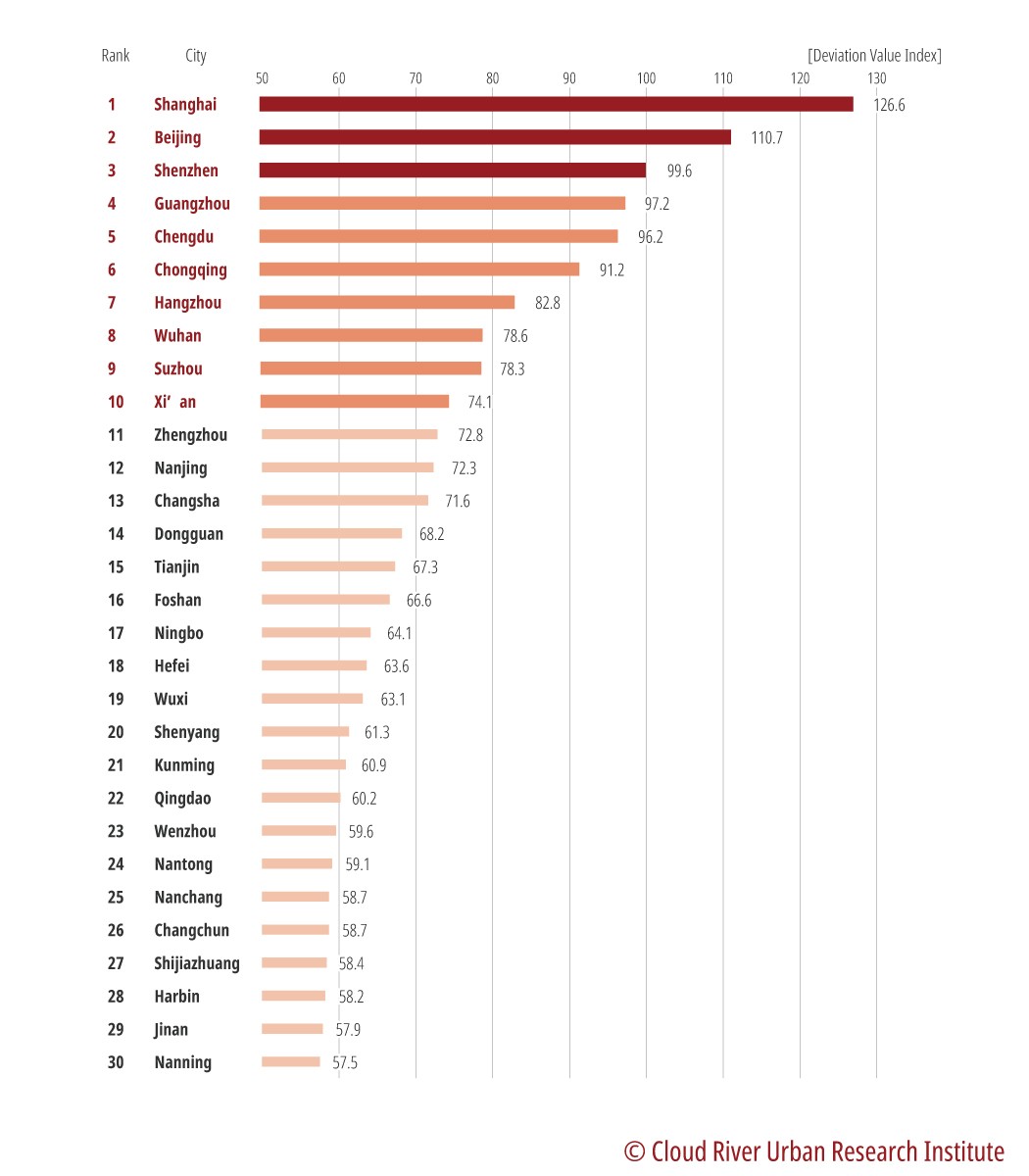

Shanghai, Beijing, Shenzhen, Guangzhou, Chengdu, Chongqing, Hangzhou, Wuhan, Suzhou, and Xi'an made the top 10. Except Suzhou, these cities are either municipalities directly under the central government, or provincial cities and cities specifically designated in the state plan.

Places from 11th to 30th were occupied by Zhengzhou, Nanjing, Changsha, Dongguan, Tianjin, Foshan, Ningbo, Hefei, Wuxi, Shenyang, Kunming, Qingdao, Wenzhou, Nantong, Nanchang, Changchun, Shijiazhuang, Harbin, Jinan, and Nanning, almost all of which are central cities.

Professor Zhou Muzhi, head of Cloud River Urban Research Institute, concluded that central cities that young people gravitate to as well as manufacturing hubs such as Suzhou, Dongguan, Foshan, and Wuxi are main sources of China's box office.

Figure 1 Top 30 Chinese cities by theater spending in 2020

Film markets cluster in certain Chinese cities

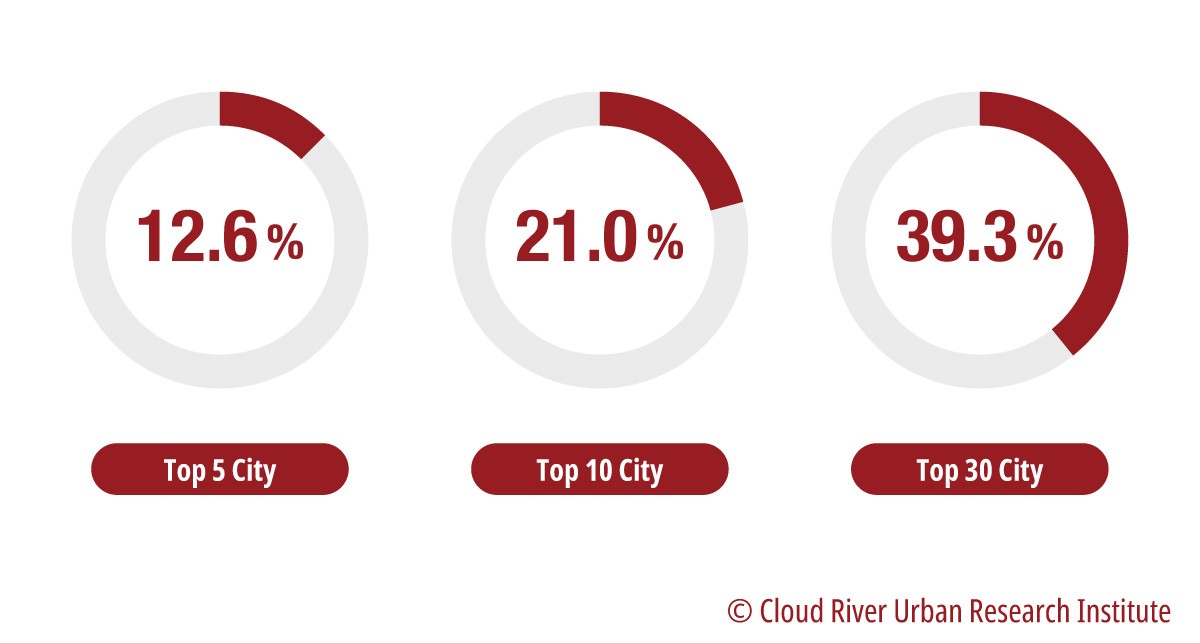

The data of the "Index of Chinese Cities' Theater Spending in 2020" backs Zhou's conclusion that certain Chinese cities are a magnet for the film market.

The top five cities by theater numbers accounted for 12.6% of the national total, the top 10 cities 10 21%, and the top 30 cities 39.3%. That means the top 30 cities, only one tenth of all Chinese cities at prefecture level and above, contributed nearly 40% of the country's theater resources.

Figure 2 Concentrations of theaters by Chinese cities in 2020

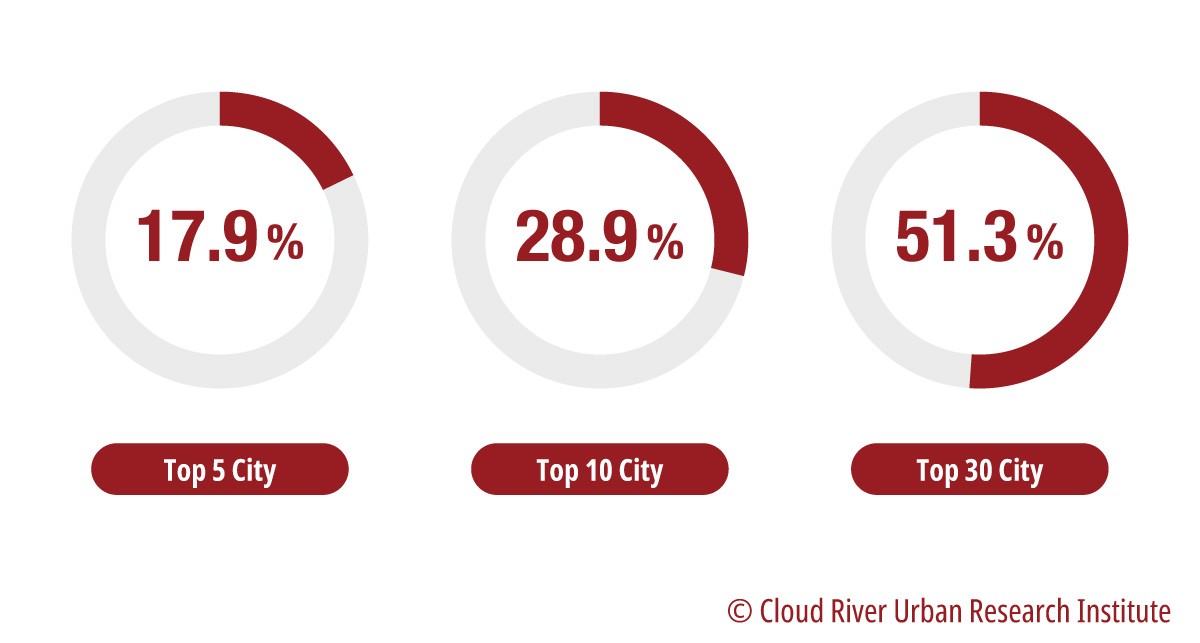

The top five cities in terms of theater trips accounted for 17.9% of the national total, the top 10 cities 28.9%, and the top 30 cities 51.3%. That means the top 30 cities were responsible for more than half of theater trips nationwide. Compared with theater numbers, theater trips are more prone to gravitate to these top 30 cities.

Figure 3 Contributions of Chinese cities to theater trips in 2020

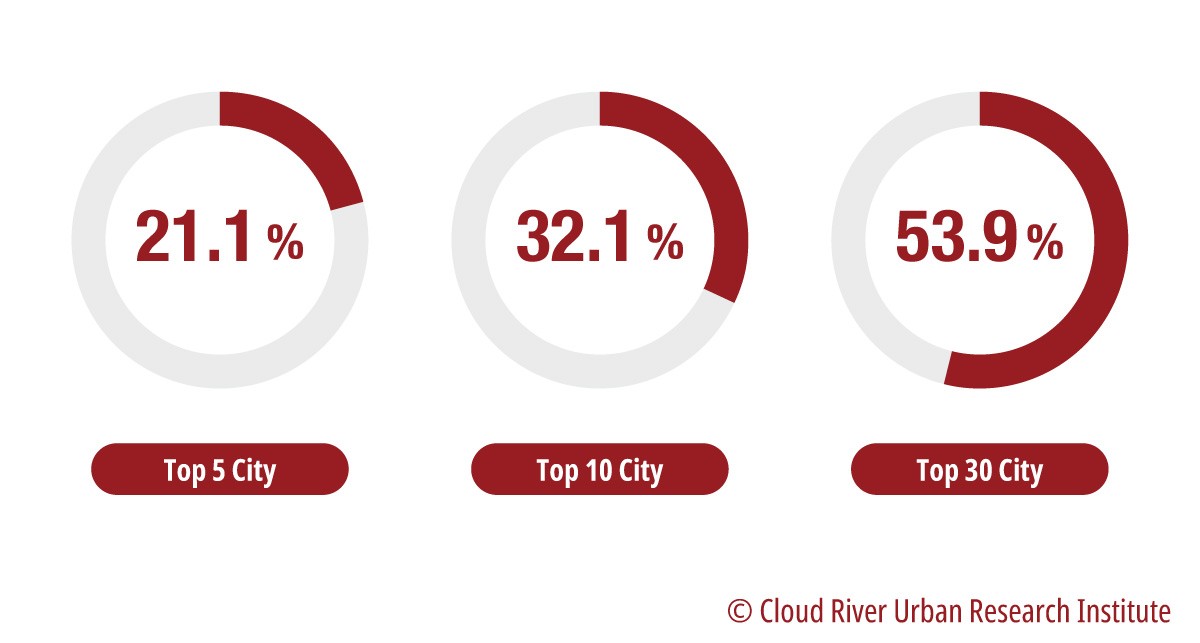

The top five cities in term of theater spending accounted for 21.1% of the national total, the top 10 cities 32.1%, and the top 30 cities 53.9%. That means the top 30 cities generated more than half of the nation's box office. From this perspective, the box office is more prone to cluster in these cities compared with theater numbers and theater trips.

Zhou explained that these top 30 cities are not only main hosts of Chinese theaters, but also main sources of China's box office due to their sheer populations of moviegoers.

Figure 4 Contributions of Chinese cities to box office in 2020

The index also reveals the following sets of data.

The top 10 cities in terms of box office were Shanghai, Beijing, Shenzhen, Guangzhou, Chengdu, Chongqing, Hangzhou, Wuhan, Xi'an, and Suzhou.

The top 10 cities in terms of theater trips were Shanghai, Beijing, Chengdu, Guangzhou, Shenzhen, Chongqing, Wuhan, Hangzhou, Xi'an, and Suzhou.

The top 10 cities in terms of per capita theater trips were Shenzhen, Zhuhai, Haikou, Hangzhou, Nanjing, Changsha, Wuhan, Guangzhou, Shanghai, and Xi'an.

The top 10 cities in terms of per capita box office were Shenzhen, Beijing, Shanghai, Hangzhou, Zhuhai, Guangzhou, Nanjing, Haikou, Changsha, and Lhasa.

It is particularly noteworthy that during the epidemic, numbers of screens and theaters in China increased rather than decreased. The number of screens in China increased from 2,668 in 2005 to 75,581 in 2020, a 27-fold increase.

From October 2019 to May 2021, numbers of cinemas in 203 out of 297 Chinese cities increased. Specifically, Chengdu, Suzhou, Guangzhou, Wuhan, Zhengzhou, Changzhou, Baoding, Beijing, Hangzhou and Shijiazhuang were the top 10 cities with biggest increases. Numbers of cinemas decreased in 38 cities, however, with Siping, Taizhou, and Jiujiang leading the decrease. That means 826 theaters in total were added in China during this period.

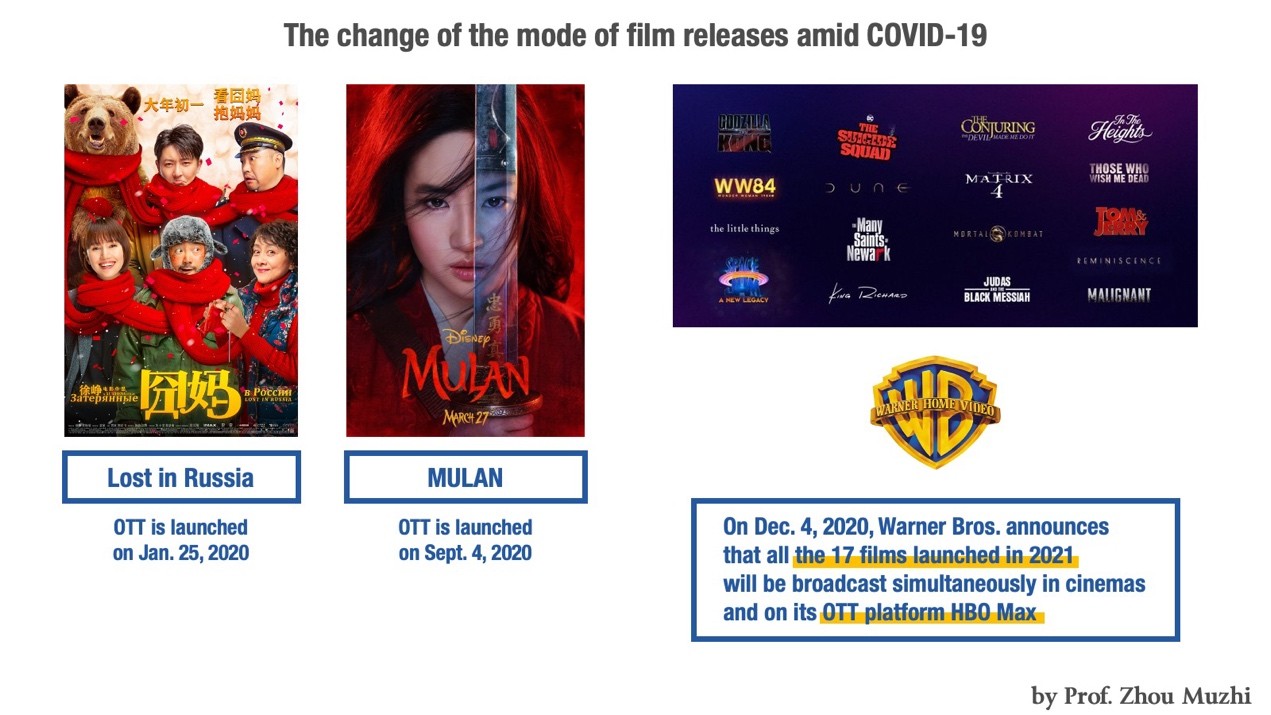

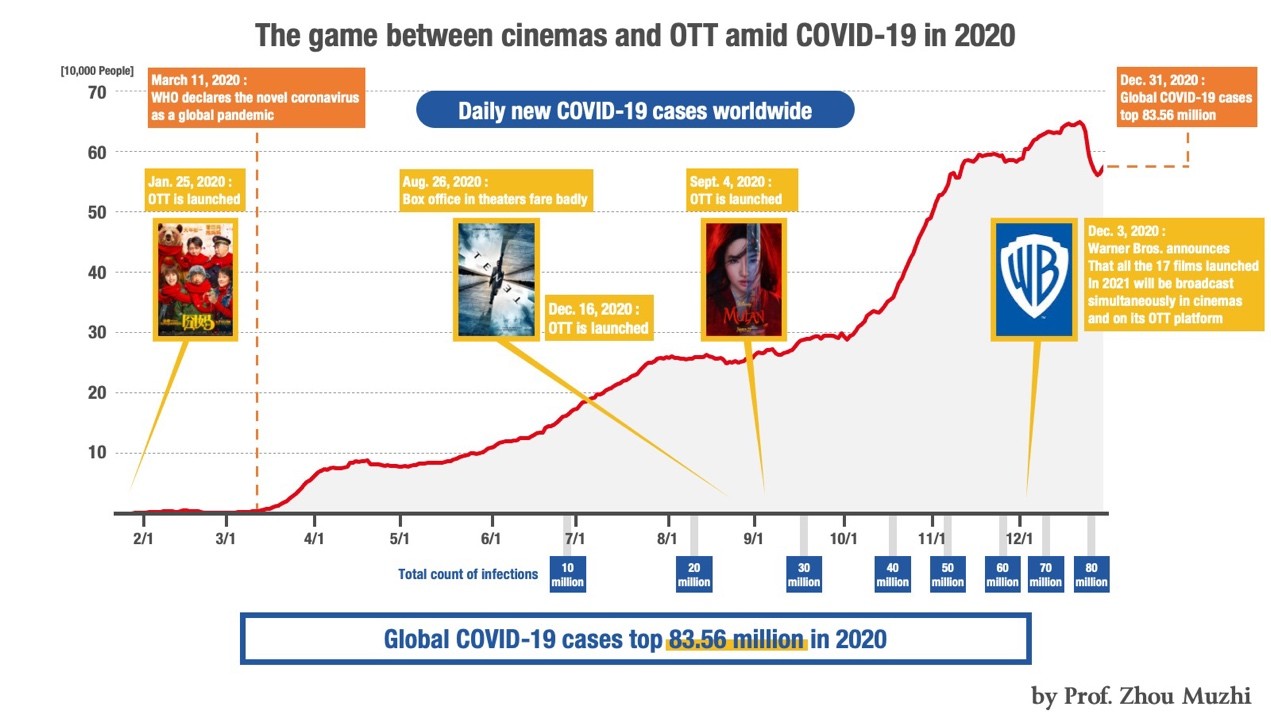

Change of the film industry's business model amid COVID-19

The COVID-19 outbreak undermined China's box office during the 2020 Spring Festival Holiday, but triggered a revolution in the film industry. "Lost in Russia," originally scheduled for release in cinemas, premiered on ByteDance's streaming platforms for free on Jan. 25, 2021, the first day of the Lunar New Year, after it was purchased by the tech firm for 630 million yuan.

The movie, despite missing its theatrical release, was viewed 600 million times and attracted 180 million viewers in the first three days on ByteDance's four video apps - Douyin, Huoshan, Jinri Toutiao, and Xigua Video, with a total number of 180 million individual viewers. The movie brought numerous viewers to those video apps.

Figure 5 Change of movie release models amid COVID-19

OTT stands for "Over The Top" and refers to any streaming service that delivers content over the internet. International major OTT platforms include Netflix, Amazon Prime, Disney+, Hulu, and HBO Max, and domestic platforms include iQiyi, Tencent Video, and Youku.

ByteDance created a brand new mode of movie screening, making "Lost in Russia" the first movie to skip theaters to premier on an OTT platform amid the COVID-19 epidemic.

Zhou believed that the movie's swift switch to the OTT platform not only reshapes the release model of blockbusters, but also represents a breakthrough in the business model for Chinese IT firms.

In 2020, the first blockbuster that premiered online was the Disney-made US$200-million "Mulan." On Sept. 4, without theatrically released in North America, Disney premiered the movie on Disney+, which was launched in November, and raked in viewing and revenue.

On Dec. 4, 2020, Warner Bros. announced that all the 17 films launched in 2021 would be broadcast simultaneously in U.S. cinemas and its OTT platform HBO Max, a move that systemically changed the eyeball game.

Now, big-budget blockbusters hit OTT platforms and cinemas simultaneously, or just OTT platforms exclusively. An OTT strategy for a film has not only become a major factor that affects the film's box office, but also had an impact on the future of the film maker.

In China, home to many IT companies, the cooperation between OTT and theaters will give a big boost to the film industry, Zhou predicted.

Figure 6 Timeline of theatrical and OTT releases of major blockbusters amid COVID-19 in 2020

The Chinese market capitulates Chinese movies into ranks of the world's top earners

Chinese films in 2020 had a strong showing. According to Box Office Mojo data, "The Eight Hundred" became the top earner worldwide in 2020. Other Chinese films leading the pack included "My People, My Homeland" at No.4, "Legend of Deification" at No. 8, "A little Red Flower" at No. 9, and "The Sacrifice" at 14th. A string of Chinese films made their way into the top at the world's box office thanks to a strong rebound in the Chinese movie market.

The contribution of domestic movies to China's box office had fluctuated between 50% and 60% since 2005, and the figure surged to a staggering 83.7% in 2020.

China's box office has skyrocketed over the past 20 years, from 2.05 billion yuan in 2005 to 64.27 billion yuan in 2019, an increase of 30 times. With the COVID-19 epidemic curbed effectively, the world's biggest film market will embrace for a bigger rise in box office

Zhou said, the sheer size of China's film market will bring its film industry to a golden era.

Figure 7 Map of top 30 Chinese cities by theater spending in 2020

Go to Forum >>0 Comment(s)