In 2007 the Chinese economy was in danger of excessive liquidity and high inflation. The central government enacted a series of measures to balance the economy. But the trade surplus still rocketed and consumer prices still soared. Relatively high inflation was the end result.

The World Bank predicted that China's trade surplus would hit US$378 billion in 2007, accounting for 11.9 percent of the GDP as compared to 2004, when the figure was only US$69 billion, or 3.6 percent of the GDP. A huge trade surplus plus constantly increasing foreign direct investment has brought in a large amount of foreign currency. As a result, China's foreign exchange reserves soared to US$1,400 billion by September 2007, making it the largest in the world and accounting for 25 percent of the world's total. The reserves were also 44 percent of China's GDP.

Meanwhile, increased foreign exchange reserves enlarged China's money base. In order to stabilize the foreign exchange rate, the central bank had to interfere with the foreign exchange market by buying in US dollars and issuing RMB. At the same time, the increasing number of RMB added more liquidity to the market. The central bank, therefore, had to take currency hedging measures in order to freeze excessive parts of the currency to keep the currency growth rate proportionate to that of the economy. Currently the Chinese financial sector still overflows with liquid capital, driving consumer prices, housing prices and share prices up and up.

In retrospect, Chinese inflation has been kept at very low levels since the mid-1990s. Yu Yongding, Director of the Institute of World Economics and Politics under the Chinese Academy of Social Sciences, said that it was a miracle China maintained its economic growth at over 10 percent while keeping inflation under 3 percent during the past 4 consecutive years. Some people even took it for granted that 2007 would be the fifth year (starting from 2003) for China to witness high economic growth with low inflation. People believed that the central bank had the ability to offset the impact that huge foreign exchange reserves would make on the money base. The reality, however, was quite different from their expectations.

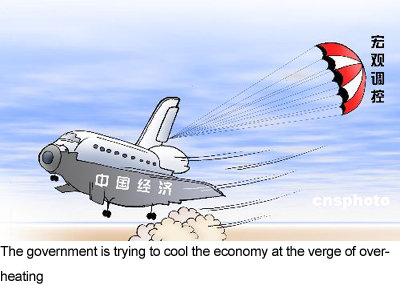

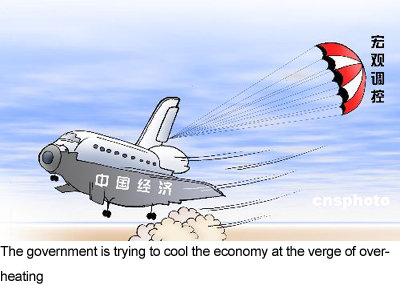

|

In November, the consumer price index (CPI) hit a decade high and jumped by 6.9 percent. Meanwhile, pork prices had been increasing for 8 weeks consecutively as of November. Pork then pushed the prices of other foodstuffs to a higher level. Even worse, rising consumer prices promoted inflation fears. Threatened by the prospects of high inflation, people invested their savings in the real estate market and thus further expanded property bubbles. Yu Yongding expressed his concern in an article warning that the Chinese macro-economy now depicts a dangerous scenario – a rising inflation rate co-existing with increasing property prices.

Fortunately, the central government has been paying careful attention to these kinds of economic problems. The latest central economic work conference lasting from December 3 to 5 set two priorities for the 2008 economic work – to prevent the economy from overheating and to curb inflation. To reach these goals, the conference decided to continue following a prudent fiscal policy but to adopt a tight monetary policy. This means that the government's public expenditures will stay stable but the currency supplies will be tightened in 2008.

Zhou Xiaochuan, chief of the central bank, said that the most demanding task in 2007 was deciding how to prevent the economy from overheating and to ease the pressure caused by consumer price hikes via a prudent monetary policy. In 2007, China raised interest rates five times and the reserve ratio 10 times. Zhou even stated that to some extent, China's monetary policy was racing with the pace of the globalization.

In addition, there is an interesting phenomenon in the Chinese economy. Since 2001, the proportion of household savings in citizen's disposable incomes has been increasing instead of falling. This means that compared with the growth of potential and actual production outputs, the domestic demand growth has been suppressed rather overheated. Given this, the biggest challenge that the Chinese economy faced in 2007 was limited domestic demands. The biggest question about the Chinese economy is not whether it can maintain its rapid growth but whether it can change its growth momentum from exports and energy-intensive production to domestic consumption, both public and private.

(China.org.cn by Pang Li, January 3, 2008)