0 Comment(s)

0 Comment(s) Print

Print E-mail China.org.cn, December 29, 2023

E-mail China.org.cn, December 29, 2023

Tourists visit the Hongyadong tourist area in Chongqing on April 30, 2023. [Photo/VCG]

Editor's note: Why do we say affluent Chinese cities are as rich as some countries? Why do we consider megalopolises as the main form to promote urbanization? In the major economic rankings of China Integrated City Index 2022, Cloud River Urban Research Institute utilizes a series of economic data to look into the dynamics of the 10 wealthiest cities and first-tier and quasi-first-tier megalopolises in China.

Top 10 cities on major economic rankings

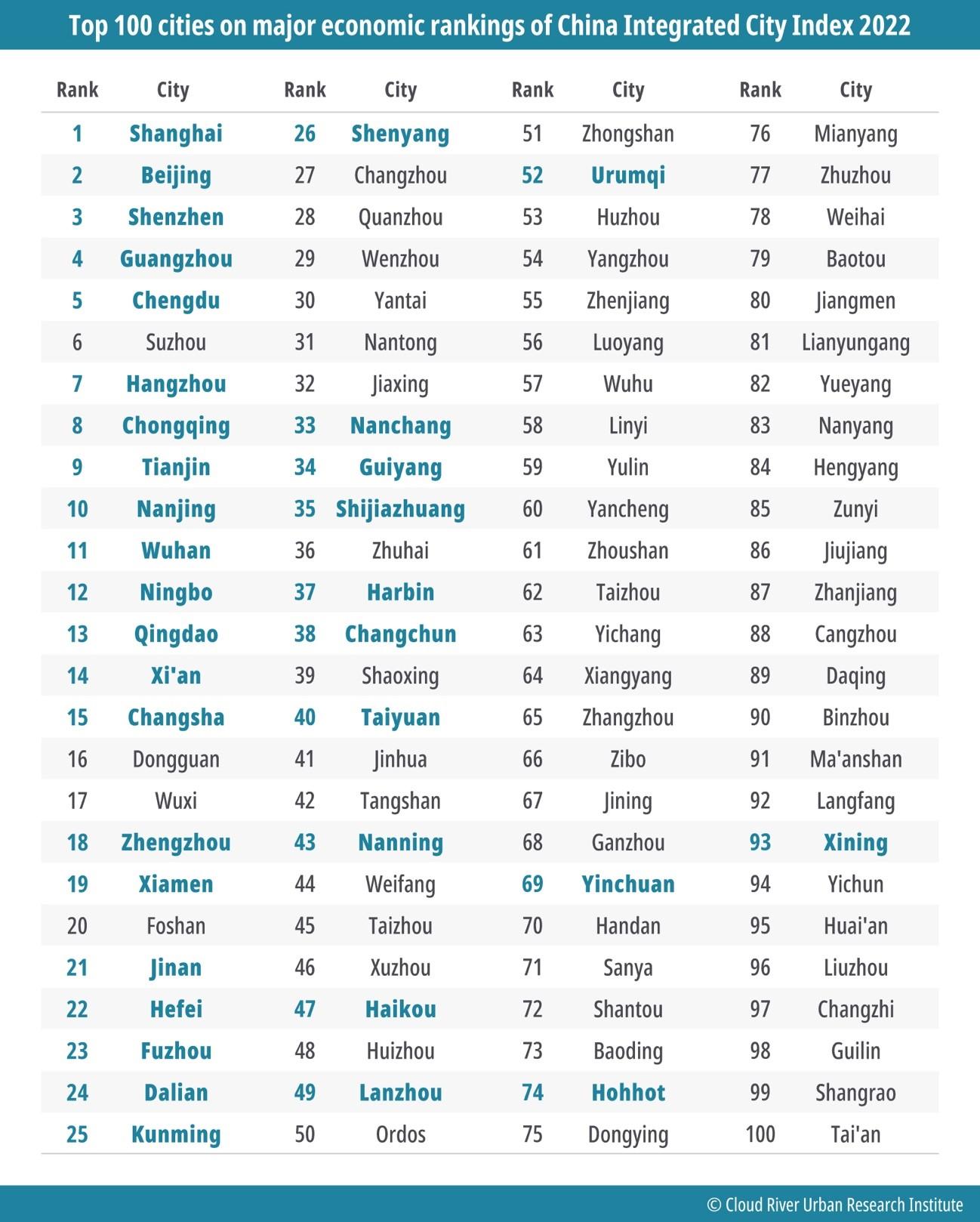

According to the major economic rankings of China Integrated City Index 2022 (hereinafter referred to as the Index), the top 10 cities are Shanghai, Beijing, Shenzhen, Guangzhou, Chengdu, Suzhou, Hangzhou, Chongqing, Tianjin, and Nanjing. Compared to 2021 rankings, Chengdu moves from 6th to 5th, Suzhou drops from 5th to 6th, Hangzhou advances from 8th to 7th, and Chongqing declines from 7th to 8th.

Ming Xiaodong, former first-level inspector of the Department of Development Planning of the National Development and Reform Commission and former minister-counsellor of the Chinese Embassy in Japan, said the top 20 cities on the rankings include all first-tier cities, quasi-first-tier cities, and seven second-tier cities.

He noted the rankings are based on nine sub-indicators including economic aggregate, economic structure, economic efficiency, business environment, openness, innovation and entrepreneurship, urban-rural integration, broad hub, and leading power, involving 227 sets of data.

He said the rankings fully illustrate that first-tier cities are the main growth engines of China's economy, while quasi-first-tier cities and some second-tier cities are the new driving forces of China's economic development.

Professor Zhou Muzhi, head of Cloud River Urban Research Institute, pointed out that as the main growth engines and new sources of China's economic development, these cities can be as wealthy as some nations.

He said GDP of some cities among the top 10 is approaching or even outstripping that of the countries ranked from 20th to 47th globally, and that the total economy of these top 10 cities accounts for 22.6% of China's GDP and 4.7% of the world's GDP, exceeds Germany's GDP (ranked 4th), and approaches Japan's GDP (ranked 3rd).

According to the comprehensive deviation values, the Index classifies the 297 cities at the prefecture level and above into first-tier, quasi-first-tier, second-tier, and third-tier cities. Further, it defines 19 megalopolises as first-tier, quasi-first-tier, second-tier, and third-tier megalopolises based on the hierarchical level of leading regional core cities. This article focuses on the analysis of the economic performance of first-tier and quasi-first-tier megalopolises in 2022.

Top 100 cities on major economic rankings of China Integrated City Index 2022

Three major megalopolises lead China's socioeconomic development

Led by the four first-tier cities — Beijing, Shanghai, Shenzhen, and Guangzhou, the Yangtze River Delta, the Pearl River Delta, and the Beijing-Tianjin-Hebei region are the three major megalopolises driving the socioeconomic development of China.

In 2022, the Yangtze River Delta accounted for 20% of China's GDP, the Pearl River Delta 8.6%, and the Beijing-Tianjin-Hebei region 7.5%. These three major megalopolises collectively generated 36.2% of the country's GDP. In 2022, the Yangtze River Delta, the Pearl River Delta, and the Beijing-Tianjin-Hebei region posted a nominal GDP growth rate of 5.1%, 4.1%, and 4.4% year on year, respectively, with the Yangtze River Delta growing fastest.

In 2022, the Yangtze River Delta made up 11.8% of the national population, the Pearl River Delta 5.5%, and the Beijing-Tianjin-Hebei region 6.2%. These three major regions concentrated 23.5% of permanent residents in the country. In 2022, the population with permanent residency in the Yangtze River Delta grew by 0.4% year on year, while the Pearl River Delta and the Beijing-Tianjin-Hebei region decreased by 0.4% and 0.3% year on year, respectively. Such decreases were related to the reduction in the number of permanent residents without local household registrations during the COVID-19 epidemic.

In 2022, the Yangtze River Delta accounted for 35.4% of China's exports, the Pearl River Delta 21.3%, and the Beijing-Tianjin-Hebei region 5.2%. These three major regions combined accounted for 61.9% of the national exports, with the Yangtze River Delta and the Pearl River Delta serving as the primary engines of China's export industry. In 2022, the export volume in the Yangtze River Delta and the Pearl River Delta increased by 10% and 5.9% year on year, while the Beijing-Tianjin-Hebei region experienced a 0.3% decline.

In 2022, the Yangtze River Delta contributed 35.4% of the country's container throughput, the Pearl River Delta 22.6%, and the Beijing-Tianjin-Hebei region 8.8%. These three major regions accounted for 66.8% of the national container throughput.

The vitality of the three major megalopolises comes from their enterprises. In 2022, the Yangtze River Delta accounted for 33.3% of the companies listed on the four major stock exchanges in Shanghai, Shenzhen, Hong Kong, and Beijing, the Pearl River Delta 14.2%, and the Beijing-Tianjin-Hebei region 13.9%. These three regions were home to 61.4% of the companies listed on the main boards in China.

Particularly noteworthy is the concentration of IT enterprises in the three major megalopolises. In 2022, the Yangtze River Delta accounted for 27.4% of the IT companies listed on the four major stock exchanges, the Pearl River Delta 19%, and the Beijing-Tianjin-Hebei region 30.3%. These three regions hosted 76.7% of such companies in China, with the Beijing-Tianjin-Hebei region and the Yangtze River Delta taking the largest shares.

The three major megalopolises have fared well in innovation and entrepreneurship. In 2022, the Yangtze River Delta made up 27.8% of granted patents nationally, the Pearl River Delta 17.9%, and the Beijing-Tianjin-Hebei region 8.6%. These three major regions contributed 54.3% of the national granted patents.

In 2022, the Yangtze River Delta were home to 13.9% of the companies listed on the ChiNext board in Shenzhen and the Growth Enterprise Market in Hong Kong, the Pearl River Delta 37%, and the Beijing-Tianjin-Hebei region 19.9%. These three regions represented 70.8% of such companies.

Go to Forum >>0 Comment(s)