Outbound investment rises

|

|

|

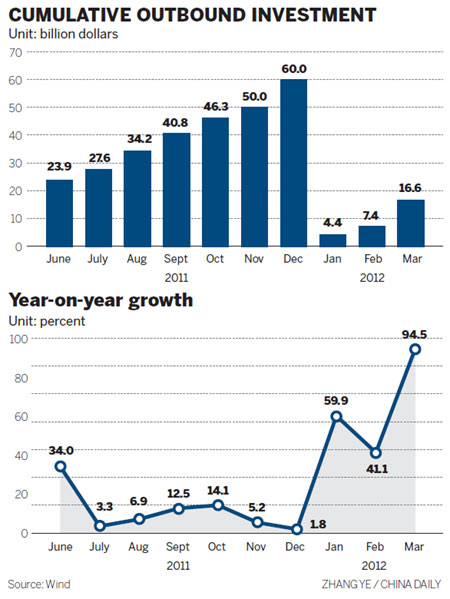

Workers assemble wheel hubs at a plant in Hung Yen province in Vietnam. The plant has received investment from the Chinese motorcycle and automobile maker Lifan Group Corp. China's outbound direct investment in non-financial sectors increased by 94.5 percent year-on-year in the first quarter of the year, hitting $16.55 billion. [Xinhua] |

Chinese outbound direct investment in the non-financial sectors almost doubled in the first quarter from a year earlier as Chinese companies were encouraged to invest abroad and opportunities arose from European debt troubles and the global financial crisis.

The fast pace of growth will continue in the coming months of the year, although it may not be as quick as what was seen in the first quarter, said Shen Danyang, spokesman for the Ministry of Commerce.

Shen said many developed and developing nations are searching the world for capital that can be used to spur their economies and, as a result, are welcoming investment from China.

At the same time, policy restrictions introduced by the Chinese government in 2011 will make State-owned enterprises more cautious about investing abroad this year, Shen said.

China's outbound investment in non-financial sectors increased by 94.5 percent in the first quarter from a year earlier, rising to $16.55 billion, the ministry said on Tuesday at a media briefing, without disclosing figures for particular regions.

Of all Chinese outbound direct investment in the first quarter of 2012, about 40 percent, worth about $6.2 billion, went into mergers and acquisitions.

"China's outbound direct investment may continue to increase rapidly this year," Shen said. "But we probably cannot expect to see growth that is as high as 100 percent, as we saw in the first quarter, be sustained."

China makes the fifth largest amount of outbound direct investment of any country in the world. By the end of March, its accumulated outbound direct investments in non-financial sectors had totaled $338.5 billion. Last year saw such investments increase by 1.8 percent year-on-year to reach $60 billion.

Although Europe has expressed a commitment to deal with its debt troubles, the world economy is still contending with great difficulties. Meanwhile, the United States, Japan, the European Union and other developed countries and regions "are still in trouble, and are not very willing to invest abroad", Shen said.

At the same time, developed and developing countries are welcoming Chinese investment.

During a recent visit to China, Italian Prime Minister Mario Monti expressed gratitude for Chinese investment. He said he expects the influx of money will spur economic growth in his country, which is perhaps being stymied by recently adopted austerity measures.

Besides Italy, the leaders of other European nations, including Germany and France, have said they will welcome more investment from China.

In January, Sany Heavy Industry Co Ltd announced plans to pay 324 million euros ($426 million) for 90 percent of Putzmeister, the largest maker of concrete pumps in Germany.

"Chinese companies are more motivated to invest abroad, while their profits are getting thinner and thinner amid rising labor and operational costs in the local market," Shen said.

China's 12th Five-Year Plan (2011-15) calls for the country to encourage domestic companies to invest overseas, as well as for foreign companies to invest in China.

China has been a target of trade protectionism for years and this situation has intensified recently, Shen said. That has driven Chinese companies to try to avoid trade disputes by investing and opening factories abroad.

In 2011, 69 trade remedy cases were filed in response to complaints about Chinese exports, which were valued at $5.9 billion. Various trade barriers, some of them dealing with product safety and environmental protection, were also aimed at Chinese goods.

China has established various funds to help its companies invest overseas. They include the China-Africa Development Fund and the China-ASEAN fund. State-owned banks have provided them with some of their capital.

And reports have said that a fund will be established to help Chinese companies invest in Latin America. The fund is due to begin operating this year.

By the end of March, 809,000 Chinese were working overseas under contracts, up by 40,000 from the same period last year.

![Workers assemble wheel hubs at a plant in Hung Yen province in Vietnam. The plant has received investment from the Chinese motorcycle and automobile maker Lifan Group Corp. China's outbound direct investment in non-financial sectors increased by 94.5 percent year-on-year in the first quarter of the year, hitting $16.55 billion. [Xinhua] Workers assemble wheel hubs at a plant in Hung Yen province in Vietnam. The plant has received investment from the Chinese motorcycle and automobile maker Lifan Group Corp. China's outbound direct investment in non-financial sectors increased by 94.5 percent year-on-year in the first quarter of the year, hitting $16.55 billion. [Xinhua]](http://images.china.cn/attachement/jpg/site1007/20120418/001aa0ba5c8510f85b2c03.jpg)