GM's Hummer comes a cropper

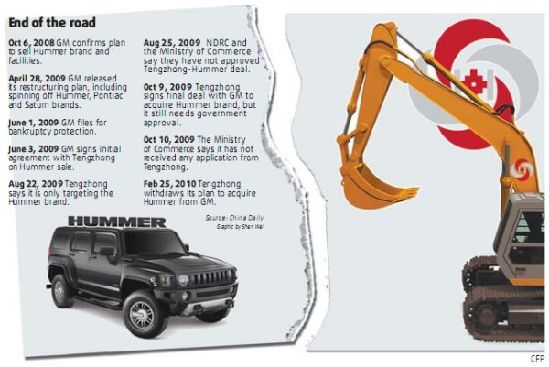

Sichuan Tengzhong Heavy Industrial Machines failure to acquire the iconic sports utility vehicle brand Hummer from General Motors (GM) does not come as a surprise and was to be expected, said leading industry analysts.

Tengzhong said Thursday it was withdrawing its proposed acquisition of Hummer, as it was unable to complete the transaction within the proposed timeframe, virtually signaling the end of the road for the US brand.

The company and GM have decided to discontinue discussions on the transaction and terminate their definitive agreement, the Chinese firm said in an e-mailed statement Thursday.

GM plans to wind down the Hummer brand over the next several months, said Nick Richards, a spokesman for the US firm. He said the US automaker does not know how many of the 3,000 Hummer jobs it would need to axe. Last year, GM managed to sell only 500 Hummer off-road vehicles in China.

Eight months back, Tengzhong's bid to acquire the Hummer brand had raised eyebrows after it signed an initial agreement two days after the ailing US automaker sought bankruptcy protection.

Meanwhile, Yao Jian, a spokesman of the Ministry of Commerce (MOFCOM), Thursday refuted reports that the deal failed as it did not get government approval. Yao said no documents related to the deal were submitted by Tengzhong to MOFCOM, the National Development and Reform Commission, or the Sichuan Provincial Department of Commerce.

"Chinese enterprises should have a clear acquisition model, including an investment and financing plan, before submitting applications to the government," said Yao.

"The failure of the Hummer deal is not unexpected, as it is not in line with China's plans to promote green cars," said Zhong Shi, an independent auto industry analyst based in Beijing.

One of the hitches could have been the fact that Hummer's major model the H2, has a 6.2-liter V8 engine. The Chinese government has been encouraging consumers to opt for smaller vehicles with an engine capacity of or less than 1.6 liters through tax cuts and subsidies since last year.

"I cannot find any persuasive reason for Tengzhong to buy Hummer," said Zhang Xin, an analyst with Guotai & Jun'an Securities. "It was not a worthy and rational deal from the beginning as Tengzhong can only own the Hummer brand through the purchase, but not the core technologies," he said.

"It will also be a good idea for Tengzhong to acquire some useful technologies when Hummer enters bankruptcy liquidation," Zhong said.

Analysts are also not bullish on the Tengzhong-Hummer deal even if the Chinese firm acquires the brand through an offshore vehicle.

"It will be even more risky. Even if they finalize the transaction, Tengzhong cannot produce the vehicles locally as it would need to set up a domestic joint venture first and then get government approval for its manufacturing unit."

0

0

Go to Forum >>0 Comments