China raises benchmark interest rates

|

Editor's notes: |

|

On February 8, the People's Bank of China (PBOC), China's central bank, announced its first interest rate increase in 2011. The surprise 25-basis-point rate hike is aimed to help dry up liquidity and curb the surging inflation. |

|

Latest news: | |

|

|

Rate hike 'aims to help tame inflation' China's central bank raised interest rates by 25 basis points. The PBOC waited until the final day of the Lunar New Year holiday to announce the move, which had been expected for weeks. Recent rate hikes: |

|

• Wen vows to control inflation in new year |

|

|

Experts' opinions: | |

|

|

"The central bank raised benchmark interest rates to adjust inflation expectations, because prices rose too fast during the spring festival and January CPI is expected to be high." -- Li Daokui, advisor to the central bank's monetary policy committee |

|

"The central bank's move is in line with market expectations. I think there may be another reserve requirement ratio hike by the end of February or the beginning of March." -- Zuo Xiaolei, chief economist at Galaxy Securities |

|

|

|

"This round of interest rate hike is aimed to manage inflation expectations and regulate the property market. I think there should be two more rate hikes in the first half of this year." -- Zhu Jianfang, chief economist at CITIC Securities |

|

"There will probably be more rate hikes this year. The central bank should do this long time ago. It's already late." -- Xu Xiaonian, Professor of Economics and Finance at CEIBS |

|

|

|

"The interest rate hike is within my previous expectations. In my opinion, the central bank's move had something to do with the CPI data of January, which could be as high as 5.3 percent." -- Lu Zhengwei, chief economist at Industrial Bank |

|

"The central bank's move was again an effort to curb inflation, however the effect will not be shown immediately. Also, there may also be a reserve requirement hike within the month." -- Zhu Baoliang, chief economist at State Information Center |

|

|

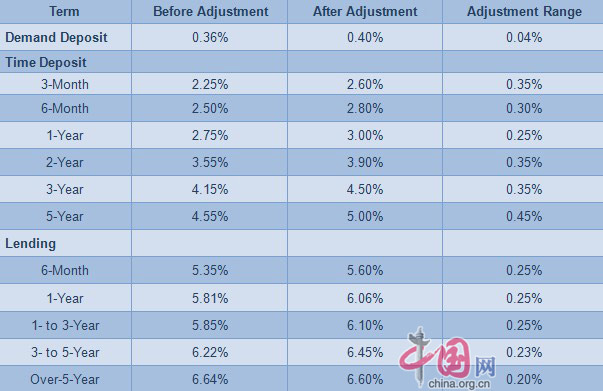

Current borrowing and lending interest rates |

|

|

|

Interest rate hikes in recent years |

|

|

0

0

Go to Forum >>0 Comments