'Hot money' inflow hits US$35.5b

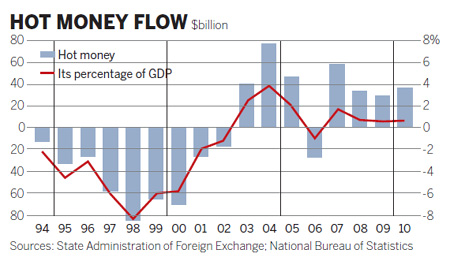

China witnessed a "hot money" inflow of $35.5 billion in 2010, accounting for a relatively small part of the increase in foreign exchange reserves, the State Administration of Foreign Exchange (SAFE) said in a report published on Thursday.

This is the first time that China announced an official estimation of "hot money" - short-term speculative capital - to the public.

The figure accounted for 7.6 percent of the increase in foreign exchange reserves from 2009, SAFE said.

Wang Tao, head of China economic research at UBS Securities, told China Daily that the official figure of $35.5 billion is very close to their estimates.

"That's a very small amount (compared to China's huge economy) and proved what we have been saying, that speculative cross-border inflows have a very limited impact on the economy," she said.

In the past 10 years, the "hot money" inflow has shown a slight upward trend, with $25 billion, on average, flowing annually into the world second-largest economy, which amounts to roughly 9 percent of the increase in foreign reserves over the period.

"The continuous capital inflows were mainly attracted by stable and rapid economic growth in China," SAFE said in the report.

The influence of "hot money" on the economy is reducing as the country maintains rapid economic growth, China News Service quoted a SAFE official as saying on Thursday.

China has been worried by the prospect of surging capital inflows that could indicate rising speculation in the real estate sector and the volatile stock market. Some analysts said that the loose monetary stance of the United States could have led to a new round of inflows, leading to an increase in inflation.

Liu Mingkang, China's top banking regulator and a member of the central bank's monetary policy committee, said in December that increasing speculative capital inflows will make it more difficult to curb inflation.

The consumer price index surged to 5.1 percent in November, a 28-month high, before declining to 4.6 percent in December and increasing slightly to 4.9 percent in January.

Lian Ping, chief economist at the Bank of Communications, said it would be very hard for the government to meet the widely reported 4-percent target this year and inflation is likely to hit 4.5 percent for the whole year.

Foreign exchange reserves increased $199 billion in the fourth quarter and rose to a record $2.85 trillion by the end of last year, an 18.7 percent year-on-year increase, according to statistics from the central bank, arousing concerns over excessive liquidity.

Wang said there could be an increase in cross-border capital inflows - including "hot money" - to China this year if major economies such as the US continue their loose monetary policies.

"But unlike other emerging countries, China always has very tight control over the inflows, so the influence would be limited," she said.

"The central bank has already taken the right measures to hedge potential inflow risks," said Wang.

Zhou Xiaochuan, the central bank governor, said in November that he was confident the country's solid measures can manage the inflow risks posed by US quantitative-easing policies.

He urged the use of a "pool" to absorb hot money inflows to the nation. Foreign exchange reserves are an example of such a pool, Zhou said.

"We should keep an eye on capital inflow, but we need to remember that it is impossible to shut the door completely," he said.

Zuo Xiaolei, chief economist at Galaxy Securities, said capital inflow risks would be lessened as the government has taken steps to cool the property market.

She expected speculative capital would turn to other emerging markets.

0

0

Go to Forum >>0 Comments