Huawei looks to take on Cisco in data routers

Huawei Technologies Co, China's largest maker of telecom-networking equipment, is banking on the rising number of mergers of computer and communication networks to narrow the gap with Cisco Systems Inc in data routers and switches.

"Cisco is clearly the leader in this domain, but we also believe changes are happening," Leon He, president of solution sales at Huawei's enterprise business unit, said in an interview on May 6.

"Those changes will mainly occur because of the emergence of converged technologies and new, innovative technologies. When those changes occur, the current market and customer needs will change."

Huawei is expanding beyond its traditional business of supplying equipment for phone networks as it strives to more than triple sales to $100 billion in the next 10 years.

The push to win more orders from businesses and government agencies may pose the biggest threat to Cisco and bolster Huawei in the United States, where its acquisitions bids have been thwarted.

The time is right for Huawei to push into the enterprise market because of the opportunities created by businesses and governments merging their audio-visual systems with telephone and computer networks for functions such as video conferencing, He said. The potential market is in the "trillions of dollars", said John Roese, Huawei's senior vice-president and general manager of North America research and development, in Shanghai on April 27.

"Huawei is definitely moving up the food chain," said Sandeep Shyamsukha, an analyst at Auriga USA LLC in San Francisco.

"As their products get better and their pricing remains aggressive, they can take market share from other players," said Shyamsukha, who has a "hold" rating on Cisco and doesn't own the shares.

Bidding for enterprise business will mean more head-to-head competition with California-based Cisco.

"Enterprise is our core capability," Cisco's Chief Executive Officer John Chambers told investors at a technology forum on April 7. "We're an enterprise company. That's where we started."

The enterprise business and the public sector account for about 46 percent of Cisco's sales, Chambers said. David McCulloch, a spokesman for Cisco, declined to comment.

"The market Huawei sees is huge," Huawei's He said. "If we digitize, we will bring a revolution. When the shift occurs from digital to smart networks, that will be another revolution."

Cisco's shares have declined 33 percent in the past year, trailing the 16 percent gain in the Standard & Poor's 500 Index as the company struggled to maintain its historic levels of profitability amid an expansion into more than 30 side businesses such as smart grids, home networking and digital music hosting.

Cisco's Chambers has promised to sharpen the network-equipment maker's focus. The company overhauled its management May 5 to concentrate on three regions and rein in its council-style management structure.

Last month, the company said it will close its Flip video-camera unit and cut 550 jobs.

"Cisco's recent issues could open up some opportunities for Huawei," said Duncan Clark, chairman of Beijing-based BDA China, which advises technology companies.

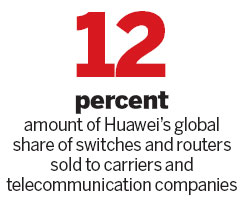

The Chinese company has seen its global share of switches and routers sold to carriers and telecommunication companies rise to 12 percent last year from 2 percent in 2005, according to Matt Walker, a Thailand-based analyst at the telecommunications consultant Ovum.

Cisco's share of that market has dropped to 41 percent from 49 percent, over the same period, Walker estimates.

Huawei has had less success cracking the market for enterprise routers, where Cisco held 81.8 percent of the market in the fourth quarter of last year, compared with fourth-placed Huawei's 2.5 percent share, according to California-based market research firm, Dell'Oro Group.

0

0

Go to Forum >>0 Comments