From Beijing to Benin, Guinea to Guangzhou

|

|

|

Workers fixing guard rails on a bridge in Bamako, capital of Mali. The bridge, built using Chinese aid funds, will be completed by September. [Xinhua] |

Investment in Africa is set to increase, as Ding Qingfen has been discovering.

The crowd roars and someone shouts "Nice goal!" to the group of boys playing soccer on a narrow, dusty 50-square-meter field in a western suburb of Conakry, the capital city of Guinea.

The whistles and boos hanging in the air indicate just how popular soccer is with these boys, and they may soon find a better location for their games - a soon to be completed stadium just a few hundred meters to the north. The project, which covers 240,000 square meters, includes a standard ground track and soccer field with 50,000 seats.

It is one of the many structures under construction using Chinese aid in this West African nation, which has a population of about 10 million, and upon completion at the end of this year it will be the largest stadium in the region.

"This is a great project and a treasure for the Guinean people," said Issa Soumah, head of the project and also a senior sports official from the Guinean government. "It provides local people with a place to play soccer and exercise, and it will also help promote the nation's sports overall."

Aid, however, is not the only thing linking China and Africa. Trade and investment are also surging between the two, and China has become an increasingly important role model of a successful transitional economy for African nations, which are working hard to accelerate economic development and improve local livelihoods.

Political turmoil broke out in a number of African nations late last year, and many countries, including those that have experienced social unrest, have "never been more eager than now to transform and grow their economies, and Chinese investment is more and more important (for them)", said Fu Ziying, China's vice-minister of commerce. "This provides Chinese investors with a huge number of promising opportunities," Fu, also team leader of a ministry delegation to Africa in April, told China Daily.

The Ministry of Commerce sends an annual delegation to Africa, seeking opportunities for economic and trade cooperation. This year, the delegation was the biggest ever, and the 50-strong team included representatives of major State-owned and private companies from a range of industries. It visited six nations: Mauritania, Guinea, Mali, Ethiopia, Egypt and Tunisia.

High-ranking officials from the African nations displayed their determination to develop the local economies, providing potential business opportunities for Chinese companies.

"We have been mulling over investing overseas. Africa is a strategic region and also our priority market, as it has fantastic consumption potential," said Teng Hexian, chairman of Beijing Runfar Investment Group.

The private company has signed a preliminary cooperative framework with Brilliance China Automotive Holdings Ltd to establish the largest auto plant in Benin, with a total investment of 300 million yuan ($46 million). The Benin plant will be Runfar's first overseas investment.

But it's not only manufacturing opportunities that are enticing Chinese companies. Zhou Jiayi, vice-president of Sinohydro Corporation Ltd, told China Daily: "the African nations' commitment to boosting their economies and enhancing the infrastructure means plenty of business in hydropower construction."

Sinohydro is China's leading provider of hydropower construction services, and is ranked sixth nationwide in terms of outbound contract engineering. The company's business covers 15 African nations, including Angola and Sudan.

Sinohydro is China's leading provider of hydropower construction services, and is ranked sixth nationwide in terms of outbound contract engineering. The company's business covers 15 African nations, including Angola and Sudan.

Historically, the majority of Chinese investment flowing into Africa has gone into the mining and agriculture industries, and China can still play a big role in those sectors. "Africa is rich in natural resources, and China can help the continent translate those advantages into commercial benefits by transferring technology and injecting capital," said Fu.

"Africa will be the first step for us going overseas, as the region has abundant resources. We are in discussions about a fairly big mining deal in Guinea," said Shi Mingwei, general manager of CPI International Minerals & Investment Co Ltd.

Robust growth

China's investment in Africa can be traced back to the 1980s. At that time the nation's businesses gained a presence in the continent's markets through aid projects. But the investment has diversified and gradually expanded region by region during the past three decades.

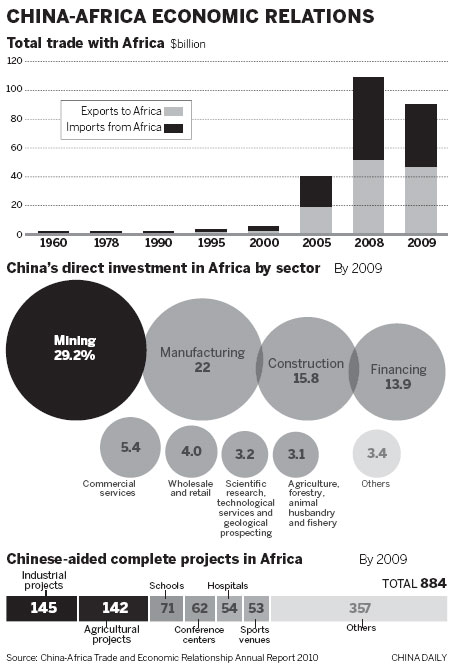

According to the Ministry of Commerce, China's investment in Africa had grown to $9.33 billion by the end of 2009, going into industries such as finance, mining, manufacturing and agriculture.

"That leaves an amazingly large potential for Chinese investors to tap into Africa. In the next five to 10 years, Chinese investment in Africa will be on a fast growth track," said Hu Zhirong, vice-president of the China-Africa Development Fund (CADF).

In the nations at the heart of the social unrest, such as Eygpt, policymakers are pushing to stimulate the local economy to improve the general standard of living.

"China's investment in Egypt will be very positive in the long term when the political situation stabilizes, although the amount invested will probably decline this year," said Ma Jianchun, a minister counselor at the Chinese embassy in Cairo.

By 2010, China's accumulative investment in Africa was $10 billion and Standard Chartered Bank has predicted that the nation will be investing a staggering $50 billion annually in the continent by 2015.

In addition to resource-related industries such as agriculture and mining, the manufacturing and infrastructure sectors will also see rapid growth and absorb more Chinese investment, Hu said.

China's investment, especially in infrastructure projects, has stimulated exports to Africa. "An upward trend has appeared in China's exports of electric machinery, power equipment and road locomotives to Africa," said a report by Standard Chartered.

In 1950, Sino-African trade was a mere $12.1 million. The establishment of the China-Africa Cooperation Forum in 2000 helped to take bilateral economic and trade relations into a new era. In 2008, bilateral trade reached $100 billion from $7.3 billion in 2000 and, in 2010, it hit a record $126.9 billion.

As a subsidiary of China Development Bank Corp (CDB), CADF was established after China's President Hu Jintao proposed a fund to promote bilateral investment relations in 2006. By 2009, CADF had earmarked $700 million for 30 projects in sectors such as agriculture, machinery manufacturing, electricity and mining.

Compared with Western projects, China's investment in Africa is "quite small, and the tiny proportion does not tally with China's long-term economic and trade relationship with the region", said Hu of CADF.

Overseas media reports have often accused China of grabbing resources in Africa by making investments and exchanging foreign-aid projects for resources. However, officials and experts from both China and the African nations have noted that Western companies made much earlier forays into the African continent and some even remain dominant in the mining industry today.

The commerce ministry's Fu said he totally disagreed with the criticism. "China's long-term foreign aid to African nations is prompted by real friendship. For example, China has a lot of foreign aid-related projects in nations such as Mali, that have few natural resources," he said.

Good bet

China contributes to Africa not only through investment, but also through its role as a successful transitional economy that can provide lessons for the continent.

For their part, African nations across the board are increasing efforts to invigorate their economies and create more jobs.

Alpha Conde, the president of Guinea - a nation that has the world's largest reserves of bauxite, the raw material from which aluminum is acquired - said that Guinea welcomes Chinese investment, which is helping to stimulate the nation's agricultural and manufacturing sectors.

Ethiopia has just launched its second Five-year Plan (2011-2015), called "The Growth and Transformation Plan", as it strives to transform itself from an agricultural economy to one based on industry.

Rob Davies, South Africa's minister of Trade and Development, said recently that African nations need to drastically develop manufacturing and labor-intensive industries to effectively address the problem of poverty, rather than over-reliance on developing their mining resources.

China has set a good example in pursuit of such a goal, and Africa can learn from China's experiences, said Davies.

China launched its reform and opening-up policy three decades ago. By the end of 2010, the country's accumulated inbound foreign direct investment was more than $1 trillion and the nation's foreign trade was $2.97 trillion, accounting for 10 percent of the global total.

According to Li Xiaobing, deputy director-general of the Commerce Ministry's Department of Western Asian and African affairs, "China and Africa need each other more and more as both are at crucial periods of economic transformation".

For the African nations, Chinese investment has brought them not only quality goods and technology at a low price, but also hundreds of thousands of job opportunities.

China-Africa Leather Co Ltd, which is situated in Ethiopia and is China's largest leather investment deal on the continent, is a good example of this.

With investment of 159 million yuan ($24.5 million), the company began operations in November 2010, with the capacity to manufacture 1.5 million square meters of finished leather and 1 million pairs of leather gloves annually, mainly for export to China and the European Union.

"We have helped strengthen the development of livestock-raising chains in Ethiopia, improving the processing capability of the local industry," said He Mingliang, chairman of China-Africa Leather. The company has created 1,300 jobs locally and could generate foreign exchange of $25 million annually, he said.

"What is certain is that we have a long-term strategy here, thanks to the low cost of labor and the huge market potential," He said.

Bumpy road ahead

However, promising prospects cannot hide the invisible conflicts and problems that can confront the Chinese companies at any time.

China-Africa Leather's He cautioned that the troubles are ever-present. In late April, the company was asked by the local government to suspend operations because of alleged water pollution. "They (the local government) always seem to be looking for errors," said He.

The unstable political situation in several African nations is another major challenge for investors and business people. Du Weiqiang, vice-president of Chery International, the overseas sales arm of Chery Automobile Co Ltd, told China Daily that Africa is not a priority area for the company's overseas investment because of the possibility of political turbulence.

"Traps always follow opportunities. We don't want to bet much on the region for the time being, although we are willing to expand in Africa," Du said.

Latin America is the company's best-performing market. China's largest auto exporter has factories in Brazil and Uruguay, and has signed an agreement with the Venezuelan government to establish another.

"The greater the opportunities, the greater the risks," said Li from the commerce ministry.

According to Li Jiping, vice-governor of CDB, a "long-term business strategy" is the best way to leverage the opportunities in Africa.

"Nobody can ignore the opportunities, especially in the next three to five years, but without a long-term strategy, we can easily see promising chances slip away," he said.

However, "we should always brace ourselves to expand business in Africa with full confidence", Li said.

"The challenges will never change our mind about gaining a foothold in Africa," agreed He Mingliang.

0

0

Go to Forum >>0 Comments