Home price falls to continue

0 Comment(s)

0 Comment(s) Print

Print E-mail

China Daily, January 10, 2012

E-mail

China Daily, January 10, 2012

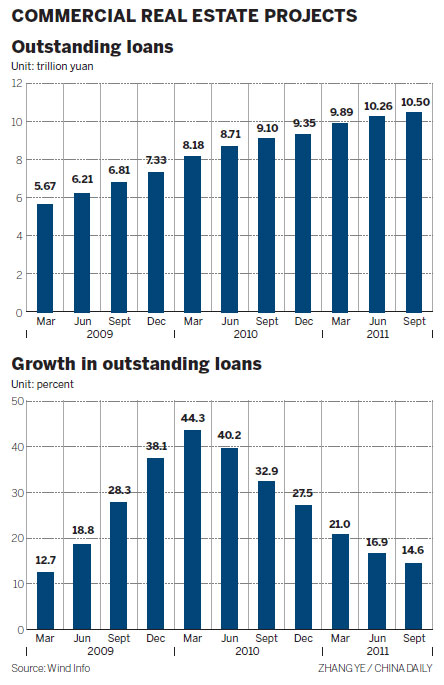

However, the ongoing correction in the country's real estate market is raising concerns for some international investors. Although the central government has reiterated its determination to maintain its rigorous policies, some industry insiders still expect a gradual loosening in the second half of the year.

The country's property market will collapse if the government maintains its tightening policies, according to Chen Li, head of China equity strategy at the investment bank UBS AG.

"The government may relax its curbs on the real estate market before the fourth quarter," Chen said, according to quotes published by Bloomberg on Monday.

James Macdonald, head of Savills China research, part of the real estate information provider, Savills PLC, held a similar viewpoint.

"It is widely believed by market observers and experts that the policies will be loosened in the second half of 2012," said Macdonald.

The worsening international economic situation means that central government policy is likely to focus on sustaining growth in the domestic economy and on employment levels. Therefore, the central government is likely to loosen the current tightening policy. An initial step was the reduction of the reserve-requirement ratio for lenders by 50 basis points, he said.

At the same time, the government is wary of loosening the restrictions too early or too quickly, Macdonald added.

The loosening of the restrictions is likely to be slower and not as comprehensive as in 2009. The temporary hard-line restrictions will be replaced by softer policies designed to be more flexible. Those measures could include replacing the home-purchasing restrictions with a property tax, which - rather than forbidding investment in multiple properties - would discourage investors by increasing the cost of ownership and diminish returns.

Go to Forum >>0 Comment(s)