Gold's sparkle likely to shine on Chinese demand

0 Comment(s)

0 Comment(s) Print

Print E-mail China Daily, March 2, 2012

E-mail China Daily, March 2, 2012

|

|

|

China has been the world's biggest gold producer for the past five years. [CFP] |

Zhao Yanyun, a 59-year-old woman saving for her retirement, said she feels safe investing her money in gold.

"I think gold is a good hedge against inflation," said Zhao. "The gold price will surely rise in the future because of the metal's scarcity. And you can easily convert gold into cash when you need it."

There are many gold bugs like Zhao in China.

Gold jewelry sales in Shanghai hit 610 million yuan (US$96.8 million) during the Spring Festival holiday in January, according to Xu Wenjun, secretary-general of the Shanghai Gold and Jewelry Trade Association. "To the Chinese people, gold represents prosperity and auspiciousness," Xu said. "It's very common for the elders to give the young gold jewelry as a blessing on their wedding day."

According to Shanghai demographics, the number of young couples expected to marry will increase until 2015, so Xu said he is confident about rising gold sales in the coming years.

Gold sales in the city rose 21 percent last year to 40 billion yuan (US$6.3 billion). About 110 tons were sold.

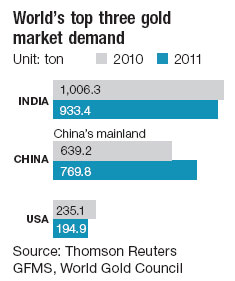

The World Gold Council, an industry body comprised primarily of gold producers, said in January that China might overtake India as the world's largest gold market for the first time this year.

Demand rises

China has been the world's biggest gold producer for the past five years.

Gold demand in China jumped 22 percent to 811.2 tons in 2011, while demand in India slipped 7 percent, according to the WGC. China's accounted for 23.5 percent of global demand.

The European debt crisis and uncertainty about the strength of the US economic rebound have helped fan demand for gold as a safe-haven investment.

The spot gold price has risen about 10 percent this year.

However, gold futures in New York dropped almost US$100 to just below US$1,700 an ounce on Wednesday after Federal Reserve Chairman Ben Bernanke, in testimony before Congress, seemed to back off any indication of a third round of "quantitative easing." Investors who bought gold expecting the Fed to expand money supply and thereby increase prospects for inflation were disappointed and sold off the metal.

In Asian trading yesterday, the gold price was recovering somewhat.

Whatever day-to-day trading brings, the outlook still shines for Shanghai.

Consumers keep visiting jewelry shops and banks in the city to buy jewelry, bullion bars and coins, believing that the yellow metal will bring them luck and fortune in the Year of the Dragon.

"Rising gold prices will not damp consumers' passion for gold," said Xu. "Especially during the Year of the Dragon, we see rising market demand for gold jewelry."

For purchases of physical gold bars, most banks charge about 10 yuan per gram extra on the price of gold at 99.99 purity traded on the Shanghai Gold Exchange.

Gold jewelry, gram for gram, is more expensive because of processing and design costs.

According to the gold exchange's January report, half of the top 10 traders in gold are Chinese banks, with Bank of China ranking first.

Gold is a hedge against inflation risk, DBS said. However, the Singapore-based bank isn't recommending people purchase gold jewelry because of the valued-added processing costs, transaction fees and physical wear and tear. Commemorative gold coins have higher investment risk because of volatile prices. The bullion bar remains the cheapest and safest way to stash away the metal for investment purposes.

Still, gold jewelry accounts for the lion's share of domestic gold sales in China. In 2011, that demand was more than twice the demand for bars and coins.

Sales of bars and coins surged 43 percent last year to 266 tons. That trend is set to continue through 2012, the WGC predicted, especially if high inflation persists in China.

Other than purchasing physical gold, investors can put their money into gold mining stocks or into exchange-traded funds.

Hang Seng Bank two weeks ago launched the first yuan-denominated gold ETF listed on Hong Kong's stock exchange. The fund, whose performance closely corresponds to London gold fixing price, has lost 1.25 percent in its trading price yesterday. So far, the fund price has gained 1.71 percent since the launch.

Winners and losers

As with any investment, there are always winners and losers.

China Guangfa Bank launched a structured product linked to the spot gold price last year, promising but not guaranteeing a maximum annual return of 8 percent. According to the prospectus, however, the return could be as little as 0.36 percent if the spot price fell below or exceeded a certain price interval during the life of the product.

In December, spot gold rose beyond the upper limit, so the return shrank substantially, leaving many unhappy investors who didn't cash in fully on the bull run of gold prices.

Most institutions are projecting a rise in gold prices this year. Citigroup earlier said it expects the gold price to hit US$2,000 an ounce in six months.

Hang Seng Bank made a similar projection.

"Spot gold will reach the historic high of US$1,921 again this year, or even exceed the US$2,000 threshold," said the bank in a report issued last month.

Goldman Sachs is also recommending investors include gold in their portfolios.

All the glowing forecasts cheer individual gold investors like Zhao.

"It's widely believed that the price will go up," she said. "Although there's no guarantee, I simply believe in it. Gold is the only international currency that has value preservation, especially if a financial catastrophe occurs."

1.6% vs 74.5%

China is the world's largest gold producer and is expected to become the biggest sales market this year. However, the nation's gold reserves pale by comparison to the US.

At the end of 2011, China's gold reserves totaled 1,054.1 tons, according to the World Gold Council, accounting for 1.6 percent of China's total foreign-exchange reserves. That proportion edged down by 0.2 percentage point last year.

The US held 6.7 times more tonnage than China, with gold reserves of 8,133.5 tons, or 74.5 percent of its total foreign reserves, said the WGC. That ratio fell 2.1 percentage points.

But the amount of gold held by each country was the same.

![China has been the world's biggest gold producer for the past five years. [CFP] China has been the world's biggest gold producer for the past five years. [CFP]](http://images.china.cn/attachement/jpg/site1007/20120302/001aa0ba5c8510ba7c3a10.jpg)

Go to Forum >>0 Comment(s)