Report shows Chinese banks lack transparency

- By Qu Yi

0 Comment(s)

0 Comment(s) Print

Print E-mail China.org.cn, July 13, 2012

E-mail China.org.cn, July 13, 2012

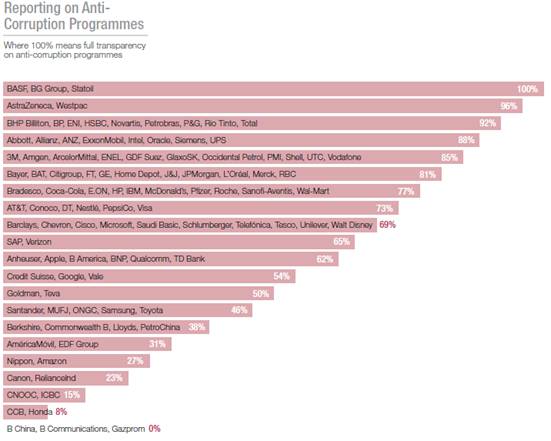

Chinese companies ranked at or near the bottom of a list of 105 international firms ranked for transparency, according to a July 10 report from anti-corruption watchdog Transparency International.

The highest-ranked Chinese company is PetroChina, but still ranked 69th on the list. Among the four Chinese major banks, Industrial and Commercial Bank of China Ltd., the country's largest lender, was 76th, the highest-ranked of the four. Out of 24 financial firms surveyed, the bottom three were state-owned Chinese banks ― China Construction Bank Corp., Bank of Communications Co. and Bank of China Ltd., with the latter two comprising the bottom of the broader list.

The list assessed transparency of the 105 biggest companies by market capitalization as reported by Forbes Magazine. The firms make up more than US$11 trillion in total value and touch the lives of people in virtually every country around the globe. Criteria for evaluation included disclosure of anti-corruption measures, corporate structures, tax payments and revenues.

According to the report, Norway's Statoil ASA held the first place, scoring an index of 8.3 out of 10, followed by Anglo-Australian miners Rio Tinto PLC and BHP Billiton PLC.

|

The Transparency International Report highlights weakness in corporate governance, media independence and state bodies.

Transparency International said resources firms scored well because they have been under pressure from advocacy groups for years, as they have traditionally been seen as high-risk in terms of corruption.

In contrast, financial companies scored on average just 4.2. Among the 24 financial institutions in the survey there are 19 banks, four diversified financial service providers and one insurance company.

Transparency International said in a statement that although financial enterprises put efforts to address the lack of transparency in the wake of the financial crisis in 2008, they still have "opaque company structures."

Transparency International also indicated that there were 78 of the world's largest companies operating in China, but only 12 of them disclosed revenue and sales via their website and only 2 of them disclosed the income taxes which they paid to country. In the anti-corruption program rankings (100 percent indicating full transparency), the transparency of Bank of China and Bank of Communications was 0 percent, and ICBC was 15 percent.

|

It is expected that the pressure from investors, governments and society can encourage businesses to become more transparent. Transparency International also recommends that governments and regulatory bodies force companies to disclose all subsidiaries, affiliates, joint ventures and other similar entities and ask companies to report on a country-by-country basis.

Go to Forum >>0 Comment(s)