Economists puzzled by state of economy

0 Comment(s)

0 Comment(s) Print

Print E-mail China Daily, June 17, 2013

E-mail China Daily, June 17, 2013

Growth pattern

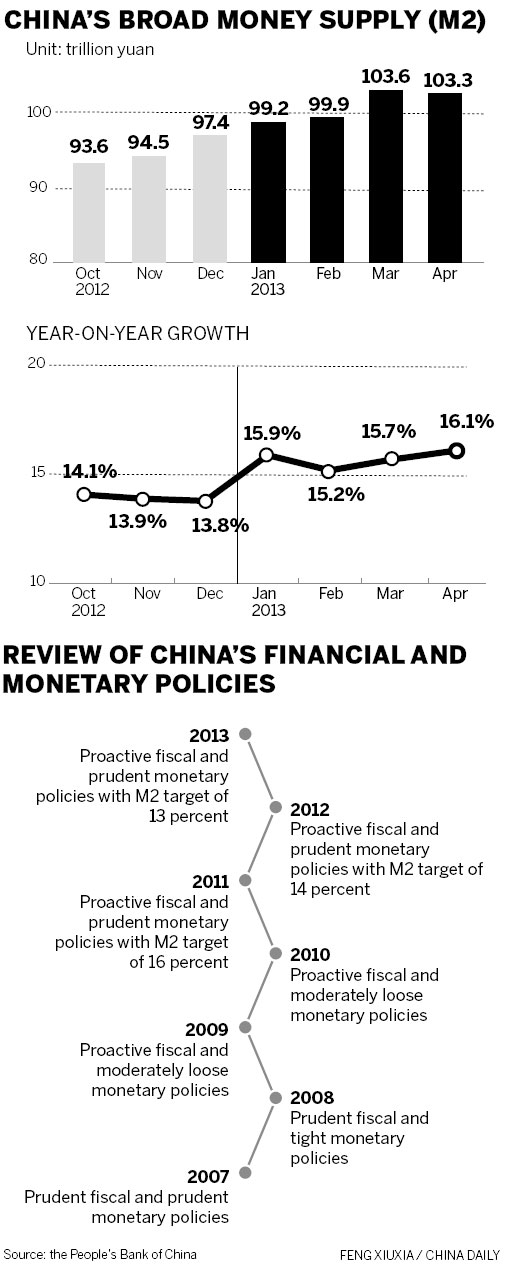

China's traditional economic growth pattern that excessively depends on investment increases the fast expansion of bank credit, when other financing channels are underdeveloped. Therefore, the base money is driven incredibly high by surging credit, said Ji from the central bank.

"Fundamentally, the nation was urged to transform the growth model but it still needs a long time to come into effect," he said.

Louis Kuijs, the chief economist in China at the Royal Bank of Scotland, said "With economic recovery not particularly strong, we see no change in the headline monetary policy stance any time soon".

"After the implementation of regulatory measures to improve transparency and constrain growth of non-bank lending, the less strictly regulated part of the financial system, we expect more such steps," Kuijs added.

A domestic risk for economic growth is that concerns about financial risks may lead to more drastic measures, he added.

The China Banking Regulatory Commission issued a regulation in March lowering the highest proportion of wealth management products that can be invested in non-standard credit assets.

In addition, bond trading between banks' proprietary accounts and their wealth management products was prohibited in May.

A report from Barclays Bank in Hong Kong said the tightening policy may bring some short-term negative effects. "But we believe proper regulation of wealth management products will help lower bank systemic risk and benefit China's banking sector over the longer term," it said.

Another reason for the high monetary supply is down to continually expanding foreign exchange reserves.

In April, foreign exchange reserves rose by $66 billion. The increase was $99 billion for the whole of 2012. They rose by $157 billion in the first quarter this year, dominated by capital inflows.

While economists predicted no interest rate rise or cut in China until the end of this year, developed economies continued to extend quantitative monetary easing measures in a bet on economic recovery.

The US Federal Open Market Committee is likely to extend its program of longer-term asset purchase plans into 2014 based on its softer manufacturing data and lower inflation, economists said, although a recent speech by Ben Bernanke, chairman of the US Federal Reserve, the country's central bank, indicated the possibility of reducing the amount of bond-buying.

Nick Matthews, an economist with Nomura Securities Co, said: "We see one third probability of a further refi rate cut of the European Central Bank in June, which is more likely accompanied by a narrowing of the corridor than a deposit rate cut - and asset purchases are under consideration." A refi rate is the benchmark interest rate in the European Union.

Wang Tao, the chief economist in China with UBS AG, said multiple rounds of quantitative easing by major central banks have resulted in abundant liquidity flooding the market, putting upward pressure on many emerging market currencies and having negative effects on their competitiveness and exports.

"In China, the currency is no longer much under-valued from a basic current account balance point of view, with the current account surplus now only making up 2 percent of GDP. The yuan has appreciated by more than 12 percent on a real trade-weighted basis. It should be on its guard against further capital flow-induced appreciation," said Wang.

The yuan exchange rate against the dollar reached a record high of 6.1818 on May 28, hitting the lowest limit of the daily trading band.

In the past two months the yuan has appreciated by 1.7 percent against the dollar while the Japanese yen depreciated sharply and most other Asian currencies depreciated moderately.

The puzzle is that many economies have recently increased capital controls in order to reduce the pressures on their currencies. However, China made the decision to let the yuan appreciate in line with market pressure, which is "indeed unusual", said Wang.

Economists speculate that a more flexible foreign exchange may be seen this year with the central bank strongly pushing for exchange rate and capital account liberalization.

|

|

|

The People's Bank of China, the central bank, plays a leading role in national economic development. The traditional economic growth pattern that excessively depends on investment increases the fast expansion of bank credit, when other financing channels are underdeveloped. Therefore, base money supply is driven incredibly high by surging credit, said Ji Zhihong, director of the research bureau of the People's Bank of China. [China Daily] |

![The People's Bank of China, the central bank, plays a leading role in national economic development. The traditional economic growth pattern that excessively depends on investment increases the fast expansion of bank credit, when other financing channels are underdeveloped. Therefore, base money supply is driven incredibly high by surging credit, said Ji Zhihong, director of the research bureau of the People's Bank of China. [China Daily] The People's Bank of China, the central bank, plays a leading role in national economic development. The traditional economic growth pattern that excessively depends on investment increases the fast expansion of bank credit, when other financing channels are underdeveloped. Therefore, base money supply is driven incredibly high by surging credit, said Ji Zhihong, director of the research bureau of the People's Bank of China. [China Daily]](http://images.china.cn/attachement/jpg/site1007/20130617/001aa0ba5c851328a4e704.jpg)

Go to Forum >>0 Comment(s)