Financial futures pioneer: Time for China to further open market

- By Zhang Lulu

0 Comment(s)

0 Comment(s) Print

Print E-mail China.org.cn, March 27, 2015

E-mail China.org.cn, March 27, 2015

|

|

|

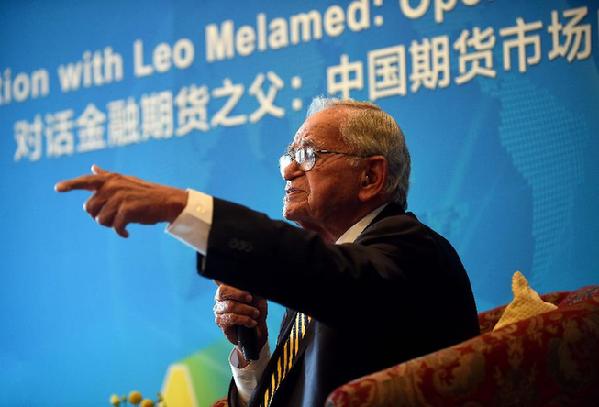

Leo Melamed, chairman emeritus of the Chicago Mercantile Exchange. [Xinhua] |

As China prepares to open its crude oil futures to international investors, Leo Melamed, a founding father of financial futures, said it is the “right time” for China to make this move and further open its financial futures market.

“China imports about 60 percent of the energy it needs from the world, but it has no voice in the discovery of the price, and it has no voice at all in determining what the price of oil to them will be,” Melamed, chairman emeritus of the Chicago Mercantile Exchange, said while attending a sub-forum at the Boao Forum for Asia on Thursday.

One way to solve that dilemma is to have an open market that involves international participation, which will help balance the price of oil and other commodities, he added.

Currently, foreign firms have very restricted access to China's commodities futures market. Yet the country’s securities regulator, the China Securities Regulation Commission, announced last December that it will open its crude oil futures to foreign investors. The crude oil futures, which will be traded at the Shanghai Futures Exchange, will be the first commodity futures made available to foreigners. This move has widely been seen as a big step in the country’s opening of its long-insulated financial futures market to the international community.

During China’s recently concluded legislative session earlier this month, Yang Maijun, the chairman of the Shanghai Futures Exchange and a deputy to the National People’s Congress, called for the country to fully promote the opening-up of China’s futures via the Shanghai Free Trade Zone.

Melamed noted at the Boao Forum that the Shanghai Free Trade Zone and the country’s three newly announced FTZs will all be important to the country’s innovation of its financial market.

China would be making “a terrible mistake” if it were to not open its futures market, he said.

The transmission of data about China’s energy market around the world and the provision of market access to qualified traders and brokers will be the first two steps that China should take to further open its financial futures market, Melamed added.

Reports say that crude oil futures will be open to foreign investors by the end of this year.

Go to Forum >>0 Comment(s)