NDB president says to work with AIIB

0 Comment(s)

0 Comment(s) Print

Print E-mail Xinhua, July 24, 2015

E-mail Xinhua, July 24, 2015

|

|

|

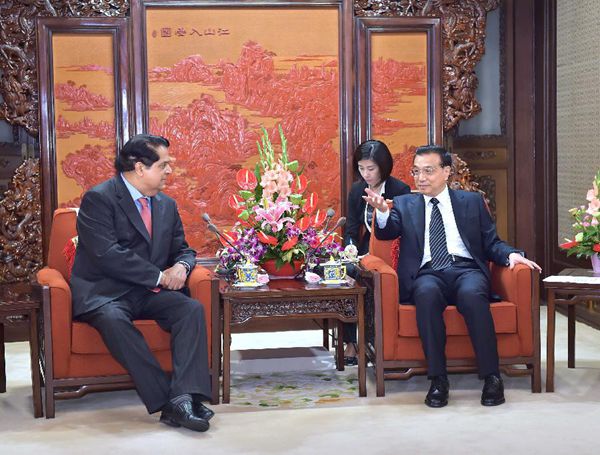

Chinese Premier Li Keqiang (R) meets with President of the New Development Bank (NDB) K.V. Kamath in Beijing, capital of China, July 23, 2015. The NDB opened in Shanghai on Tuesday to finance infrastructure projects, mainly in BRICS countries -- the emerging economies of Brazil, Russia, India, China and South Africa. [Photo: Xinhua] |

The New Development Bank (NDB) will work with the Asian Infrastructure Investment Bank (AIIB) on different projects, NDB president K.V. Kamath told reporters on Thursday.

The New Development Bank (NDB) opened in Shanghai on Tuesday to finance infrastructure projects, mainly in BRICS countries.

BRICS countries are the world's major emerging economies: Brazil, Russia, India, China and South Africa. BRICS leaders signed an agreement to establish the bank during their sixth summit in Brazil in July, 2014. The bank will start operations at the end of this year or early in 2016.

"There are so many structures we can work with (the AIIB)," Kamath said during an interview in Shanghai. "Infrastructure and project needs are very large, so we will collaborate with everyone."

"We have partnerships that we will forge with the AIIB, the national loan banks and indeed, the exiting market loan banks," he said.

With an authorized capital of 100 billion U.S. dollars, the China-initiated multilateral bank AIIB is designed to finance infrastructure in Asia. China, India and Russia are the three largest shareholders, with a voting share of 26.06 percent, 7.5 percent and 5.92 percent, respectively.

Chinese Finance Minister Lou Jiwei said Tuesday that both the NDB and the AIIB showed how emerging economies could improve global infrastructure and reform global economic governance. The two will complement each other, as they are different in membership and have different directions. The global demand for infrastructure funding is huge, he said.

Other institutions, including the World Bank Group (WBG), have expressed intent to work with the NDB.

"We are committed to working closely with the New Development Bank and other multilateral institutions, offering to share our knowledge and to co-finance infrastructure projects. These types of partnerships will be essential to reach our common goals to end extreme poverty by 2030, boost shared prosperity, and to reduce inequalities," Jim Yong Kim, WBG president, said in a statement on Tuesday.

But before any cooperation, Kamath said it is important for the NDB to stand firm first.

"The first step is to establish ourselves...and get our policies and framework right," he said.

The NDB will have an initial authorized capital of 100 billion U.S. dollars, and initial subscribed capital of 50 billion U.S. dollars "equally shared" among the five founders.

Kamath said the NDB will "get our first loan approved in April of 2016", and that the first loan will be issued in the Chinese renminbi.

During the interview, he hailed the significance of the bloc, saying that the setting up of the NDB signals "the coming of age of the developing countries."

"Developing countries can now stand on their own feet, and try to organize themselves regarding funding," he said.

Chinese Premier Li Keqiang also hailed the opening of the NDB as an "important step forward" in cooperation among BRICS countries.

"This is great progress in financial cooperation among developing countries and emerging economies, as well as a helpful supplement to the global financial system," Li said while meeting Kamath in Beijing on Thursday.

The five BRICS countries are home to 42.6 percent of the global population, 21 percent of the world's economy and nearly half of the world's forex reserves, but have been marginalized in the global financial landscape.

The IMF agreed in 2010 to give emerging economies greater a vote in decision-making, but the reform has been blocked by the United States, despite the fact that more than 140 countries have approved it.

Other regional development banks are mainly dominated by developed countries. Developing countries complain that loans from organizations like the World Bank always come with strings attached.

Demand for new infrastructure is climbing across the world, but some rich countries are increasingly hesitant to lend, said Shen Yi, an expert on BRICS countries with the Fudan University in Shanghai.

"The setting up of NDB...the setting up of the AIIB is a statement that we will try to balance some things ourselves rather than borrow from those that could create volatility," Kamath said.

Through improved infrastructure the NDB can make the sustainable growth of developing countries a reality, and China can share its experience, infrastructure production capacity and funds with other members, according to Zha Xiaogang, an analyst with the Shanghai Institute for International Studies.

Kamath is credited with turning ICICI Bank into one of India's largest private lenders during his 13 years as managing director and CEO. He spent several years at the Asian Development Bank and has served as non-executive chairman of both ICICI and Indian software giant Infosys.

Go to Forum >>0 Comment(s)