China clarifies economic policies, reform agenda at G20 meeting

0 Comment(s)

0 Comment(s) Print

Print E-mail Xinhua, February 27, 2016

E-mail Xinhua, February 27, 2016

|

|

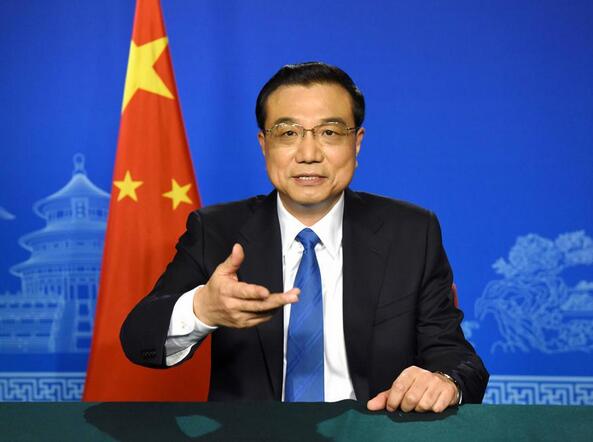

Chinese Premier Li Keqiang speaks in a video message to the G20 Finance Ministers and Central Bank Governors Meeting that opened in Shanghai, east China, Feb. 26, 2016. [Xinhua] |

Chinese policymakers on Friday sketched out the country's economic policies and reform agenda, reassuring the world that the government has plenty policy tools to combat downward pressure as financial leaders from G20 nations gathered in Shanghai.

In a video message to the G20 Finance Ministers and Central Bank Governors Meeting, Chinese Premier Li Keqiang reiterated that China has the confidence to handle the complex economic situation at home and abroad.

"The Chinese economy has great potential, resilience and flexibility, and we will capitalize on such strengths," he said.

Friday's gathering came amid weak economic growth worldwide and increasing volatility in the financial markets. The IMF earlier this week highlighted increasing risks to global recovery and called for urgent and bold action to support growth.

In January, the fund predicted growth of 3.4 percent for the world economy this year but may downgrade the figure when it publishes its next forecast in April.

Li called for G20 nations to stand together during the difficulties. "When formulating macroeconomic policy, G20 members need to keep in mind not just their own growth, but should also watch for the spillover effects of their policies," he said.

Continued turbulence in the stock market and yuan depreciation at the start of 2016 did little to disguise what could be a very difficult year ahead, putting the country's economic policies and reform agenda in spotlight at Friday's meeting.

Monetary policy: prudent, with easing bias

At a press briefing ahead of the G20 meeting, China's central bank described its monetary policies as "prudent with a slight easing bias".

The shift of official tone, which had been characterized as "prudent" for the past few years, brings language on the policy stance into line with reality, Bloomberg economist Tom Orlik wrote in a research note.

To arrest the cooling of the economy, which logged its lowest annual expansion in a quarter of a century at 6.9 percent in 2015, China has cut benchmark interest rates and the reserve requirement ratio of banks several times since 2014.

For possible downside risks, China still has the space and tools for monetary easing, central bank governor Zhou Xiaochuan said. He also stressed that China will not "overly" base its macroeconomic polices on exterior economic performance or capital flows.

"Our interpretation is that there is still room and space for use of low-profile tools like the medium-term lending facility to guide loan costs down, and the need to avoid selling pressure on the yuan will make it more difficult to cut benchmark rates in the short term," Orlik noted.

Fiscal expansion

Aside from support of monetary policies, governor Zhou Xiaochuan has called for more to be done on the fiscal front and structural reforms.

The message echoed with the remarks of finance minister Lou Jiwei. "In times of economic slowdown, expansionary reforms such as reducing administrative approval, targeted tax cuts and granting rural migrant workers welfare and benefits should take precedence," he said.

China still has room to expand fiscal policy to push structural reforms, he said, predicting an increase in budget deficit this year.

China raised its budget deficit to 2.3 percent of GDP in 2015, up from 2.1 percent in 2014. A 3-percent deficit ratio is normally considered a red line not to be crossed.

But director of the central bank's surveys and statistics department Sheng Songcheng on Wednesday suggest China could raise the ratio to 4 percent of GDP or even higher to offset the impact of reduced fiscal revenue and to support broader reform.

"The 3-percent warning line does not fit with China's reality," he said, citing China's relatively small outstanding debt, rational structure, continued growth in fiscal revenue and solid assets of state firms as among the factors backing his conclusion.

Foreign exchange

China's currency has been heading south since the country revamped the foreign exchange mechanism last year, and concerns about capital outflows have been on the rise.

Zhou on Friday repeated that there is no basis for continued weakness of the Chinese currency as the country's economic fundamentals remain sound. He also cited China's current account surplus and foreign exchange reserves as solid support for the balance of international payments.

There is no concern over China's foreign exchange adequacy and China has the ability to make overseas payments, he said.

HSBC reckons that the Renminbi will likely weaken moderately beyond the near term, given the challenges on the cyclical front and in China's balance of payments. It forecast the exchange rate against the U.S. dollar at 6.9 by end of 2016.

Go to Forum >>0 Comment(s)