Gov't to build 10 m homes

The country will spend about 1.3 trillion yuan ($197 billion) to build 10 million units of government-subsidized housing this year, a senior official said on Wednesday, amid government efforts to curb surging property prices and deliver the benefits of economic growth to more people.

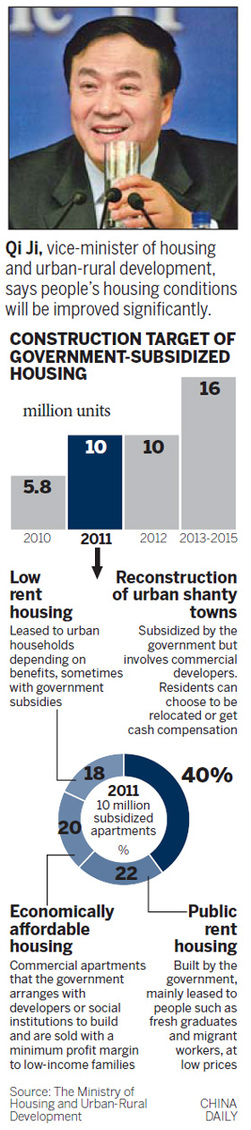

To fund the project, "at least 10 percent of net revenue from land sales by local governments must be put into the subsidized housing program", Qi Ji, vice-minister of housing and urban-rural development, told a news conference.

More than 500 billion yuan will be provided by the central and local governments, with the remainder channeled from social institutions and individuals.

This, in addition to loans, subsidies and tax incentives to support the program, means the capital for the 10 million units is "completely viable", Qi said.

At a news conference on Monday, Finance Minister Xie Xuren said land transfer revenue will be used, for the first time, to build affordable housing.

Land transfer revenue rose 106.2 percent year-on-year to 2.94 trillion yuan last year, Xie said.

Soaring property prices are a hot topic during this year's annual sessions of the top legislature and advisory body.

Premier Wen Jiabao said last week that the government is resolved to curb property speculation and ensure an adequate supply of low-cost homes, while delivering the government work report.

According to the government's plan, 10 million units of subsidized housing will also be built next year, and 16 million from 2013 to 2015.

When completed, the program is expected to cover 20 percent of the country's total housing supply.

However, such a massive construction project has raised questions among the public as to where the finance would come from.

Based on the spending announced on Wednesday, China may need a further 3.38 trillion yuan from 2012 to 2015 to accomplish the construction plan.

To ensure sufficient finance, central authorities are also mulling rules covering the entry of insurance funds into the subsidized projects.

Pacific Asset Management Co Ltd, the investment arm of China Pacific Insurance (Group) Co, announced on Wednesday that it had won approval from the China Insurance Regulatory Commission to start a low-rent housing project in Shanghai.

The project, which aims to raise 4 billion yuan to finance the construction and operation of 500,000 square meters of low-rent housing by Shanghai Real Estate Group, is the company's first investment in the real estate sector after the revised Insurance Law made it possible last year.

The government has taken measures recently to curb soaring property prices, including piloting a property tax in Shanghai and Chongqing municipalities, and setting purchase limits in dozens of cities.

Despite the measures and recent interest rate rises, the average price for residential housing in 100 major cities still rose 0.48 percent in February over January, and the 10 big cities, including Beijing and Shanghai, saw a year-on-year increase of at least 15 percent in February, according to statistics from China Index Academy, a Beijing-based property research institute.

However, some real estate developers have sensed a "winter" ahead for the property sector.

Pan Shiyi, chairman of SOHO China, one of the largest developers in Beijing, warned the basket of government policies, particularly the massive supply of low-cost housing, will have a huge impact on the real estate market.

"The 36 million units of government-subsidized housing in the next few years will take half of the country's real estate market, posing a great challenge to developers," he said on his micro blog on Wednesday.

Pan said he estimated that about half of the country's real estate developers will not survive the next two or three years.

0

0

Go to Forum >>0 Comments