The World Bank launched

China Quarterly Update on February 4, 2005, providing an update on recent economic and social developments in China, as well as findings from ongoing World Bank work on China. The full text follows:

Overview: macro risks easing, more emphasis on reforms

Despite the unexpectedly high growth in the last quarter of 2004, the risk of China's economy overheating has declined, as domestic demand growth and consumer price inflation have come down in the wake of measures taken to cool the economy. However, the domestic slowdown was more than compensated by buoyant export growth and moderating import growth. As a result of the strong trade balance, the buildup of international reserves accelerated through 2004, even as capital inflows eased in the second half of the year. Public finances benefited from the strong growth of activity and imports, and government used the higher than budgeted revenues to repay arrears on VAT refunds and beef up the social security fund. Many local governments forged ahead with further support for farmers by abolishing the agricultural tax.

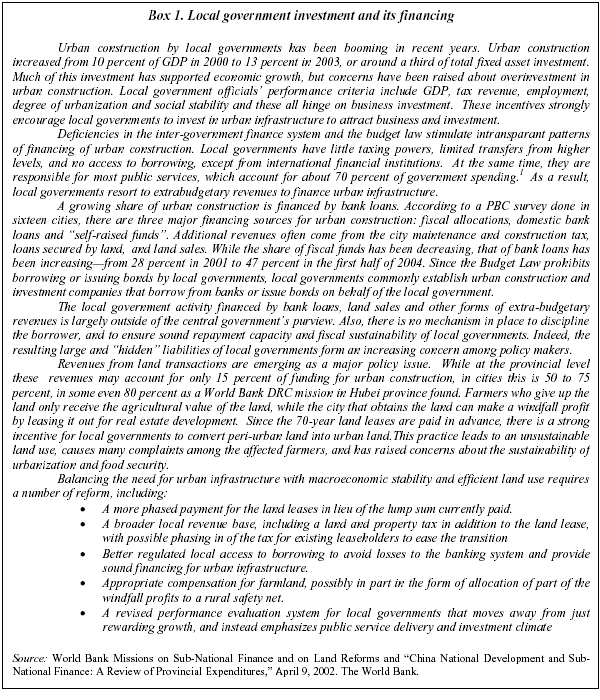

The macroeconomic outlook for 2005 remains favorable, with a supportive external environment, prospects of robust domestic demand growth, and waning underlying inflation pressures. In these circumstances, policymakers are rightly putting emphasis on institutional and structural reforms. The December Central Economic Work Conference formulated directions on macroeconomic management, public finances, and institutional and structural reforms. The announced switch from a "proactive" to a "prudent" monetary policy stance likely reflects the authorities' willingness to increase interest rates if warranted. Announced further interest rate reforms could improve rural finance and resource allocation. The fiscal deficit target for 2005 remains largely unchanged from last year's outcome, whereas the announced increase in government spending on public goods and services, especially in poor rural regions, could improve equity and increase consumption. Several worthy tax reforms are under consideration, including unification of enterprise income tax regimes and a fuel tax. To reduce the tendency of over¬investment and improve the use of land, urban finance, the intergovernmental fiscal system, and the performance monitoring system for local governments are in need of reform.

Recent Economic Developments--domestic demand easing

China's economy finished the year 2004 on a strong note, with a gain of 9.5 percent in GDP against 9.3 percent in 2003. This unexpectedly high outturn was driven by strong export performance in the second half of the year, whereas domestic demand has been easing in 2004, led by a slowdown in investment. Growth in domestic demand declined from almost 11 percent in the first half of the year to a more sustainable 8.5 percent in the second half (Figure 1).

Investment growth has come down from a breakneck pace of over 40 percent year-on-year (yoy) in real terms in the first quarter of 2004 to an estimated 13 percent in the fourth quarter (Figure 2).

Thus, overall it seems that the authorities' monetary policy and administrative measures to slow the economy taken over the course of last year are starting to show results. A pick up in growth of private consumption, buoyed by solid household income growth, has partly offset the investment slowdown (Figure 3). Rural household incomes have risen particularly robustly supported by higher agricultural output, a hefty grain price increase, and a reduction in net agricultural taxes. Real retail sales grew 10.2 percent in 2004, compared to 9.4 percent in 2003.1

Inflation as measured by the CPI has come down in the second half of 2004. After peaking at 5.3 percent in July, consumer price inflation declined gradually to 2.4 percent by December (Figure 6), largely due to a decline in food price increases. Since September, "upstream"prices like the PPI and prices of raw materials and imports have also decelerated. A note of caution is that not all demand and price pressures show up in CPI inflation. High real estate price increases (Figure 7) are not fully reflected in the CPI index, as the share of residential services in the CPI basket is likely to be too low. In addition, prices of several goods and services administered by the government including public transport, rents, utilities, electricity and coal have lagged cost increases.

Other indicators are consistent with slowing domestic demand growth. M2 growth (yoy) has declined in 2004, to end the year at 14.6 percent, compared to 19.6 percent in 2003 (Figure 4), with bank loan growth following a similar trend decline. Real industrial value added growth (yoy), which peaked at 19.4 percent in March 2004, has since declined to 14.4 percent by the end of the year, whereas energy consumption growth also eased throughout 2004. Reflecting the slowdown in domestic demand, the growth of imports measured in dollars also declined through 2004 from 42.4 percent in the first quarter to 30.3 in the fourth (yoy).

Exports have outpaced imports. Continued export strength2 reflects more production capacity coming on stream, robust external demand, and China's rising price competitiveness due to the depreciating US$ (Figure 5). But higher exports in the second half of 2004 also reflect the slowdown in domestic demand, especially investment: exports of steel and cement were particularly strong— products less in demand at home because of slowing investment. The trade surplus totaled US$32 billion for 2004 as a whole, after showing a deficit in the first four months of the year. The contribution of trade to GDP growth will likely turn out to be even higher than the nominal numbers suggest, as import prices rose a hefty 10 percent in 2004, compared to only 5 percent for exports.

Economic growth has become more balanced over 2004. In the recent decade or so, growth had relied heavily on a rapid expansion of industry (which, in 2003, contributed about 73 percent to GDP growth) and, on the demand side, on investment (which reached 42 percent of GDP in 2003).3 While beneficial in many respects, this pattern of growth has been intensive in capital, and has been associated with limited urban employment growth, a limited role for private consumption, and high resource and energy intensity in the economy. While a significant rebalancing of the pattern of growth and the associated policies is still "in the works", during 2004 the contribution of agriculture and services to overall growth increased— value added in these sectors rose 6.3 percent (against 2.5 percent in 2003) and 8.3 percent (7.3 percent) respectively. Industrial growth slipped by 1.6 percentage point to 11.1 percent. This pattern of growth seems to be better for employment: 9.8 million urban jobs were created in 2004, taking down registered unemployment 0.1 percentage points to 4.1 percent, the first decline since 1995.

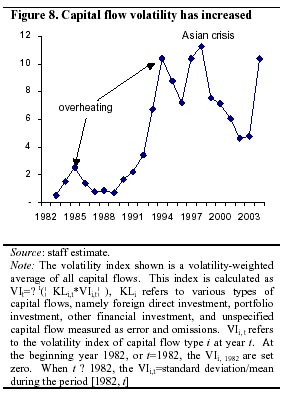

The balance of payment surplus and concomitant reserve buildup accelerated through 2004, even as capital inflows diminished. Net capital inflows (including "errors and omissions") reached US$60 bn., or 8.4 percent of GDP, in the first half of 2004. These flows consisted of US$ 30 bn. in FDI, US$ 19 bn. reallocation of foreign exchange assets, and US$ 5.5 bn. from overseas IPOs. Foreign exchange reserve reached US$610 billion by end-2004, having increased by a full US$95 billion in the fourth quarter, apparently driven by the rising trade surplus rather than capital flows. Capital inflows, while they remained strong in 2004, are estimated to have declined through the year, from US$49 billion in the first quarter of 2004 to 26 billion in the fourth.4 At the same time, the volatility of the flows has been increasing in 2004 (Figure8), which complicates the authorities' efforts to sterilize the reserve built-up-- even though the overall volume of sterilization remains manageable for now (see below).

|

Public finances benefited from the strong growth. Continuing a trend, tax revenues increased by 25.7 percent in 2004, and were around RMB 345 billion (2.6 percent of GDP) higher than budgeted. The government used part of the extra revenues to pay off RMB 200 billion of outstanding VAT rebate arrears, and introduced a new system of rebates, which, by lowering refunds on some exported items, promises to keep refunds current from now on. Spending on agricultural subsidies, provision of public goods and services and social transfers were also increased; non-debt fiscal expenditures increased by 14.1 percent yoy in January-November 2004. The overall fiscal balance is estimated to have declined to 1.8 percent of GDP in 2004, although this number seems to exclude the payment of the VAT refund arrears.

A Favorable Outlook for 2005

At this juncture, the external environment and domestic macroeconomic conditions suggest a favorable outlook. Externally, the world economy and world trade are expected to continue to grow briskly, although at a somewhat lower pace than the record year 2004 (Table 1).

Exports may receive an additional boost from the removal of restrictions on textile and the continued effect of a weaker dollar to which the RMB is tied. International commodity prices have started to fall, which should moderate China's import prices.

Domestically, current trends suggest robust, sustained domestic demand growth. Investment, while expected to slow down further as a result of a lagged impact of the tightening in 2004 and slowing profit growth, is still projected to continue growing at double-digit rates (Table 2).

Income prospects suggest that the pace of private consumption growth can be sustained or even increased, even though income growth in rural areas may not grow at the pace of 2004, with grain prices projected to level off. Moreover, in contrast to a year ago, the absence of a need for drastic changes in the policy stance (see below) enhances predictability in the economic environment. Macroeconomic stability is further underscored by waning underlying inflation pressures, and strong and improving fiscal and external positions.

Key macroeconomic risks going forward remain. A renewed pick up in investment growth, for instance due to difficulties in keeping the administrative controls effective, is not inconceivable, as the underlying incentives for over-investment stemming from low interest rates and the incentives for local governments to spur growth remain (see Box 1). In addition, further increases in foreign exchange inflows— from capital flows and the trade surplus— could complicate monetary management. The risks warrant vigilance in maintaining prudent macroeconomic policies, and the Central Economic Work Conference rightly called for a shift to a "prudent" stance.

Economic policies: a good time for advancing structural reforms

The current favorable macroeconomic outlook situation makes 2005 a good year to pursue structural reforms. The broad directions of reform formulated during the Central Economic Work Conference will shape policies in what was defined "the year of reform" 2005. On macroeconomic management, the aim is to put more emphasis on the quality and efficiency of economic growth and to move the fiscal and monetary policy stance from "proactive" toward "prudent." On public finances, government plans to deepen fiscal and taxation reforms. Moreover, fiscal policy reforms are crucial in achieving the "harmonious society" that has become an official goal, and which requires the benefits of growth to be more equally shared among all Chinese. On structural policies, broad guidelines were formulated on strengthening the economic structure and improving the allocation of resources and investment, including by increasing the role of market mechanisms in the allocation of resources. This could influence policies in monetary management and those affecting the financial and corporate sectors. Consistent with the main themes of the Conference, various government departments have set out the policy agenda or targets for year 2005, and the State Council set the tone with Document No.1 of 2005 focusing on agricultural productivity increases.

Monetary and exchange rate policy--how much of a challenge are foreign inflows?

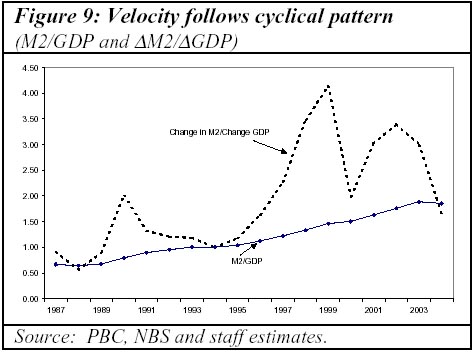

The PBC's monetary program for 2005 includes targets for (yoy) M1 and M2 growth of 15 percent, and RMB 2.5 trillion of new Renminbi loans. Compared to the outcome in end-2004, this implies roughly unchanged growth of monetary aggregates. Such growth rates of monetary aggregates are broadly in line with growth and inflation targets, provided no major changes in velocity, or its inverse, M2/GDP. China's ratio of M2 to nominal GDP has been trending upward from 0.37 in 1980 to 1.85 in 2004 as a result of gradual financial deepening and monetization. The marginal ratio (the ratio of the change in M2 to the change in nominal GDP) has shown a highly pro-cyclical pattern, falling during a boom, and rising after a boom. On the basis of the World Bank projection of 8.3 percent real GDP growth, a 15 percent growth in M2 would yield an inflation in the GDP deflator of some 3-5 percent, if M2 over GDP gradually returns to trend levels. The announced switch from a "proactive"to a "prudent"policy stance should probably be seen as reflecting an increased willingness to increase interest rates to achieve such an inflation target consistent with a "soft" landing.

|

|

Foreign inflows could complicate monetary policy. Surpluses on the balance of payments are manageable as long as the central bank can sterilize the monetary expansion that comes along with the resulting buildup of international reserves. So far, sterilization seems to have caused few problems: in the 12 months to November 2004, a rise in the PBC's net foreign assets of RMB 1216 bn. compares with a net supply of bonds by the PBC of RMB 579 bn., while an increase in reserve requirements mopped up an estimated additional RMB 274 bn.. The interest rate paid on the central bank bonds to absorb the liquidity is low, and perhaps lower than the yield on international reserves, so sterilization may actually be profitable. In addition, recent US interest increases expand the room for maneuver for China's monetary policy. On the other hand, the need to sterilize is difficult to project and high and volatile "speculative" capital inflows could still complicate monetary management. Moreover, the current balance of payments surpluses are increasingly caused by rising trade surpluses due to the depreciation of the effective exchange rate in the course of a further dollar decline. This could increase the international political pressure to adjust the exchange rate regime, which in turn could trigger renewed capital inflows in speculation of an exchange rate change. Maintaining exchange rate stability while improving the exchange rate system remains a key objective of the authorities, and these international pressures can probably be withstood. However, continued balance of payment surpluses may also lead to trade friction, which can altogether be more damaging.

The People's Bank's announcement on February 1 that it would further pursue interest rate liberalization is also welcome. Current levels of interest rates contribute to misallocation of investment and, more generally, increasing the role of interest rates in monetary policy would improve the allocation of resources, and further reduce excess demand for investment. Further liberalization of interest rates that rural financial institutions can charge would also be welcome. Until now, these institutions face a lending rate cap, and as a result they cannot get adequate compensation for the risk they face. The consequence of this is the opposite of the intention of the policy: rather than more access, farmers have far less access to credit than they would have with liberalized lending rates.

Fiscal Policy--a shift in expenditure priorities

The Ministry of Finance's fiscal targets for 2005 include a fiscal deficit at around last year's level (2 percent of GDP), and higher spending on public goods and services, especially in poor rural regions. The latter is consistent with a planned shift "from construction of physical infrastructure to social infrastructure, including social security, legal framework, science and education, and public administration."

Indeed, there seems to be significant scope for such a shift: the flow-of-funds tables in the national accounts show, surprisingly, that general government (central and local) is a voracious saver. China's government saved some 7.5 percent of GDP in 2003, whereas governments in countries such as Japan and the USA dissaved some 2.2 and 1 percent of GDP respectively. China's budgetary investments are with 3.8 percent of GDP rather modest. However, capital transfers to enterprises, such as construction companies that build infrastructure but also commercial enterprises, is over 6 percent of GDP. So in total, the government budget alone finances some 10 percent of GDP in investment— almost a quarter of all investment in China. 5 Urban construction and real estate development have been one of the key contributors to China's high investment rates. Changes in the urban financing system in particular are needed to moderating local governments' incentives to invest (Box 1).

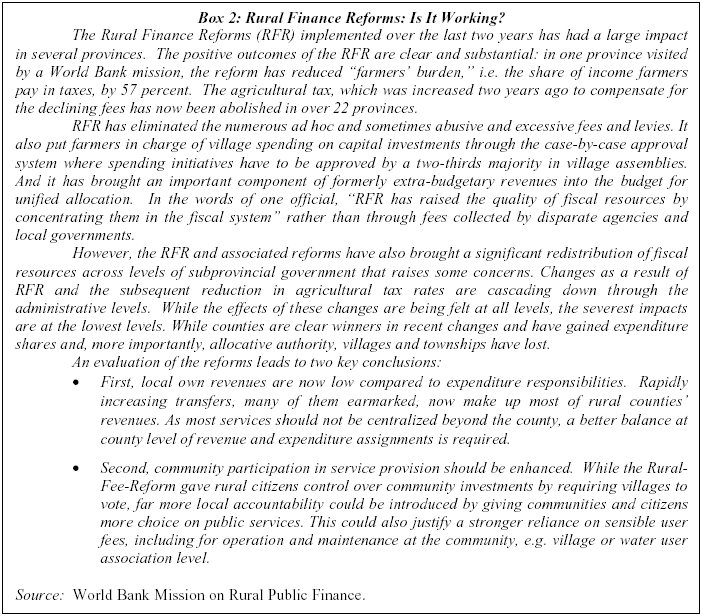

The emphasis on rural public finances is appropriate, as this is where services fall most short of the standards suited for a Xiaokang society. Already, rural finances are going through considerable reforms, and the number of provinces that have abolished agricultural taxes has increased to 22 (Box 2).

|

The current benign fiscal outlook offers scope to look beyond individual programs to the whole system of intergovernmental finance. In this context, consideration could be given as to how to ensure that all households have access to basic health care and education for their children regardless of their income. The recent initiative in Hainan on free compulsory education for the poor offers an interesting example in this respect. Shifting spending in this direction would, by supporting household disposable income, especially of the poor, equally support growth in private consumption, which is also a key policy objective. Further reforms could include accelerating reforms of the rural health system, and further solidifying the emerging urban pension system: security against the risks of high health expenditures and old age are likely to bring up consumption a notch.

Several tax reforms are on the agenda. Tax reforms that are considered and for which there is a strong case are unifying profit tax regimes between domestically and foreign¬owned firms (the latter are currently favored) and the introduction of a fuel tax. Another tax reform worth considering now is moving further in the direction of a comprehensive tax base for the personal income tax. The unification of the foreign and the domestic enterprise income tax is currently being discussed, with a sticky point being the rate at which the tax is unified. Foreign investors have until now enjoyed a lower (15 percent) rate, and they have raised concerns about possibly being taxed at a higher rate. Such concerns can probably be abated, if, along with unification of the rates, China's enterprise income tax is brought more in line with international practice. The tax administration (SAT) will continue the pilot project, applied to certain industries and regions, of transforming the current "production based" VAT to "consumption based" VAT (with VAT on investment creditable). At this stage, when concerns on overinvestment are still fresh on the mind, absence of a plan to extend this reform nationwide in 2005 is appropriate, as the move is likely to stimulate investment.

Financial Sector Developments

China's financial sector remains largely administered by the state, with nearly all financial institutions owned or controlled by the central or sub-national governments and SOEs. The recent acquisition by HSBC of a near-20% stake in Bank of Communications, China's fifth largest bank behind the four state commercial banks (SCBs) 100% owned by the central government is a major milestone in terms of the size of the investment and the extent to which HSBC will be able to influence the governance and operation of the bank. The central government continues to move ahead with plans to attract strategic investors in the two SCBs that were recapitalized at the end of 2003 (Bank of China and China Construction Bank). Both banks have now been incorporated under the Companies Laws and boards of directors have been constituted for the first time, clarifying responsibility for bank governance. Similar action with respect to a third SCB, Industrial and Commercial Bank of China, is anticipated.

These and other actions by the authorities, including markedly increased emphasis on loan loss provisioning and capital adequacy by the China Banking Regulatory Commission, are serving to motivate commercialization of the banking system, seen as a vital component of efforts to improve the allocation of financial resources in China. In this regard the recent removal of the cap on interest rates that banks can charge for loans gives bankers the necessary flexibility to better price credit risks and opens the door to new, potentially lucrative, lines of business, such as meeting the credit and financial services needs of smaller businesses. These businesses until now have had little access to credit from formal financial institutions, in part due to the ability of banks to charge interest rates adequate to cover the costs of granting smaller loans. The authorities have recently demonstrated a strong interest in taking other steps to promote an increase in access by small businesses to credit by formal financial institutions.

China's listed equity markets in Shanghai and Shenzhen continue to turn in poor performances persisting over the last several years. A key contributing factor is the large overhang of shares in listed companies that are not tradable on the exchanges (so-called state and legal person shares held by governments and SOEs). The potential that these shares would be added to the supply of tradable shares exerts a negative influence of equity price expectations. The government's recent attempt to centralize over-the¬counter transfers of non-tradable shares onto the exchanges served as a reminder to investors of the problem. The central government has long been expected to formulate a plan to address this issue, yet nothing definitive has been announced. Another contributing factor is the well-publicized financial and ethical problems of many securities broker firms. It is too early to determine whether and how the recently announced plan by the China Securities Regulatory Commission to audit all brokerage firms will rectify this situation.

In the face of uncertainties regarding the health of financial institutions in China, the State Council recently approved in principle the establishment of depositor and securities investor protection schemes. The details regarding the manner in which these programs will be administered and financed remain to be determined, and the devil is in the detail of how such a deposit insurance will take shape. But it seems likely they will serve to bolster confidence in the financial services industry while at the same time creating a more explicit (and, potentially, more limited) obligation on the part of the central government to finance repayment of protected claims on the industry.

Corporate Sector Developments

The central government's State-Owned Assets Supervision and Administration Commission (SASAC), established in early 2003, continues efforts to increase its control over 178 central state-owned enterprise (SOE) groups and improve management of SOE equity nationwide. Central SASAC recently appointed a second batch of 22 senior SOE managers through public recruitment (instead of Party appointment), removed some top managers, and signed management performance contracts at 30 SOE groups. Generally of higher quality than locally administered SOEs, central SOEs reportedly earned RMB 400 billion in 2004. Hence, central SASAC faces financial management issues, including what cash surpluses to extract from central SOEs in the form of dividends and whether to reinvest these or return funds to the ministry of finance. To regulate privatizations of local SOEs, central SASAC has further tightened policies on management buy-outs (MBOs) and instead encouraged ownership sales through open and competitive bidding.

Corporate governance continues to reflect tensions between State shareholder dominance and administrative initiatives to protect minority shareholders. In October, the government reshuffled management among China Telecom, China Mobile, and China Unicom. The three companies' share prices have not suffered. But outside observers question the effect of this reshuffle on managements' allegiance to public shareholders and the missed opportunity to recruit more diverse skill sets. Responding to past abuses by controlling shareholders, the China Securities Regulatory Commission (CSRC) ruled in December that a majority of public shareholders must approve major moves, for example, issuance of new shares or convertible bonds, financial restructurings, or overseas spin-offs. In a first test, public shareholders rejected a new share issuance by a Chongqing company in late December. To encourage dividends, the CSRC also now forbids listed companies that have not paid cash dividends within three years from issuing shares or convertible bonds. Lastly, also in December, news of $550 million in trading losses by China Aviation Oil highlighted the need for effective risk management.

Recent corporate restructuring transactions include an interesting mix of rationalizations and outbound investment. Urged to privatize non-core businesses, central SOE groups did 651 spin-offs in 2004. Central SASAC also decided in December to merge 20 of its SOE groups, reducing to 178 the number of central SOE groups. Lenovo's acquisition of IBM's personal computers business may be a major departure, depending on how well Lenovo handles post-acquisition integration. By acquiring a brand with worldwide suppliers and customers, Lenovo could show how to transform China's industry from cost-based modular manufacturers of commodity products into industry standard-setters and global supply chain integrators. The alignment of interests through IBM's 19% stake in Lenovo should support both IBM's greater focus on value-added services and Lenovo's PC business. In October, Shanghai's SAIC auto group gained control of South Korea's Ssangyong Motors, an ex-Daewoo company seized by creditors in 1999, and is reportedly assessing a Daewoo plant in Poland. SAIC hopes Ssangyong will aid SAIC's own development. The acquisition of an ex-Daewoo company, however, should also serve as a reminder of the possible dangers from imprudent expansion.

China still lacks efficient and transparent mechanisms for resolving corporate distress. Since taking over privately-owned D'Long Group, which failed in August after borrowing more than $3 billion since 2002, the Huarong asset management company has appointed new management. The search for buyers for D'Long companies continues, including for two U.S.-based lawnmower makers. But little is known about D'Long's prospects or likely payout to creditors. In October, the National People's Congress completed its second reading of a draft enterprise bankruptcy law. Especially controversial was a change to give workers priority over secured creditors. This is at odds with the global trend in insolvency law, which is moving away from priority for workers and toward protecting previously negotiated contracts with secured creditors.

(China.org.cn February 5, 2004)