QE3's impacts on the Chinese economy

- By Yi Xianrong

0 Comment(s)

0 Comment(s) Print

Print E-mail China.org.cn, September 25, 2012

E-mail China.org.cn, September 25, 2012

The US Federal Reserve on September 14 announced a third round of quantitative easing (QE3) that entails buying US$40 billion in mortgage-backed securities (MBS) each month until the US job market shows a substantial sign of improvement. However, Fed Chairman Ben Bernanke declined to provide specific estimates of how long the purchases might last.

|

|

|

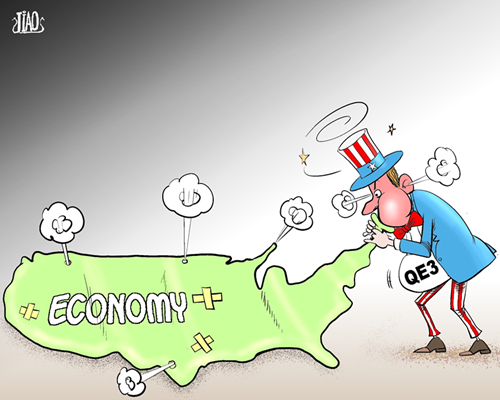

Beat the air [By Jiao Haiyang/China.org.cn] |

QE3 has some new features compared to the previous two programs. First, there is no cap or end date for the purchase. According to estimations, it will take the US three years to lower the national unemployment rate to 7 percent. Since the duration of the zero-interest-rate policy is extended into 2015, the Fed will have to spend US$1.44 trillion in all on its MBS purchases. This indicates the US government is determined to rev up its economy at all costs.

Second, in the QE3 program, the Fed will mainly buy MBS instead of government debt as they did in the previous two programs. This shows the US government is pinning its hopes of economic revival on the booming real estate market.

Third, QE3 gives top priority to employment, which is both an economic and political issue. Since the US will hold presidential election later this year, the policy will be a boon for Barack Obama's re-election campaign.

More importantly, the US dollar is the basis for the international monetary system. Thus, excessive issuance of US dollar will inevitably lead to a depreciation of the currency and push up global commodity prices.

So, what will be the impacts of QE3 on the Chinese economy?

First, it may lead to the flow of a large amount of hot money throughout the world, posing risks to the stock market and real estate market of some particular countries. The Chinese government must be keenly aware of this risk. To be specific, Hong Kong is highly likely to be the destination of the hot money, and once bubbles occur in the stock market and real estate market there, the entire financial market and property market of China will be affected.

Second, the price hike of commodities will increase the cost of China's economic development and might result in imported inflation. It will take China more time to complete its economic restructuring.

Third, the depreciation of US dollar will force the yuan appreciation to continue. China's foreign trade will suffer as a result, and the globalization of the yuan will also be obstructed.

Doubtlessly, QE3 will have a substantial impact on both the US and Chinese economies. We must keep a close eye on where the liquidity caused by the program will flow to, because that is the key to the whole problem.

The author is a researcher with the Institute of Finance and Banking of the Chinese Academy of Social Sciences.

(This post was published in Chinese and translated by Chen Xia.)

Opinion articles reflect the views of their authors, not necessarily those of China.org.cn.

Go to Forum >>0 Comment(s)