Latin America – China's answer to the U.S. 'Asian Pivot?'

- By Tim Collard

0 Comment(s)

0 Comment(s) Print

Print E-mail China.org.cn, February 1, 2015

E-mail China.org.cn, February 1, 2015

|

|

|

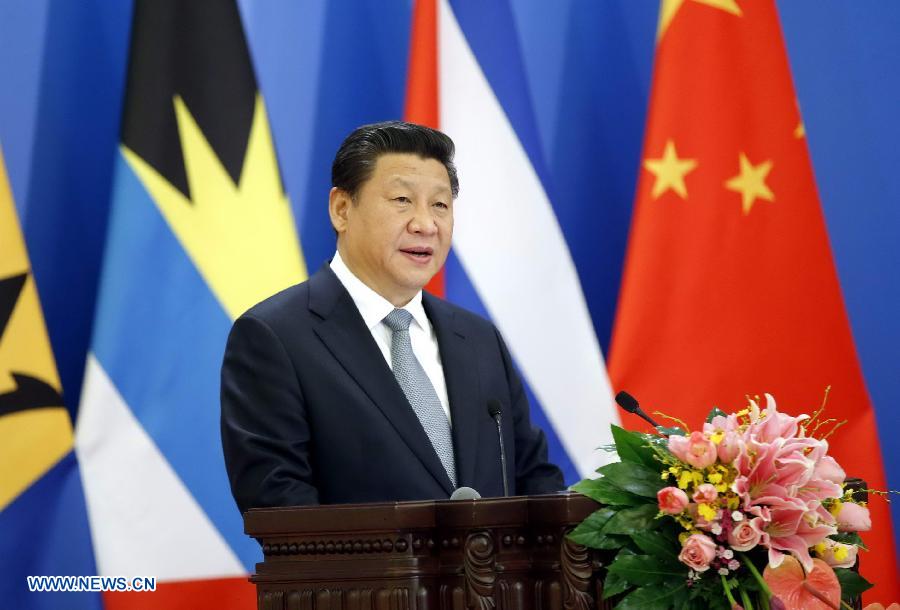

Chinese President Xi Jinping speaks at the opening ceremony of the First Ministerial Meeting of the Forum of China and the Community of Latin American and Caribbean States (CELAC), in Beijing, capital of China, Jan. 8, 2015. [Xinhua/Ju Peng] |

China's hosting of the newly-established China-CELAC Forum (CELAC being an association of 33 countries in Latin America and the Caribbean) earlier last month not only signalized China's determination to preserve and extend its economic reach, but was obviously meant to be seen in the context of recent U.S. policy, especially the "pivot to Asia" launched last year by the Obama administration. If the Americans want to bolster their position in China's "back yard," the thinking goes, China wishes to make clear that it has a solid position on the American continent. This is a somewhat simplistic view: what is really behind it?

China's strongest card, of course, was the vast financial resources at its disposal for trading and direct investment: President Xi, in his keynote speech, promised a doubling of trade volumes with the region to US$500 billion and an increase of direct investment to US$250 billion. Given that, after the United States, China has become Latin America and the Caribbean's second-largest trading partner and third-biggest source of foreign investment. This is a very attractive package.

However, China is not unaware that the trading relationship is problematic; although the Chinese side appealed to the fact that China is a developing country like the CELAC members, there are very different stages of development involved. China largely imports raw materials from the countries of this region, and exports to them finished industrial products, approximating to the classic developed/developing country trading model. The Latin Americans remain concerned that their own manufacturing industry may be undercut by Chinese imports (though Chinese investment will go some way towards offsetting this). Latin America also contains oil-producing countries, such as Venezuela, Argentina and Ecuador, which have been badly hit by the worldwide fall in oil prices, from which China will inevitably be a beneficiary. The Chinese offer of support will be welcome, but at the same time there will be disappointment if the deal is seen to be too one-sided in practice.

Also there are signs that China is less inclined than before to bail out those countries which have been less prudent with their finances. The Venezuelan President Maduro was hoping for an emergency cash loan to help his country through a debt crisis caused by falling commodity prices. China, however, was not prepared to stump up any extra money, only to repackage a US$20 billion line of credit already promised. China is clearly worried, as are many others, about the possibility of a Venezuelan default, now that the huge oil incomes from the boom years have all been spent.

Go to Forum >>0 Comment(s)