China's economy growing 5 times as fast as US'

- By John Ross

0 Comment(s)

0 Comment(s) Print

Print E-mail China.org.cn, August 5, 2016

E-mail China.org.cn, August 5, 2016

During the last year some international financial media, with Bloomberg playing a particularly active role, attempted to present a picture of the world economy that the U.S. is growing strongly while the rest of the world, including China, is relatively weak. Publication of new U.S. GDP data confirms the truth is the exact opposite: The U.S. economy has slowed drastically with China growing far more rapidly than the U.S. Indeed, the U.S. in the last year has grown more slowly even than the EU.

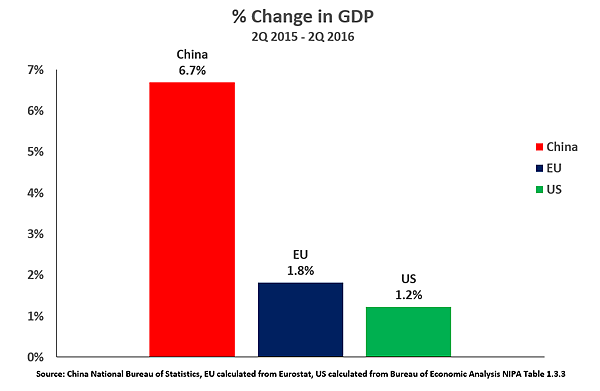

Total GDP growth

The wise Chinese dictum says "seek truth from facts." To establish the facts regarding the global economy, Figure 1 therefore shows the last year's growth, up to the latest available data, in the three largest centers of the world economy - the U.S., China and the EU. The pattern is unequivocal. In the year to the 2nd quarter of 2016 China's economy grew by 6.7 percent, the EU by 1.8 percent and the U.S. by 1.2 percent. The U.S. is therefore the most slowly growing major part of the world economy. Making a bilateral comparison, China's economy grew more than five times as fast as the U.S.' during the last year.

These three major economic centers together account for 61 percent of the world's GDP at market exchange rates. No other economies have remotely the same impact on the global economy. Therefore, there is no doubt that in the last year it is the U.S. which has been the biggest drag on the world economy.

|

Figure 1 |

|

|

Per capita GDP growth

The situation in terms of per capita GDP growth shows an even more dramatic advantage for China. Population growth in China and the U.S. is rather stable - at 0.5 percent a year in China and 0.8 percent in the U.S. China's and America's per capita GDP growth in the year to the 2nd quarter of 2016 is therefore easily calculated - 6.2 percent in China and 0.4 percent in the U.S.

An element of uncertainty, however, exists regarding the EU's population due to the refugee influx. Two estimates for the EU population are therefore used for calculation. One ("EU low population") assumes there has been an influx of 1 million refugees over and above the EU's 2015 0.3 percent population growth. The second ("EU high population") assumes a refugee influx of 2 million.

These assumptions regarding the EU population naturally affect its own per capita GDP growth rate - producing rates of increase of per capita GDP of 1.3 percent or 1.1 percent depending on which population assumption is made. But either assumption confirms the EU's superior per capita growth rate compared with the U.S. - in either case the EU's per capita GDP growth rate is much higher than the 0.4 percent in the U.S.

It is also clear that U.S. per capita GDP growth, at only 0.4 percent, was extremely stagnant. During the last year, EU per capita growth was approximately three times as fast as the U.S. But China's per capita GDP growth entirely outperformed both. China's per capita GDP growth was more than 14 times as fast as the U.S.!

| Figure 2 |

|

|

U.S. economic deceleration

It may be argued against these factual trends that future revisions to the U.S. may raise its estimated growth rate. This is a factual question which requires watching future data releases - it is also possible future data will revise U.S. growth downwards. U.S. GDP growth is sufficiently close to the EU's, with a 0.6 percent gap, that is not impossible that U.S. GDP growth will be seen to be faster than the EU - although of course U.S. GDP growth will remain far slower than China. However, it may easily be demonstrated that huge revisions of the U.S. data would be required to alter the pattern that it is the U.S. economic slowing which has been the main cause of the downward trend in world economic growth.

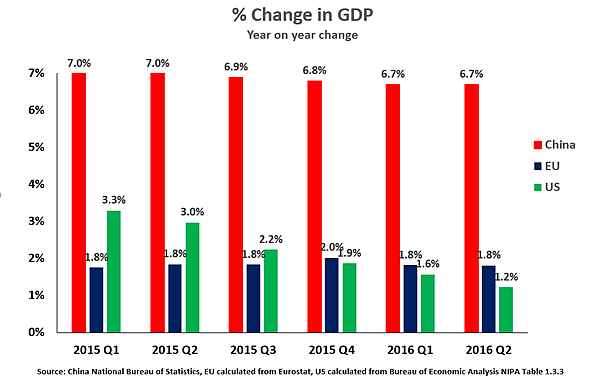

To demonstrate this, Figure 3 shows year on year growth in China, the EU and U.S. for successive quarters since the beginning of 2015. The changes over that period are clear. The EU has maintained relatively consistent GDP growth of 1.8 percent. China's GDP has slowed slightly from 7.0 percent to 6.7 percent. U.S. GDP growth however fell sharply from 3.3 percent to 1.2 percent.

Compared to the beginning of 2015, EU GDP growth has not fallen at all, China's declined by a mild 0.3 percent but the U.S. decelerated by 2.1 percent. By far the most severe slowdown in the world economy has therefore been in the U.S. Only huge, and therefore highly implausible, revisions in U.S. data would be required to alter this pattern.

| Figure 3 |

|

|

Conclusion

What therefore is the conclusion of the examination of the actual factual trends in the world economy?

· China continues to be by far the most rapidly growing of the major international economic centers. China's total GDP in the last year grew over five times as fast as the U.S., and China's per capita GDP growth was over 14 times as fast as the U.S.

· The chief cause of the slowing of the world economy in the last year is the slowdown in the U.S.

· The EU and above all China have outgrown the U.S. in terms of total GDP increase.

· U.S. per capita GDP growth, 0.4 percent on the latest data, is extremely slow.

· During the last year China and the EU have undergone either no or only mild economic slowdown while the U.S. has suffered a severe economic deceleration.

The factual situation of the world economy is therefore that not only has China been growing far more rapidly than the U.S. but even the EU has been growing more rapidly than the U.S.

Gross inaccuracy in international financial media regarding China is not unusual - they have, of course, been regularly predicting the "collapse of China" and a "China hard landing" for several decades. But the picture presented that the pattern of growth of the global economy has been strong growth in the U.S. and weak growth in China is therefore entirely false - it was the U.S. which showed to the weakest growth. Titles from Bloomberg this year such as "Fed Leaves China Only Tough Choices," "Why China's Economy Will Be So Hard to Fix," and "Soros Says China's Hard Landing Will Deepen the Rout in Stocks," coupled with claims of the strong performance of the U.S. economy, are shown by the data to be simply inaccurate.

But international and Chinese companies, as well as the Chinese authorities, require strictly objective information - not claims which are the opposite of the facts. Perhaps the wise Chinese dictum should be modified to read "seek truth from facts - not from Bloomberg."

The writer is a columnist with China.org.cn. For more information please visit:

http://www.china.org.cn/opinion/johnross.htm

Opinion articles reflect the views of their authors, not necessarily those of China.org.cn.

Go to Forum >>0 Comment(s)