China hikes reserve requirements again

|

Editor's notes: |

|

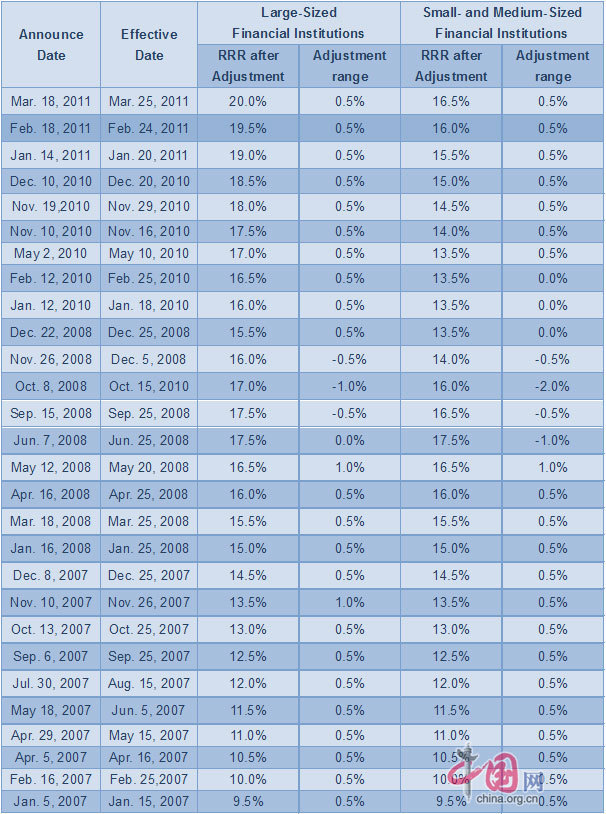

On March 18, the People's Bank of China (PBOC), China's central bank, raised the reserve requirement ratio for the third time this year and the ninth since the beginning of last year, in an effort to drain excessive liquidity from the banking sector. The 50-basis-point hike is expected to freeze approximately 400 billion yuan of cash. |

|

Latest news: | |

|

|

PBOC increases reserve ratios The People's Bank of China (PBOC), China's central bank, announced on Friday that it would raise the bank reserve requirement ratio (RRR) by 50 basis points starting on March 25. [Full article] Recent hikes: |

|

• Banks may suffer liquidity problems • High liquidity strains anti-inflation moves |

• 3-month PBOC bill's yield unchanged |

|

Experts' opinions: | |

|

|

"Besides liquidity control, Arab world turmoil and Japan's earthquake are also causes of the central bank's RRR hike." -- Mei Xinyu, researcher with Chinese Academy of International Trade and Economic Cooperation of MOFCOM |

|

"The purpose for the central bank's RRR hike this time is to soap up excess liquidity in the commercial banking sector, as well as prevent high commodity prices from leading to a second round of inflation." -- Li Daokui, advisor to the central bank's monetary policy committee |

|

|

|

"China's reserve requirement ratio has not reached a peak yet and may reach about 23 percent by year-end. This round of RRR hike is a normal move to mop up liquidity and does not indicate a tighter monetary policy." -- Lu Zhengwei, chief economist at Industrial Bank |

|

"The reserve requirement increase highlighted the central bank's resolution to curb inflation and consolidate the effect of previous monetary policies." -- Ba Shusong, deputy director of Finance Research Institute of DRC |

|

|

"The RRR hike is designed to cope with surging funds outstanding for foreign exchanges and the extra liquidity brought by central bank papers that will mature this month. It has no direct connection with Japan's earthquake. " -- Zuo Xiaolei, chief economist at Galaxy Securities |

|

"The reserve requirement hike will lock up 350 billion yuan in liquidity. More RRR hikes are expected within the year. A interest rate increase is possible in April." -- Li Xunlei, chief economist at Guotai Junan Securities |

|

|

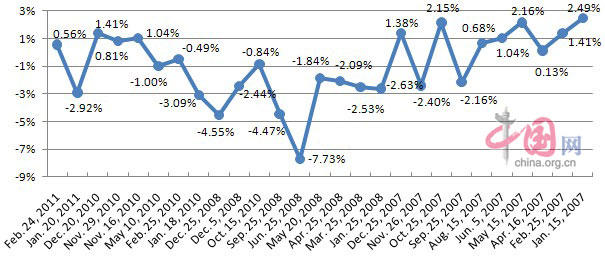

Performance of Shanghai Composite Index after each hike |

|

|

|

Reserve requirement ratio hikes in recent years |

|

|

0

0

Go to Forum >>0 Comments