China raises reserve requirements

|

Editor's notes: |

|

On April 17, China's central bank announced its fourth reserve requirement hike this year, asking domestic banks to set aside more money from lending, in yet another effort to curb stubbornly high inflation. Effective from April 21, the reserve requirement ratio for banks will rise by 0.5 basis points. The move is expected to lock up 376.4 billion yuan in liquidity in the banking market. |

|

Latest news: | ||

|

China raises interest rates again to curb inflation China's central bank announced Sunday that it would raise the required reserve ratio of the country's lenders by 50 basis points for the fourth time this year, in the latest effort to curb stubbornly high inflation.

Mar. 18, 2011 | Feb. 9, 2011 | Dec. 26, 2010 | Oct. 20, 2010

| ||

|

• Strong growth, inflation worries |

• Changing face of China's economy • Red-hot growth fuels economy | |

|

Experts' opinions: | |

|

|

"This round of reserve requirement hike is expected to lock up 370 billion yuan. The central bank is expected to step up liquidity sterilization in the second quarter through central bank bill sales and more RRR hikes." -- Ba Shusong, deputy director of Finance Research Institute of DRC |

|

"Central bank governor Zhou Xiaochuan said at the Boao Forum that current CPI level has exceeded China's control target, therefore the government will adopt various policies to tackle the problem. The RRR hike is within market expectation and won't have a large impact on the money market. Investors have no need to panic." -- Tan Yaling, director of the China Forex Investment Research Institute |

|

|

|

"Sunday's reserve requirement hike is well within expectation. The central bank made such move because of increasing credit expansion and ample liquidity. I think the central bank may further raise the reserve requirement ratio for several times this year." -- Zhu Jianfang, chief economist at CITIC Securities |

|

"Judging from current situation, the effect of the several round of reserve requirement hikes is not very obvious. The central bank should conduct more interest rate hikes and raise the reserve requirement ratio by more basis points." -- Li Chang'an, associate professor at the University of International Business and Economics |

|

|

|

"Not surprisingly, the central bank once again raised the reserve requirement ratio. China is facing huge inflationary pressure right now, also over 900 billion yuan of central bank paper will mature this month. The RRR hike can help adjust liquidity, manage inflation expectations and eliminate factors that contribute to the current inflation." -- Guo Tianyong, professor at the Central University of Finance and Economics |

|

"The central bank raised reserve requirements again, our judgement was right. So far, the central bank has made the reserve requirement hike a montly move."

-- Zuo Xiaolei, chief economist at Galaxy Securities |

|

|

Performance of Shanghai Composite Index after each hike |

|

|

|

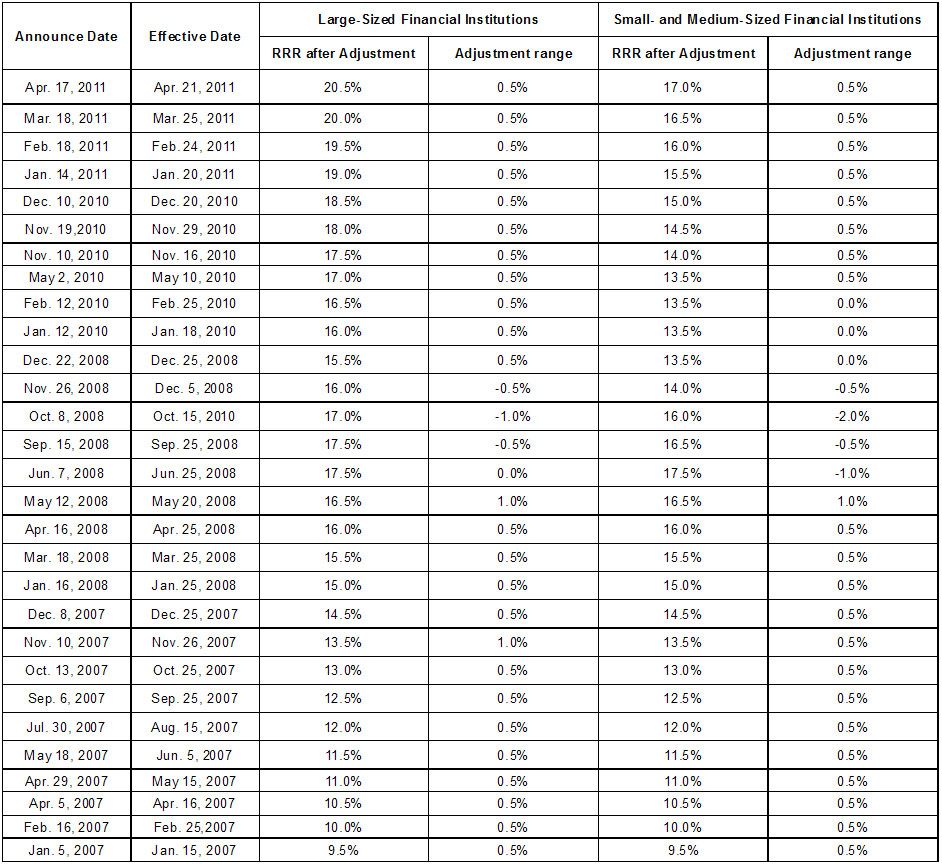

Reserve requirement ratio hikes in recent years |

|

|

0

0

Go to Forum >>0 Comments