SOE reform must precede private capital injections

- By Tong Dahuan

0 Comment(s)

0 Comment(s) Print

Print E-mail China.org.cn, June 2, 2012

E-mail China.org.cn, June 2, 2012

Recent moves by the State Council and certain state-owned enterprises (SOEs) have indicated willingness to introduce new inflows of private capital into SOEs without setting conditions for such private investment.

|

|

|

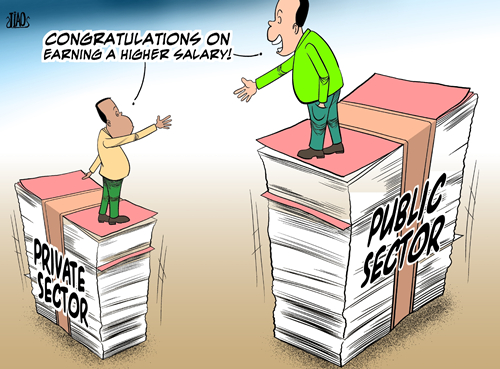

Out of step [By Jiao Haiyang/China.org.cn] |

The new regulations issued by the State-owned Assets Supervision and Administration Commission of State Council (SASAC) on May 25, commanded that SOEs should actively introduce private capital during restructuring and reorganizing; and should not, particularly, set additional conditions for such investment.

A few days earlier, the Ministry of Railways announced its full openness to private capital, again, without additional conditions.

However, there is a widespread concern that private capital is only a money tree for SOEs, which when short of money, will open their doors to private capital; and when running well, will leave out private enterprises in the cold.

In general, existing SOEs are very large, and tend to deprive private enterprises of a voice in decision-making. Meanwhile, SOEs, which are sizable rather than strong, have insufficient market competitiveness. Profits of industrial enterprises above a designated size (yearly business turnover of 20 million yuan) were down by 5.2 percent in January and February this year, with local SOEs falling by 10 percent and central enterprises falling by 19.8 percent.

The latest data showed that from January to April this year, profits of SOEs, on a year-on-year basis, fell for three consecutive months. In April, central enterprises achieved a net profit of 71.35 billion yuan, decreasing by 13.6 percent in contrast to March. Under such circumstances, the private capital "investment" in SOEs may turn into sacrificial offerings in the very end, with no profits gained.

Take the Ministry of Railways for example. In 2010, the ministry had a total debt of 1.8 trillion yuan, of which 150 billion yuan should have been repaid in that very year. However, in 2010, it only made a profit of 15 million yuan. It will take the Ministry of Railways 10,000 years to pay off all the principal and interest of the debt. In 2011, it faced a full-year loss. Figures showed that the ministry suffered losses of 6.979 billion yuan in the first quarter of 2012, nearly twice the losses of the same period in 2011. As of March 31, 2012, the total assets of Ministry of Railways were 4.008414 trillion yuan, with a total liability of 2.429836 trillion yuan. The liability ratio was 60.62 percent.

According to the China Industrial Economy News, Ministry of Railways itself has completely lost the ability to repay the debt. With more debt comes more interest. Instead of paying down its principal, the Ministry of Railways has been using new debt to service the old debt.

What does Ministry of Railways, deeply in debt, intend to do by opening its doors to private capital? It is out of the scope of precedent both at home and abroad for monopolies to invite private investors to share profits, said the Shenzhen Evening News in a recent commentary. The partition of several major electronics companies in the United States was mandated by US courts in order to break monopolies and ensure a competitive market.

Secondly, existing SOEs see increased concentration of resources but decreasing competitiveness, making pricing enterprises' equities difficult. A low price leads to the loss of state assets, and a high price drives private capital to a critical situation.

Thirdly, the legal system of fair competition between SOEs and private enterprises is not complete. The Ministry of Railways, for example, publishes its rules and regulations. In this case, the rushed entry of private funding into stated-owned assets is bound to turn into a game between an ant and a lion that no one dares to play.

In regard to these concerns, revising and improving the legal system and splitting the state-owned monopolies should come before SOEs' introduction of private capital. Competition brings fairness and productivity and leads to the reasonable pricing of SOEs.

Zhang Wenkui, a researcher with the Development Research Center of State Council, says that state-owned sectors are undeniably inefficient. All serious research has come to this conclusion. What is now necessary is to reduce the size of state-owned sectors, which will lessen distortions in resource allocation and inequality in market competition and lead to a balanced growth model.

The United States has demanded the Organization for Economic Cooperation and Development (OECD) to study the "competitive neutrality" framework which restricts the governments' support for SOEs. The framework, with a set of policy recommendations, ensures fair competition between SOEs and private enterprises through tax neutrality, debt neutrality, rules neutrality and through ensuring a comparable profit margin between both state-owned and private enterprises.

In China, we need to do such primary studies too.

The author is a current affairs commentator.

(This post was first published in Chinese.)

Opinion articles reflect the views of their authors, not necessarily those of China.org.cn

Go to Forum >>0 Comment(s)