Hopes for wealth gap reduction at session

0 Comment(s)

0 Comment(s) Print

Print E-mail Xinhua, November 11, 2013

E-mail Xinhua, November 11, 2013

Income distribution reform is again under the spotlight as observers pin high hopes on the key session of the Communist Party of China (CPC) that opened over the weekend.

|

|

|

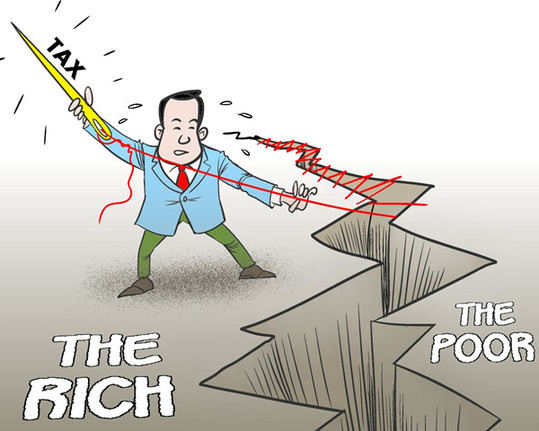

A timely patch [By Jiao Haiyang/China.org.cn] |

In February, the government issued guidelines to reform income distribution mechanisms amid growing public frustration over the widening wealth gap, though details on a reform timetable are not yet available.

“There’s no doubt it’s at the top of agenda, considering the urgency of the issue,” said Chi Fulin, president of the China Institute for Reform and Development, a Hainan Province-based think tank.

The National Bureau of Statistics reported in January that in 2012, China’s Gini coefficient, a widely used measure of income distribution, was 0.474, in which zero equals perfect equality.

Chi said he believes a package of detailed policies will come after the Third Plenary Session of the 18th CPC Central Committee.

China has been working on income distribution reform since 2004, but people’s expectations have been unfulfilled. Powerful interest groups, such as state-owned monopolies, have become a major target of public complaints.

“That is why college graduates try to break into state-owned enterprises or become civil servants, because higher welfare will be guaranteed,” said Zhao Xiaoming, who graduated from Sichuan Normal University in July and has failed to find his dream job as a school teacher.

In a widely watched move, the State-owned Assets Supervision and Administration Commission launched an investigation into the incomes of employees of state-owned organizations or enterprises in mid-August. It includes a fresh item targeting hidden income.

The investigation is to be completed by the end of this year.

“It’s directed at the crux of the problem,” said Chi. “You can’t make a fair distribution before you actually know how much you have. The investigation results will be an important reference to push forward distribution reform.”

According to Chi, the current unfair distribution of income is partly caused by the disparity between urban and rural areas and coastal and inland regions. But it is also attributed to industrial monopolies and government agencies competing with the private sector, which is at a disadvantage.

The reform is a readjustment of the current structure of interests, he said. Zheng Xinli, executive deputy director of the China Center for International Economic Exchanges, said China should increase the income of the middle- and lower-income earners to form an “olive-shaped” income distribution structure.

According to the General Social Survey by the Chinese Academy of Social Sciences in 2012, the income range of the middle class is US$11,800-17,700 per year, which means the middle class makes up around 23 percent of the population, far lower than the percentage in developed countries.

According to the February guideline to reform income distribution mechanisms, the government will work to double the average real income of urban and rural residents by 2020 from 2010 levels and allow faster income growth for the poor.

It will also strengthen scrutiny of high-income groups, such as officials, employees of state-owned enterprises, and other wealthy individuals.

According to the latest survey by Forbes early this year, China had 122 billionaires in terms of US dollars. Another list in the Hurun Report in February said China had 317 billionaires — a fifth of the world’s total.

Many observers say that fundamental tax reforms are essential to create more equal income distribution. Debate has sizzled since October over the government’s intention to levy inheritance taxes and property taxes to regulate income distribution.

Jia Kang, director of the Research Institute for Fiscal Science at China’s Ministry of Finance, said there is disagreement, even at the government level, on whether a pilot tax reform should be carried out before it becomes law.

Go to Forum >>0 Comment(s)