Trade agreements should not be political

- By Don Bonker

0 Comment(s)

0 Comment(s) Print

Print E-mail China Daily, March 12, 2014

E-mail China Daily, March 12, 2014

US President Barack Obama has such good intentions, but his lofty goals often become bridges to nowhere. The latest is international trade. This time the problem is not the Republicans, but his own party.

|

|

|

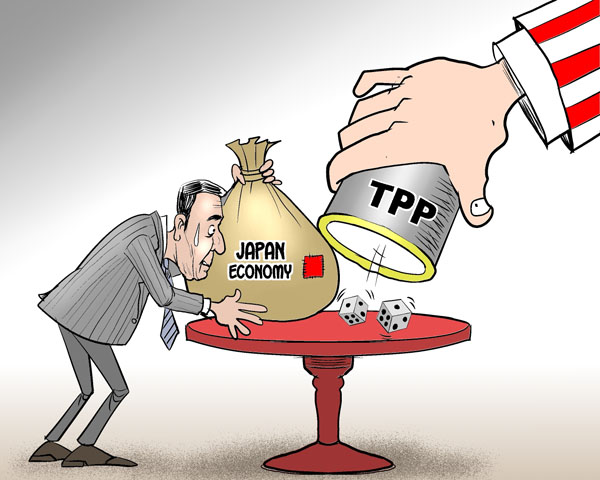

Double or nothing [By Jiao Haiyang/China.org.cn] |

His administration has been actively negotiating two huge trade agreements, one with Pacific Rim countries and one with the European Union, yet Congress must first pass the Trade Promotion Authority bill to allow fast-track consideration of the two trade agreements.

However, the Democrats' top leader in the US Senate, Harry Reid, has already set up a roadblock by cautioning that "everyone would be well advised just to not push this right now". That is the sentiment of most Congressional Democrats who see this as a risky vote in an election year.

Maybe it is time for the Obama administration to take a break from pursuing contentious regional trade deals and give a higher priority to the US-China economic relationship.

Why launch trade negotiations with 11 Asian countries and leave out China.

The Obama administration earlier portrayed the Trans-Pacific Partnership as a geopolitical strategy that would give the US a stronger presence in Asia, plus allow a protective shield for Asian countries feeling threatened by China's growth and influence in the region. However, since the US already has trade pacts with six of the TPP countries, why cast a larger net that unnecessarily adds burden, if not controversy, to the negotiating process?

As the world's two largest economies, the stakes are greater when it comes to China-US relations, as are the opportunities and challenges.

Chinese investments in the US doubled last year to a record $14 billion and early this year had a jump start with Lenovo Group's two huge purchases of Google's Motorola handset division for $2.9 billion and its purchase of IBM's low-end server unit for $2.3 billion. At the same time, two large Chinese entities, Richard Li's Hybrid Technology and China's largest auto parts company, Wanxiang, were fiercely competing to take over the bankrupt Fisker Automotive with plans to revive the electric sports car manufacturer.

True, Chinese investments in the US are increasing rapidly, but their numbers would have been larger were it not for the hostile environment many of China's proposed acquisitions and mergers encounter. The Wall Street Journal reported that the Lenovo acquisitions (both IBM and Google's Motorola) will "likely draw scrutiny from US regulators and concern about security issues involving acquisitions by Chinese companies". That certainly was the case with Huawei and ZTE, two large Chinese telecom network providers.

Go to Forum >>0 Comment(s)