RMB globalization highlights balance between stability and reform

- By Sun Lijian

0 Comment(s)

0 Comment(s) Print

Print E-mail Shanghai Daily, June 26, 2015

E-mail Shanghai Daily, June 26, 2015

|

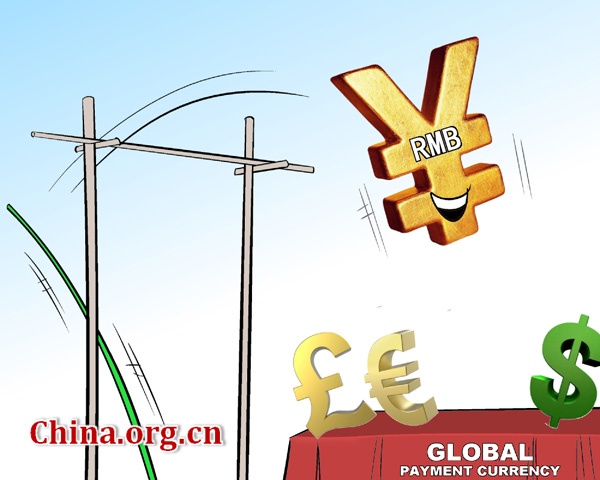

[By Jiao Haiyang/China.org.cn] |

The yuan has emerged as the fifth most-used currency in international business transactions, with 2.07 percent of the global payments made in the yuan in April. The trend is stronger in the Asia-Pacific region, where the yuan has emerged as the first-choice payment currency in China’s mainland and Hong Kong, while only three years ago it ranked a distant fifth in terms of popularity as a currency for payment.

The Hong Kong and Shanghai Banking Corporation has even predicted that the yuan will replace the yen as the most-used currency in Asia by the second quarter of this year.

The yuan is no longer under-valued and it is a matter of time before it joins the IMF’s Special Drawing Rights (SDRs) club. Once the yuan is included in SDRs, central bankers all over the world will naturally increase their holdings of the yuan in their foreign exchange reserves, a move that will likely help to stabilize its value.

What’s more, the yuan’s cemented role as a payment and reserve currency will inevitably lead to its greater influence in setting global commodity prices. At present, it has minimal influence compared to that commanded by the US dollar and the euro.

The yuan’s internationalization is also hugely important in light of the need for asset security, which is a key concern of Chinese businesses with global aspirations. And this concern is increasingly desperate in the wake of the 2008 global financial crisis, prompting Chinese authorities to moot the strategy of elevating the yuan’s global status.

A series of efforts, such as allowing for the yuan’s cross-border use in the Shanghai Free Trade Zone, currency swap deals featuring the yuan, the establishment of the Silk Road Fund and the Asian Infrastructure Investment Bank, have underscored China’s commitment to promote the yuan as a global currency in an organized way.

Risk control

Nonetheless, I’d like to shed light on some fundamental changes in the yuan’s internationalization which merit due attention.

Since risks abound of speculators making arbitrage gains from exchange rate differences, thanks to a unilaterally rising yuan, the Chinese government proceeded with great care in their previous bid to globalize the currency.

But today, not only Chinese firms themselves are eagerly engaged in yuan settlement in cross-border trade, their overseas partners no longer shy away from involvement in yuan-related business.

However, I do feel that although expectations for a stronger yuan are generally high, both at home and abroad, the ways to achieve that goal are perhaps seen in broadly different terms.

Go to Forum >>0 Comment(s)