Renminbi on bumpy road to internationalization

- By Zhang Yugui

0 Comment(s)

0 Comment(s) Print

Print E-mail China.org.cn, March 6, 2016

E-mail China.org.cn, March 6, 2016

|

|

|

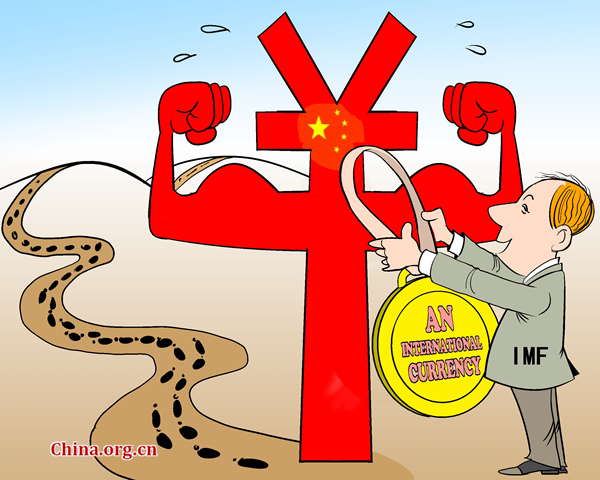

Just a step away [By Jiao Haiyang/China.org.cn] |

A strategic goal of Chinese economy up to 2020 is to consolidate the competitive advantage of its manufacturing industry, enhance its trade competence in the global value chain, and ensure the key role of its currency in global financial evolution.

The renminbi should change its role from that of a passive participant to an active, dominant power and a bonus provider in the global currency system. Its internationalization will necessarily lead to a reevaluation of the U.S. dollar. This is an inevitable step in China's assuming its global responsibility as a big country.

Finance is a distribution of global wealth based on pricing and trade rules. As a super emerging economy, China should strive for its due position to defend its core national interests, boost the renminbi's internationalization and actively struggle for its share of global asset pricing rights.

The year 2015 saw the renminbi join the International Monetary Fund's Special Drawing Rights program, and the China International Payment System was also successfully launched. These are crucial steps as they provide the currency with a mechanism to join global deals, and integrate its payment system at home and abroad.

The renminbi has established its status as an important trade currency, last year surpassing the Euro to become the second largest currency in trade and financing settlement after the U.S. dollar. For many Asian nations, it has become a main trade currency along with the dollar representing China's status as the region's main trade partner.

It accounts for 53.9 percent in the trade and financing between Hong Kong and the mainland, and 28.5 percent between Singapore and China. According to Society for Worldwide Interbank Financial Telecommunication, the renminbi accounted for 2.31 percent of the global payment market in December 2015, and would rise to 3 percent this year. After joining the IMF's SDR arrangement, its share in global reserved assets will also rise steadily.

Further, the renminbi will be transformed from a trade settlement currency to an international investment currency, and then major global reserve currency. Joining the SDR, indeed, is a kind of pledge of a state credit asset, enabling China to achieve a modern financial system and a multi-layer and developed capital market, loosen controls over the capital account and finally realize full renminbi convertibility.

Shanghai has an important mission in this process. The city will help build the second phase project of the renminbi cross-border payment system, a base price formation center of the currency, an asset pricing center and a payment and clearing center by 2020 with controllable risk.

After that, the renminbi aims at joining the global reserve currency system and staple commodity trade system. If these goals can be realized, it will undoubtedly become a main competitor of the U.S. dollar. This process will take about 20 years, and the next five years, therefore, is an important period within which to cultivate relevant technological elements.

Renminbi offshore centers are spreading from Asia to Europe, America and Australia. And the scale asset priced in renminbi, which is invested in by central banks and sovereign wealth funds of various countries, becomes ever bigger. If the European Central Bank ever decides to invest in renminbi assets, the U.S. Federal Reserve might not be able to stop it.

Go to Forum >>0 Comment(s)