Challenges ahead

As with any companies entering a foreign market, challenges are inevitable for Chinese companies.

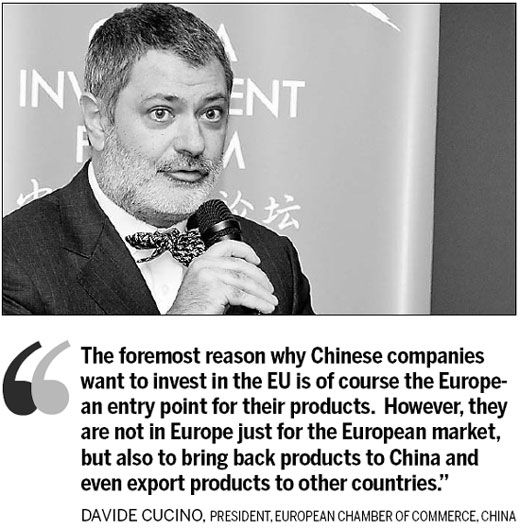

Cucino said the survey respondents cited operational problems, rather than market access, as the biggest obstacle for Chinese investment in Europe.

Other big problems included obstacles in obtaining visas and work permits for Chinese employees, European labor laws, human resources costs and cultural differences in management style.

Many Chinese companies have found it difficult to employ Chinese workers at their UK subsidiaries because the British government often rejects their applications to sponsor work permits for employees who are non-EU nationals.

This is because the government limits the number of work permits granted to 20,700 a year. This quota is then allocated to each professional category.

If the number of applications for work permits made by companies in a particular professional category exceeds the category's quota, generally applicants with the highest salary will get the places, said Xue Haibin, a partner in the London office of Zhong Lun Law Firm.

Xue said that it has been very difficult for his company to secure work permits for employees because the salary it offers cannot compete with that of the biggest British law firms.

"The minimum salary of a trainee in London is only 20,000 pounds ($30,000) annually but some large law firms have the financial ability to pay 50,000 pounds," Xue said.

Headquartered in Beijing, Zhong Lun expanded into the UK in 2006 to provide legal services to both Chinese businesses going there and UK businesses expanding into China.

"The British government said the country is open to businesses but its regulations show that it isn't so open," Xue said, adding that Zhong Lun may consider investing more in its offices elsewhere that have more open markets.

The company now has overseas offices in Riyadh, Lyon, Paris and major cities in the US.

An alternative way of employing Chinese workers in UK subsidiaries is through intracompany transfer (ICT), but this method is very costly.

Under the UK's ICT scheme, foreign companies can only transfer workers to their UK subsidiaries if their salaries are above 24,000 pounds.

However, employees whose annual salary is between 24,000 pounds and 40,000 pounds can work in the UK for only one year which, for most companies, is not enough for a worker to fully contribute toward the company's business there.

Those whose annual salary is above 40,000 pounds can stay in the UK to work without time restriction. The UK's average full-time salary was only 26,500 pounds as of April 2012.

Paul Taylor, CEO of Dynex Semiconductor Ltd, a British company bought by China's Zhuzhou CSR Times Electric Co and which is now a subsidiary, said it is very expensive to transfer workers from the parent company to work with his team in the UK.

"This is a problem because we sell our products in China through our parent company and we need people working in China who understand our products. By transferring them to work in the UK for maybe three years, they can gain a good understanding of our products," Taylor said.

"If we sell more products in China, our manufacturing in the UK will grow, and we can recruit more local people to work for us if we grow."

In 2008, Zhuzhou CSR Times Electric bought a 75 percent share in Dynex. It has since invested in Dynex to build a new research and development center costing 12 million pounds.

Taylor said most of the Chinese workers at Dynex are sent from Zhuzhou CSR Times Electric on one-year ICT visas because the salary of 40,000 pounds needed to pay workers staying for more than a year is unaffordable.

Sylvain Godinet, vice-director of the HLB Swiss member firm Beau Group, sees differences in business culture as a big challenge and, in particular, "the difficulty of EU counterparts to understand the Chinese manners in business".

"Typically, Europeans consider signing a contract with their Chinese counterparts to be the most important act in a partnership. And typically, in mergers and acquisition cases, Europeans focus only on the selling price. This is difficult for Chinese parties who generally want to develop more deeply the relationship, exchange know-how and strengthen the relationship and collaboration."