A majority of Chinese people do not have sufficient finances or funds to maintain their current standard of living after retirement, according to a survey sponsored by American International Assurance Company Limited (AIA).

The AIA Life Matters survey, conducted by international independent research firm TNS, revealed the financial fears many Chinese have about their old age, and particularly the cost of healthcare.

Some 60 percent of respondents believed they did not have sufficient finances or funds to maintain their current standard of living post-retirement. But the vast majority anticipated social security funds and personal savings would be the major sources of income after they quit working.

However, 49 percent of respondents with commercial insurance believed they would have a sufficient income after retirement, higher than the 36 percent among those without commercial insurance.

Major lifestyle changes as a result of improved living standards and higher life expectancy have led to a greater occurrence of serious illnesses.

While 71 percent of respondents expressed concerns about falling ill, 50 percent of them said they would be unable to cope with the costs if one of their relatives ended up in hospital.

"The survey has highlighted what we at AIA see as a need to change perceptions and thinking in China toward retirement and personal protection insurance," said Jacky Chan, AIA Greater China Region president.

These results also indicate a need for the insurance industry to further educate and guide customers and continue to enhance the reputation of the sector, said Chan.

According to Yu Nanping, a professor at East China Normal University, the survey will help raise public awareness of the importance of insurance and also convince the insurance industry that product and service innovation in accordance with market demands is the key to its healthy and rapid development.

The AIA survey is a new annual national initiative to monitor and track perceptions in China toward financial protection and personal risk, and highlights behavior in the country that could affect financial well-being. Data was collected via telephone interviews and door-to-door from a representative sample of 5,200 people in the urban and suburban areas of seven cities. Respondents were aged between 18 and 60.

"The market research and demographic data we are collecting from the survey will assist us in developing further innovative products and marketing strategies that will help in creating further financial products to meet the financial needs of the people of China," Chan said.

The survey studied people's awareness of and attitudes to insurance and financial risk. In Beijing, Shanghai, Shenzhen and Guangzhou a representative sample of 1,000 interviews was conducted per city. In Nanjing, Xuhou and Shantou 400 interviews were conducted in each city.

Similarly, China Minmetals Corp and Europe's No 2 insurer AXA's joint venture AXA-Minmetals Assurance Co Ltd have launched the AXA Life Outlook Index, showing that in Asia, Chinese middle and high-end customers are the most optimistic group in terms of their outlook on life for the next five years.

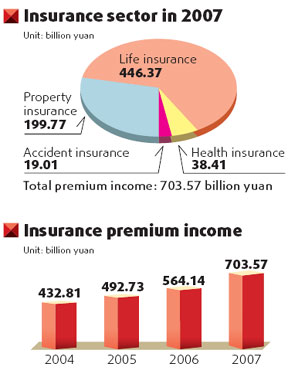

The survey, covering over 2,000 interviewees in Asia, shows that most Chinese customers have a quite simple investment portfolio, mainly of residential property, stocks and deposits. Only 31.3 percent of respondents have bought insurance products, meaning the potential market for insurance, especially the pension business, remains large. And AXA-Minmetals is eyeing this huge potential market.

(China Daily September 19, 2008)