The year 2008 wasn't a lucky year for domestic securities firms -- the Chinese stock market experienced the worst performance in its history and the Shanghai Composite Index plunged by about 65 percent in just one year. Almost all securities firms have been reducing expenses by making pay cuts and layoffs. However, based on a recent internal report obtained by National Business Daily, the Guotai Junan Securities Co. (GTJA), a leading brokerage firm in China, apparently isn't suffering such problems.

A large payroll – 3.2 billion yuan

According to a work report made by Guotai Junan Securities President Chen Geng, the company paid a total of 3.2 billion yuan in employee salaries and welfare costs, far exceeding the budget of 2 billion yuan forecast at the beginning of 2008.

As shown in the work report, GTJA now has approximately 3,200 employees on the payroll, which means that the average salary of its employees reached about 1 million yuan in 2008.

Guotai Junan is one of the three largest domestic securities firms and has more than 100 branches around China. Even in the 2008 bear market, Guotai Junan still ranked in the top three brokerage firms based on total transaction volume. This may be the reason the company has had the muscle to raise employees' salaries during such a difficult time for the securities industry. But how on earth did GTJA achieve such an excellent performance last year? The newspaper tried to find the answer in the report, but failed.

Core businesses face budget shortfalls

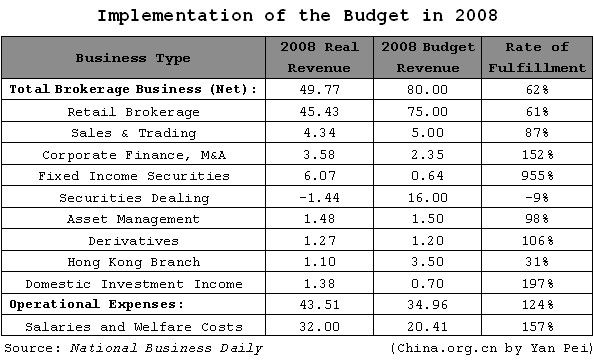

In the report, one table – "Implementation of the Budget in 2008" -- showed that most of the company's main businesses failed to achieve their revenue targets in 2008. All of the businesses with a budget target over 300 million yuan are looking at revenue shortfalls.

Last year, GTJA's revenues in brokerage business were 5 billion yuan, compared with the budget of 8 billion set at the beginning of 2008. Its Sales and Trading Department and Hong Kong Asset Management Headquarter also failed to achieve their budget targets. The Securities Dealing Department even reported a loss of 144 million yuan, while the department's budget was set at about 158 million profit.

There are some departments who did indeed achieve their budget targets, which were apparently set at a low level, the newspaper noted. For example, total revenues in Fixed Income Securities were 607 billion, while its budget was only 64 million yuan.

Where did GTJA's high payroll come from? The answer is the sale of corporate shares held by the company. Data from the work report show that GTJA received 4.5 billion yuan by cashing in corporate shares. Chen Geng also said in the report that GTJA was able to secure its business performance through these share sales.

GTJA pays far more in salaries than other brokerage firms

According to the newspaper, as of December 31, 2008, Guosen Securities' payroll costs were 1.25 billion yuan, China Merchants Securities' were 1.55 billion yuan, and Ping An Securities' and Huatai Securities' were 159 million yuan and 175 million yuan, respectively. While these four firms are all major brokers in China, their payrolls are far smaller than GTJA's.

Several GTJA employees interviewed by National Business Daily expressed surprise when told that their average salary in 2008 was about 1 million yuan, as they had not received nearly as much.

Late yesterday GTJA posted a statement on its website, responding to the issue. The company noted the newspaper's calculations and interpretation of the 3.2 billion yuan are wrong. "The 3.2 billion-yuan payroll consists of accumulated surpluses from previous years, accrued salaries, and salaries payable in 2008," the broker said in the statement.

(China.org.cn by Yan Pei, February 5, 2009)