Spring is yet to come to China's housing market, and the government should take more measures to stimulate real estate development, said Ren Zhiqiang, President of Huayuan Group, at a breakout session of the 2009 Boao Forum for Asia Annual Conference in Hainan Province on Friday.

|

|

|

Ren Zhiqiang |

China's real estate market has shown no sign of any remarkable recovery so far. After the global financial crisis broke out, the Chinese government worked out a 4-trillion-yuan emergency plan to boost the domestic economy. To date, however, only some 200 billion yuan has gone to the real estate market, and this investment is far from adequate to bring about any radical change, said Ren Zhiqiang.

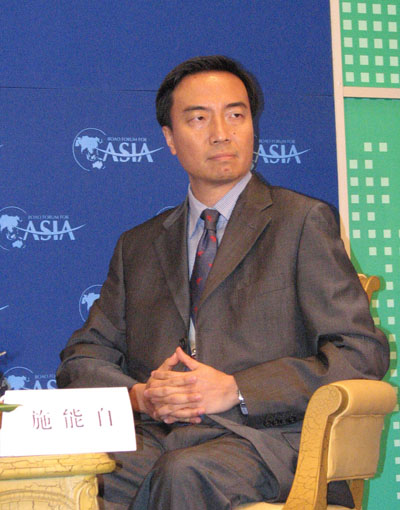

As the global financial crisis unfolds, China has loosened some restrictions on the market in second-hand homes. Duties like stamp tax and land appreciation tax have been cut down to some extent. Most banks, however, are still taking a wait-and-see attitude because they have learnt a serious lesson from the global financial crisis and are not confident of the development of the domestic housing market, Shi Nengzi, a partner in Deloitte Consulting China, pointed out.

|

|

|

Shi Nengzi |

To help the industry get through these tough times, Ren Zhiqiang appealed to the government to launch more positive policies and further reduce such taxes as business tax and tax on dividends.

Ren's view, however, was countered by Pan Shiyi, another real estate developer who owned many skyscrapers in Beijing's Central Business Districts. According to Pan, the government has taken all possible measures to support the real estate market, and now the only thing left to do is to wait and see the results.

|

|

|

Pan Shiyi |

(China.org.cn by Chen Xia, April 19, 2009)