General Motors Corp may be struggling mightily in the US, restructuring under bankruptcy protection, but the automaker has harvested a half-year sales record in China, where it promised to "continue to invest in heavily".

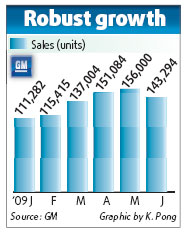

GM China Group yesterday reported that the company and its two local joint ventures sold 814,442 vehicles in the country in the first six months, representing an increase of 38 percent from the same period last year, after its June sales continued the robust growth with 61.6 percent over last year.

The government's stimulus measures have helped boost the demand of small cars and minivans.

For the first time, GM and its joint ventures exceeded domestic sales of 100,000 vehicles in each of the first six months of the year.

The bullish market also made GM, the first auto company to release June and first-half sales figures for China, raise its expectation for the booming domestic auto market for the whole year.

"We expect China's industry-wide auto sales to reach 10.4 to 10.5 million units in 2009, up about 15 percent from 2008," said Kevin Wale, president and managing director of GM China.

The company had forecast in April that vehicle sales in China might increase between 5 percent and 10 percent.

Wale refused to disclose specific numbers on the whole-year sales target for GM China.

However, Wale said: "We could say that GM sales in China will definitely outpace the 15 percent market growth. GM China vehicle sales are expected to remain strong in the second half of 2009."

In the first five months, China's automobile sales increased 14.3 percent to 4.96 million units, with 3.36 million passenger cars sold across the country, a 21-percent jump over last year, according to statistics from China Association of Automobile Manufacturers.

The association may release half-year figures next week.

"China's vehicle market continued to outpace most expectations for growth," said Wale.

"The market benefited from stimulus policies adopted by the Chinese government as well as growing demand for personal transportation in tier-three and tier-four cities and rural areas," he said.

This year, the government has halved retail taxes on small cars and it plans to give 5 billion yuan ($729 million) in vehicle subsidies in rural areas to drive up automobile consumption after sales last year rose at the slowest pace of 6.7 percent, to 9.38 million units, in a decade.

"The majority of GM products sold in China have engines under 1.6 liters. They are benefiting from the tax reductions.

"And the 5-billion-yuan subsidy to encourage farmers to move to mini-commercial vehicles from farm vehicles is having a positive impact on our Wuling minivan sales," Wale told China Daily.

The Detroit-based company filed for bankruptcy protection on June 1 in the US. However, it promised that its operations in China "will stay largely unaffected".

The automaker cut its workforce, closed factories and sold assets worldwide to weather its dreary auto sales in the US.

Despite its struggles elsewhere, Wale said GM's early planning of doubling sales from 2008 to about 2 million units over the next five years in China, would remain unchanged.

Moreover, "we are rolling out great new products under each of our brands, expanding our distribution network and growing our product development capability," Wale said.

"GM is committed to long-term development in China."

(

China Daily July 2, 2009)