The 6th Reserve Requirement hike in 2011

0 Comment(s)

0 Comment(s) Print

Print E-mail

China.org.cn, June 15, 2011

E-mail

China.org.cn, June 15, 2011

|

Editor's notes: |

|

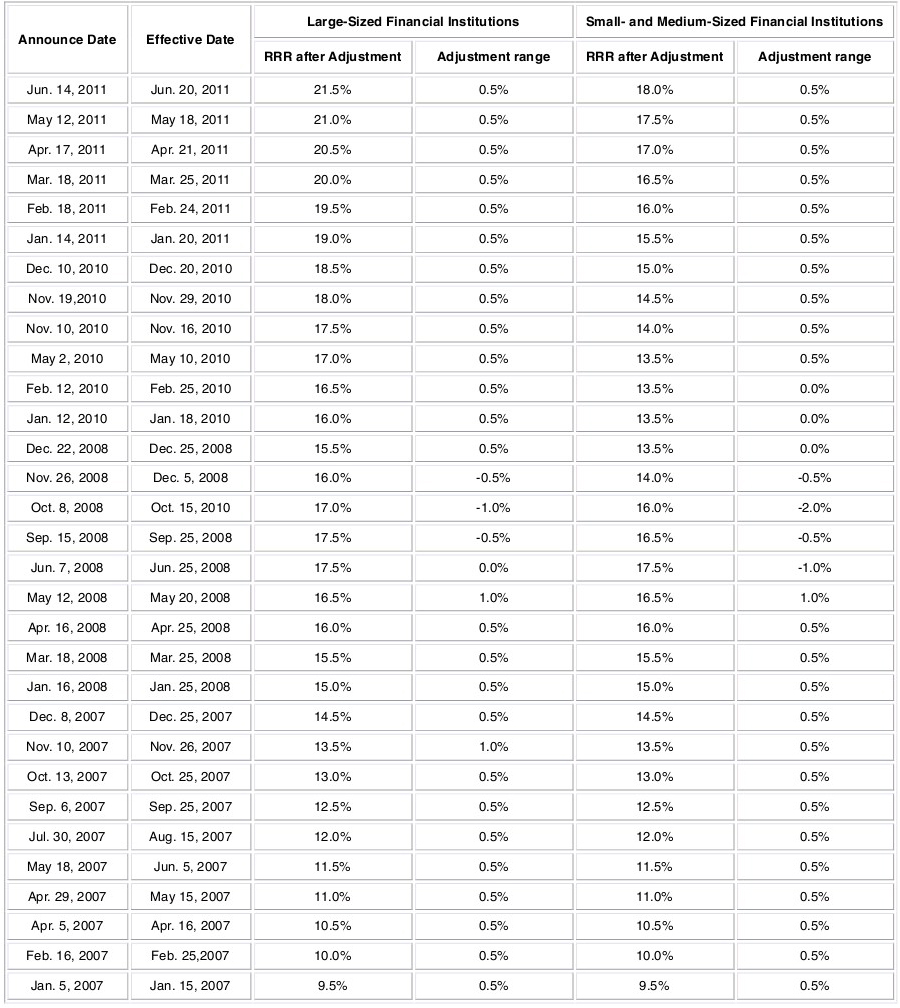

Not surprisingly, China's central bank again raised reserve requirement ratio for banks on June 14, 2011, the sixth time this year. The country has been hiking reserve requirements once every month since the beginning of the year. The move, targeted to further tackle the stubbornly high inflation, requires domestic banks to put away more money from lending. Effective from June 20, the reserve requirement ratio for banks will rise by 0.5 basis points, bringing RRR for large financial institutions to a record high of 21.5 percent. |

|

Latest news: | ||

|

China hikes reserve requirement by 50 bps China's central bank Tuesday said it would raise the banks' reserve requirement ratio (RRR) by 50 basis points for sixth time this year, a move aimed to withdraw liquidity out of the market as inflation remains stubbornly high. [Full article]

May 12 | Apr. 17 | Mar. 18 | Feb. 9 | Jan. 14

| ||

|

• Soaring CPI puts squeeze on manufacturers |

||

|

Experts' opinions: | |

|

|

"The central bank raised reserve requirements to control money supply, which will lead to a surge in private lending rate. The central bank may also raise interest rate. The RRR hike does not rule out the possibility of a rate hike in the future." -- Andy Xie, independent economist |

|

"The reserve requirement hike has become a routine move for the central bank, with one increase each month. All these moves are targeted at withdraw market liquidity. The RRR hike will inevitably postpone a possible interest rate increase." -- Li Xunlei, chief economist at Guotai Jun'an Securities |

|

|

|

"The reason why the central bank didn't raise reserve requirements over the weekend as usual is because it want to provent from a possible leak of its move and avoid market fluctuation... It's just a matter of time for the central bank to further raise the interest rates, because the inflationary pressure is still very high, with May's CPI reaching 5.5 percent." -- Lu Zhengwei, economist at Industrial Bank |

|

"There's no upper limit of reserve requirement rate. Judging from China's current economic situation, a RRR hike is far more important than an interest rate hike. However, the former cannot entirely replace the latter. A rate hike is possible every weekend recently." -- Ye Tan, economics commentator |

|

|

|

"China's consumer price index (CPI) probably has not topped yet, even with May's CPI reaching as high as 5.5 percent.The reserve requirement increase is targeted as maintain prudent monetary policy, effectively management market liquidity and control inflation."

|

|

"The foremost reason for Tuesday's RRR hike is to sterilize the 600-billion-yuan of central bank bill that is going to due in June. The move will further restrain the lending capacity of small- and medium-sized banks." -- Ba Shusong, deputy director of Finance Research Institute of DRC |

|

|

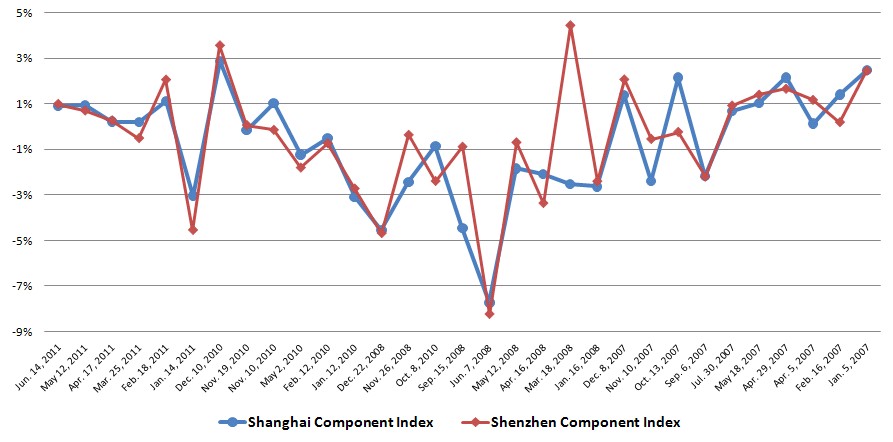

Performance of China's stock market on the first trading day after each hike announced |

|

|

|

Reserve requirement ratio hikes in recent years |

|

|

Go to Forum >>0 Comment(s)