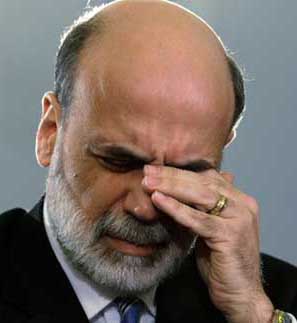

It seems fitting that as the world faces its worst economic crisis since 1929, the Chairman of the United States Federal Reserve, Ben Bernanke is a leading expert on the Great Depression.

Whether the lessons he has drawn from the classroom will be effective in the real world, only time will tell; and how much time he has depends on whether incoming President Barack Obama chooses to keep him at the Fed.

The former Princeton professor is said to be in theoretical terms a critic of President Roosevelt's New Deal, which is credited by many as having ended the Great Depression. But in office he has shown himself a pragmatist who, together with Treasury Secretary Hank Paulson, has supported government intervention where necessary to restore market confidence.

Bernanke was given his nickname "Helicopter Ben" by right wing critics after a 2002 speech in which he said the threat of deflation could be countered by dropping cash out of helicopters.

Bernanke inherited a troubled housing market when he took over as Fed chairman in February 2006. Starting in 2007 he made a series of interest rate cuts in an attempt to stave off a collapse.

In September, he backed Hank Paulson's move to seize Fannie Mae and Freddie Mac, the nation's largest mortgage holders, agreed to an US$85 billion rescue of insurance giant American International Group and supported Paulson's US$700 billion plan to buy toxic mortgage debt from Wall Street.

(China.org.cn by John Sexton, November 13, 2008)