Securities companies led a 4.94 percent rebound on the mainland stock market on Friday as investors looked forward to government moves in support of the industry this weekend.

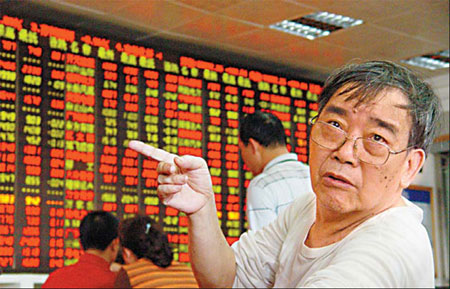

An investor at a securities house in Haikou. The Shanghai Composite Index rose 4.94 percent to close at 3580.15 on Friday. [China Daily]

The benchmark Shanghai Composite Index jumped 168.66 points to close at 3,580.15, with 764 out of 911 stocks closing higher. The Shenzhen Component Index surged 4.43 percent to close at 13,692.84.

Turnover on the two bourses amounted to 130.3 billion yuan, up 16.7 percent from Thursday. Market capitalization rose 4.6 percent to 23.3 trillion yuan.

In Hong Kong, the Hang Seng Index rose 2.74 percent to close at 23,285.95.

Securities companies led the rally on the mainland after the China Securities Regulatory Commission announced new rules that will allow qualified securities companies to set up direct investment businesses, which is expected to boost earnings of stockbrokers.

The Shanghai-based Haitong Securities surged to daily limits to close at 32.1 yuan. CITIC Securities, the mainland's largest stock broker, soared 7.71 percent to close at 55.04.

Analysts said yesterday's jump was a technical rebound after the major indicator sunk 10.1 percent in the first four trading days this week.

"After shares of some major companies dropped below their IPO prices, the investment value appeared, as many institutional investors become unwilling to sell shares for less than their buying price," Zhu Haibin, an analyst at Essence Securities, said.

Meanwhile, several banks posted better earnings than analysts expected. Shares of Industrial and Commercial Bank of China surged 7.84 percent after it announced a 66.4 percent increase in net profits in 2007. Bank of China shares rose 3.86 percent after it posted a net profit increase of 31.9 percent.

In addition, there were rumors that the government would announce several measures this weekend that could support the market, including a reduction of the stamp tax from 0.3 percent to 0.2 percent and supplementary rules for listed companies looking to issue new shares.

"We will wait and see how positive the government's measures will be," Zhu said, adding that the inflation figures for March, which are expected to be announced on April 18, will help determine whether the government takes other measures.

Analysts widely projected the CPI would jump to around 8.1 percent this month.

"The government is expected to relax the price controls in the middle term, which is expected to boost the earnings of electric and oil refining companies," Cheng Weiqing, an analyst at CITIC Securities, said.

(China Daily March 29, 2008)