Chunghwa Picture Tubes is set to be the first Taiwan company to tap the mainland capital market in a so-called "backdoor" listing of its assets valued at 2.76 billion yuan.

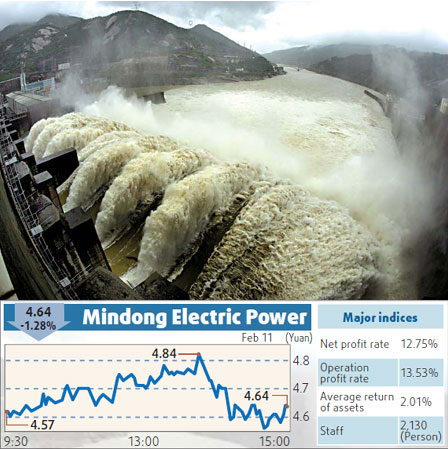

The fourth largest producer of liquid-crystal displays in Taiwan has swapped a 75 percent interest in four of its manufacturing plants on the mainland for an 82 percent stake in Mindong Electric Group, a Shenzhen-listed electric generator producer, whose shares have been suspended from trading for nearly 2 years.

The transaction, which must be ratified by the stock exchange and government regulators, values Mindong's shares at 4.35 yuan apiece. Trading in shares of Mindong, which has failed to produce profits in the past several years, was resumed on Feb 4 after the capital injection arrangement was disclosed. Since then, the price of the company's shares has surged a total of 33 percent to about 6.5 yuan each.

Mindong is expected to terminate its unprofitable electric generator manufacturing and concentrate on the production of LCD modules for supply to manufacturers of television sets and personal computers.

Stock analysts said if the transaction goes through it will serve as a model for other Taiwanese manufacturing companies, especially those that have established extensive production facilities in the Yangtze River Delta region and other industrial bases, to raise new capital on the Shanghai or Shenzhen stock exchanges. Gaining access to mainland capital is of particular significance as many manufacturers are feeling the pinch of the global credit squeeze.

"The deal will be a landmark breakthrough for enterprises in Taiwan," said Lin Xianbin, a Shanghai-based analyst with Taiwan International Securities Group. "I am very optimistic that both parties of the transaction will do well."

Lin said the timing is also good for backdoor listing in the mainland market: "There hasn't been any IPO since the second half of last year, and the prices of shell companies, like Mindong, are quite low now."

"The success of CPT will encourage more Taiwan companies to seek the backdoor listing as the least time-consuming and cheapest way to raise funds in the mainland's capital market," said Liu Fangrong, president of Friendly Business Group, a consultant firm.

Many enterprises from Taiwan are interested in gaining a listing on mainland stock exchanges, the analysts said. But it is difficult at this stage because offers of new shares to the public have been strictly limited since the market crashed in late 2007.

Among the 70,000 Taiwan enterprises with investment on the Chinese mainland, only seven have obtained a listing on a mainland stock exchange.

CPT, established in 1971, is traded at the Taiwan Stock Exchange Corporation. Drawn by falling demand, it reported a net profit loss of TWD11.65 billion, or US$34 million, in 2008, a plunge of 232 percent year-on-year. It reported revenue of TWD118 billion, or US$3.5 billion.

Liu said the backdoor listing is a good move for CPT since it opened another door for the company's future financing.

"It will be easier for the company to get loans from banks on the mainland, and it can also seek capital by issuing more shares."

(China Daily February 12, 2009)