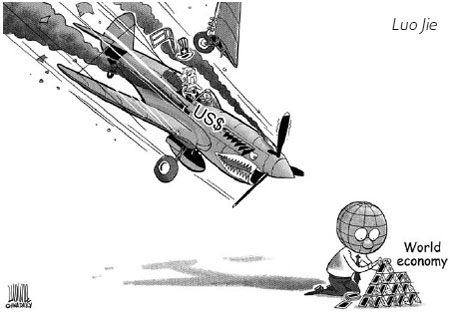

Sharp devaluation in the US dollar, which some economists are forecasting, would deal a heavy blow to both the world and Chinese economy. Policymakers need to take pre-emptive measures to minimize possible impacts.

|

| Devaluation on dollar means trouble for China. [China Daily] |

The United Nations has warned the hard landing of the dollar might be a major factor deferring world economic recovery and stressed the possibility of hefty drops in the greenback's value in its World Economic Situation and Prospects 2009 report.

The US Federal Reserve (Fed) started to lower interest rates in January 2007 and the greenback began softening as international assets prices continued to go up. The European Union did not follow suit for fear of spurring inflation but raised interest rates on July 3, 2008. During that period the dollar depreciated against the euro due to worsening US economic fundamentals.

But since August 2008 the greenback has regained its strength, as large amounts of capital flowed back to the US in pursuit of relatively safe Treasury bonds amid the global economic slowdown. The increasing demand for the treasuries drove up the value of the greenback as people shunned risky assets. Strengthening of the dollar during that period was not a result of improving economic fundamentals, but changing investor sentiment that favored less risky investment channels.

As the US economy slipped into recession the Fed kept cutting interest rates and Fed Chairman Ben Bernanke said last November that new credit instruments would be created to spur credit, meaning an increasing amount of dollars will be pumped into the financial system. As a result the greenback started depreciating again.

But the Obama administration's massive economic stimulus bill and interest rate cuts in European countries are making the dollar strong again.

The movement of the greenback hinges on both long-term and short-term factors. The improvement of US economic fundamentals determines the dollar's value in the long run. But in the short term multiple market factors, such as changes in investor sentiment, market expectations and major events help change the dollar's value.

The recent fluctuations in the exchange rate of the dollar against other currencies, for example, is due to the combined effects of improving national economic indicators (which cause a nation's currency to climb), policy moves, such as interest rate cuts (which cause a nation's currency to depreciate) and large-scale government initiatives, such as the US economic stimulus program, which will improve market expectations (and in turn drive the dollar up).

But the greenback faces a possible hard landing.

The US economy is uncertain. It is already in recession and could slip further in the near future. The UN report forecasted the US economy would contract 1.9 percent in 2009, while the IMF projected it would drop 0.7 percent. The OECD forecast a 0.9 percent decline. These forecasts suggest the US economy is yet to bottom out and its prospects are not bright enough to prop up a strong dollar in the long run.

The Fed pledged to keep its interest rates at a low level until the economy resumes stable growth, which means it will maintain a relaxed monetary policy for some time. This, combined with other monetary tools aimed at injecting capital into the market, will boost money supply.

The US government has adopted expansionary fiscal policies, unveiling a US%200 billion bailout program in February last year and another US%700 billion stimulus plan last September. The Obama administration just won the approval of another US%787 billion stimulus package in Congress. Such programs widen the US government's fiscal deficit. In 2008 the deficit hit a record US%438 billion and is expected to exceed US%1 trillion this year. The US will likely continue to suffer from a large amount of trade deficit, which will weaken the greenback.

China is pulling out all stops to maintain its economic growth and jack up domestic demand. But the country needs to be alert to external economic risks, especially the currency value of major developed countries. China should keep a close eye on the greenback's exchange rate, because a significant fall in the value of the dollar is bound to have an adverse impact on the Chinese economy.

The exchange rate between the yuan and the dollar and other currencies would fluctuate drastically if the dollar suffers in the future.

A weaker greenback will also boost the price of commodities, such as oil and grains, in the international market, which may cause a new bout of global asset price surge. This would push up production costs for Chinese businesses and fuel domestic inflation, posing a new challenge for the country to keep its stable economic growth.

China is the largest holder of US treasuries. If the dollar depreciates the value of dollar-denominated assets will contract. A weakening dollar pushing up commodities' prices would affect the purchasing power of China's colossal foreign exchange reserves.

(China Daily March 2, 2009)