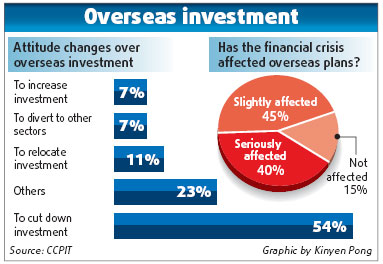

The world financial crisis has severely dampened Chinese companies' enthusiasm for investing overseas, although many of them said they still want to go global, results of a survey showed on Wednesday.

|

| Crisis dampens zeal to go global [China Daily] |

About 85 percent of respondents said their overseas business has been hampered by the crisis, and as a result, merely 7 percent said they would like to add to their outflows this year.

However, when asked whether they will expand overseas investment in the next two years, 40 percent answered yes.

The report, released by the China Council for the Promotion of International Trade (CCPIT) and the third of its kind, is based on a four-month survey of 1,100 companies in sectors ranging from textiles, hi-tech and construction to resources.

Companies that are waiting for overseas opportunities see investment as part of a long-term strategy to improve profit margins and build their brands on the international stage, according to the report.

The findings do not appear to tally with recent high-profile merger and acquisition (M&A) activity involving Chinese enterprises, which many experts believe heralded a fresh burst of overseas investment.

In January and February, more than 20 overseas M&A deals worth US$20 billion were reportedly inked by Chinese companies, involving many big players.

In February alone, Shenzhen Zhongjin Lingnan Nonfemet, China's fifth largest zinc producer by output, acquired 50.1 percent of Perilya, an Australian zinc and lead mining company. In the same month, Chinalco announced plans to inject US$19.5 billion into Rio Tinto, one of the largest mining corporations worldwide.