A senior planning official said on Friday that the actual amount of money to be spent on boosting China's economic growth could be larger than the 4 trillion yuan (US$586 billion) stimulus package already announced.

"The estimated 4 trillion yuan would only be part of the country's total investment," Mu Hong, vice-director of the National Development and Reform Commission (NDRC), told a press conference organized by the State Council Information Office. Vice-minister of Finance Wang Jun and Yi Gang, vice-governor of the central bank, also attended the news briefing.

The central government would provide 1.18 trillion yuan for the package, Mu said.

The investment, combined with that of businesses and local governments, would bring the total spending to about 4 trillion yuan by the end of 2010. But Mu suggested that investment from across society could be even higher.

Though local governments are prohibited from raising capital through bond issues, the central government is considering allowing them to "raise funds through loan transfers or appropriate channels or measures with central approval", Mu said.

The government also welcomed all types of capital, including private equity, to help sustain economic growth, Wang Jun said.

It was the first time the government had revealed details about its spending plans.

Mu said the drastic measures were necessary as the external economic situation "posed a severe challenge" for China to maintain growth.

"The economic slowdown in China is becoming clearer, especially after September," he said.

China's gross domestic product grew 9 percent in the third quarter, down from 10.1 percent in the second quarter and 10.6 percent in the first quarter.

The growth rate of October's industrial value-added output dropped to a seven-year low of 8.2 percent, which analysts said was strong evidence of a slowdown.

If the slowdown accelerated, it would severely damage China's productivity, Mu said.

"This is why the Chinese government decided to make major shifts in macro-economic policies and launched the 4 trillion yuan stimulus package."

Officials have said that a "large part" of the total package will be new capital, but they have not provided specific figures.

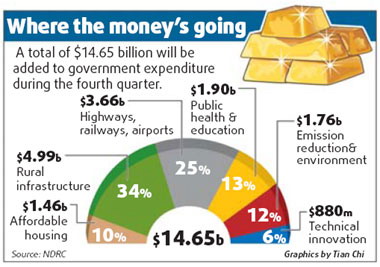

The stimulus package was announced on Sunday amid rising concern about a sharp slowdown. A total of 100 billion yuan would be added to government expenditure during the fourth quarter.

But Mu said he was "very confident" that China could weather the storm.

With 1.3 billion people, China has strong potential to boost investment and consumption, Mu said.

"Boosting domestic demand has become the priority of economic work," Mu said. The package would stimulate both short and long-term demand, as it would spur economic growth while transforming the type of growth.

The stabilization of foreign trade was also an important part of the macro-economic controls, said Mu.

Meanwhile, financing conditions have improved for small- and medium-sized enterprises (SMEs) in recent months, reflecting government moves to increase their access to loans.

Yi Gang, vice-governor of the People's Bank of China (PBOC), cited a record increase in total loans.

"Many SMEs have secured more loans from commercial banks, as total loans made in the first 10 months reached a record high of 3.66 trillion yuan," Yi said.

He noted that China is prepared to work with other countries and the International Monetary Fund to deal with the current crisis.

But at the same time, he reiterated that the most important step Beijing can take is to keep its own economy stable.

(Xinhua News Agency, China Daily November 16, 2008)